Ethereum (ETH) Validators Exit in Record Numbers

09.08.2024 20:00 1 min. read Alexander Stefanov

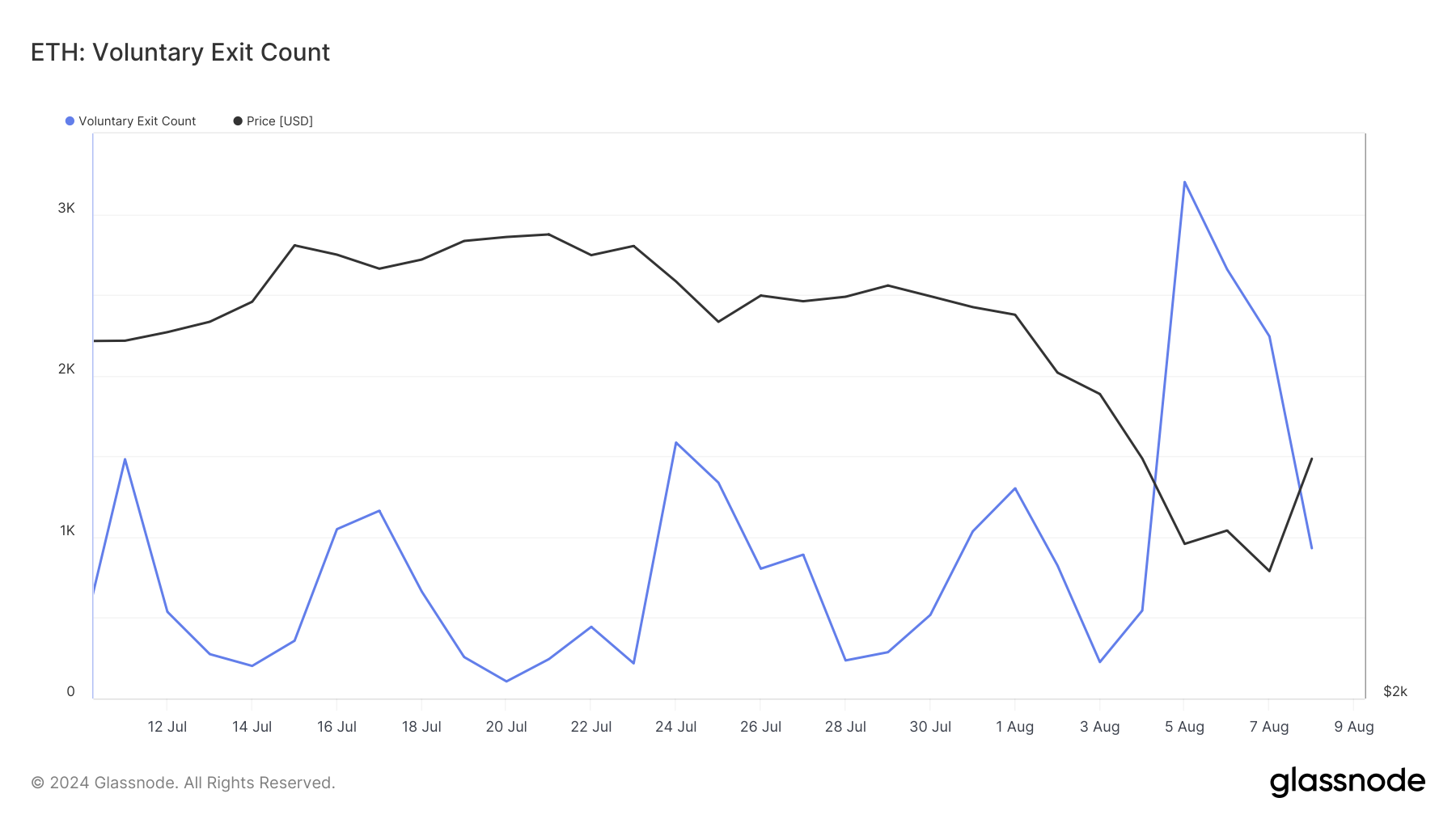

On Monday, Ethereum saw a significant rise in validator exits amidst a broader market downturn, while investments in Ethereum ETFs surged.

The price of ETH dropped to a seven-month low of $2,100 but later recovered. During this period, 3,199 validators left the Ethereum network, the highest number in a month, likely due to market volatility and falling ETH value.

At the same time, inflows into Ethereum spot ETFs totaled $49 million. This spike has reignited discussions about the potential effects of these ETFs on Ethereum staking.

Analysts were previously divided on whether the introduction of ETFs would influence validator behavior, with some predicting a shift from staking to ETFs, while others believed ETFs wouldn’t provide enough incentive.

Juan Pellicer from IntoTheBlock suggested that traditional finance institutions might be driving the ETF inflows, capitalizing on the price drop. He also mentioned that hedge funds might be engaging in profitable basis trades involving ETFs and futures.

ETH is currently priced at $2,673, reflecting a 10% increase over the last 24 hours. However, weak trading volume and bearish indicators suggest that this price surge may not be sustained, potentially leading to a reversal.

-

1

Sui Price Prediction: SUI Could Rise to $5 If This Pattern Plays Out

16.06.2025 23:35 3 min. read -

2

XRP Could Beat Solana to the ETF Finish Line, Analysts Say

12.06.2025 17:00 2 min. read -

3

Pi Price Prediction: Can Pi Coin Retest All-Time Lows?

13.06.2025 20:10 3 min. read -

4

Trump Family Reaches Resolution on Memecoin Dispute, Eyes Major Token Purchase

08.06.2025 14:00 2 min. read -

5

Plasma’s ICO: A $500M Frenzy Sparks Fairness Debate

10.06.2025 22:00 2 min. read

TRON (TRX) Eyes Breakout as Bollinger Bands Signal Squeeze

According to a new analysis from CryptoQuant, TRON (TRX) may be gearing up for a breakout as tightening Bollinger Bands point to an imminent expansion in volatility.

BNB Chain Boosts Transaction Speed and Stability with New Upgrade

BNB Chain is set to upgrade the BNB Smart Chain (BSC) by cutting the block time in half, from 1.5 seconds down to 0.75 seconds.

Chainlink Bounces From Key Support, Eyes Breakout From Downtrend

Cryptocurrency analytics firm MakroVision has shared its technical assessment of Chainlink (LINK) price action.

Pennsylvania Man Sentenced to 8 Years for $40M Crypto Ponzi Scheme

The U.S. Department of Justice has sentenced Dwayne Golden, 57, of Pennsylvania to 97 months in prison for orchestrating a fraudulent crypto investment scheme that stole over $40 million from investors.

-

1

Sui Price Prediction: SUI Could Rise to $5 If This Pattern Plays Out

16.06.2025 23:35 3 min. read -

2

XRP Could Beat Solana to the ETF Finish Line, Analysts Say

12.06.2025 17:00 2 min. read -

3

Pi Price Prediction: Can Pi Coin Retest All-Time Lows?

13.06.2025 20:10 3 min. read -

4

Trump Family Reaches Resolution on Memecoin Dispute, Eyes Major Token Purchase

08.06.2025 14:00 2 min. read -

5

Plasma’s ICO: A $500M Frenzy Sparks Fairness Debate

10.06.2025 22:00 2 min. read