Ethereum ETFs Set New Record with $295M Inflows

12.11.2024 13:30 1 min. read Alexander Stefanov

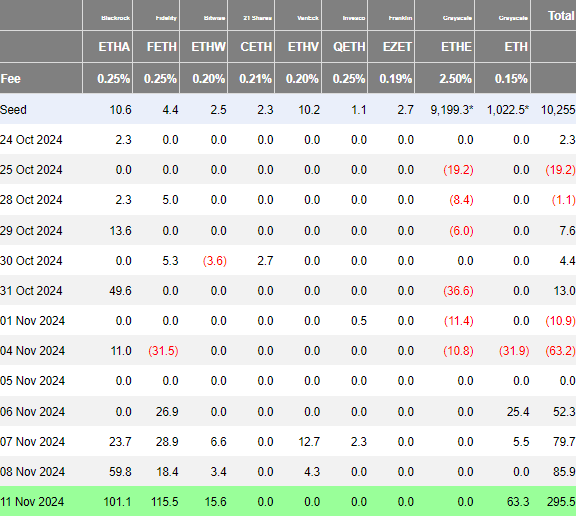

U.S. spot Ethereum ETFs experienced an unprecedented influx on Monday, drawing $295.5 million—more than double the previous record.

Fidelity’s Ethereum ETF led with $115.5 million, followed closely by BlackRock’s ETHA at $101.1 million, while Grayscale and Bitwise products saw smaller but notable inflows.

This surge in investment comes in the wake of the recent U.S. presidential election, with spot ETH ETFs collectively attracting $513 million in just four trading days. Daily trading volume also hit a new high of $912.9 million, suggesting increasing optimism about regulatory shifts.

Analyst Rachael Lucas of BTCMarkets noted that the DeFi token rally, including gains in Aave and Uniswap, may signal broader confidence in Ethereum, potentially fueling further ETF interest.

Ethereum ETFs now manage a combined $9.7 billion, equating to 2.4% of Ethereum’s market cap, while ETH’s price has risen 7.3% to $3,367.

Spot Bitcoin ETFs also saw robust inflows, adding $1.1 billion on Monday, with BlackRock’s IBIT accounting for the majority. Cumulative inflows for Bitcoin ETFs now stand at $26.9 billion.

-

1

Analysts Warn Bitcoin Is Easier to Attack Than Ethereum

18.05.2025 14:00 2 min. read -

2

WalletConnect Launches WCT on Solana with $3M Airdrop

25.05.2025 22:00 2 min. read -

3

Top Crypto Trader Cashes Out $46M Bitcoin Profit, Eyes Altcoins Next

24.05.2025 18:00 1 min. read -

4

Binance Announces 70th Launchpool Project with Token Farming Starting May 23

22.05.2025 20:00 1 min. read -

5

Sui Network Moves to Restore $162M After Cetus Hack

30.05.2025 19:00 2 min. read

Bitcoin Holds Above $100K, But Analyst Sees Trouble Brewing

The crypto market’s well-known skeptic, Il Capo of Crypto, has once again sounded the alarm—arguing that the worst may still be ahead, even as Bitcoin remains above the $100,000 mark.

Solana Price Prediction: Trend Reversal and EMA Crossovers Favor Retest of $100

Solana (SOL) has gone down by 6% in the past week and although the token has recovered in the past 24 hours, technical indicators favor a bearish outlook. Trading volumes have gone up by nearly 18% as bulls managed to reverse an early sell-off during the Asian session. However, meme coins, an important segment of […]

Corporate Interest in XRP Surges as Firms Eye It for Treasury Reserves

A growing number of publicly traded companies are turning to XRP as a potential reserve asset, signaling a shift in how institutions view the utility of digital assets in treasury management.

Coinbase Brings Wrapped XRP and DOGE to Base for DeFi Integration

Coinbase has taken another step toward boosting cross-chain utility by introducing wrapped versions of XRP and Dogecoin on its Layer 2 network, Base.

-

1

Analysts Warn Bitcoin Is Easier to Attack Than Ethereum

18.05.2025 14:00 2 min. read -

2

WalletConnect Launches WCT on Solana with $3M Airdrop

25.05.2025 22:00 2 min. read -

3

Top Crypto Trader Cashes Out $46M Bitcoin Profit, Eyes Altcoins Next

24.05.2025 18:00 1 min. read -

4

Binance Announces 70th Launchpool Project with Token Farming Starting May 23

22.05.2025 20:00 1 min. read -

5

Sui Network Moves to Restore $162M After Cetus Hack

30.05.2025 19:00 2 min. read