Eric Trump Says Ethereum is Undervalued, Backs Analyst’s $8,000 Target

25.07.2025 15:50 2 min. read Kosta Gushterov

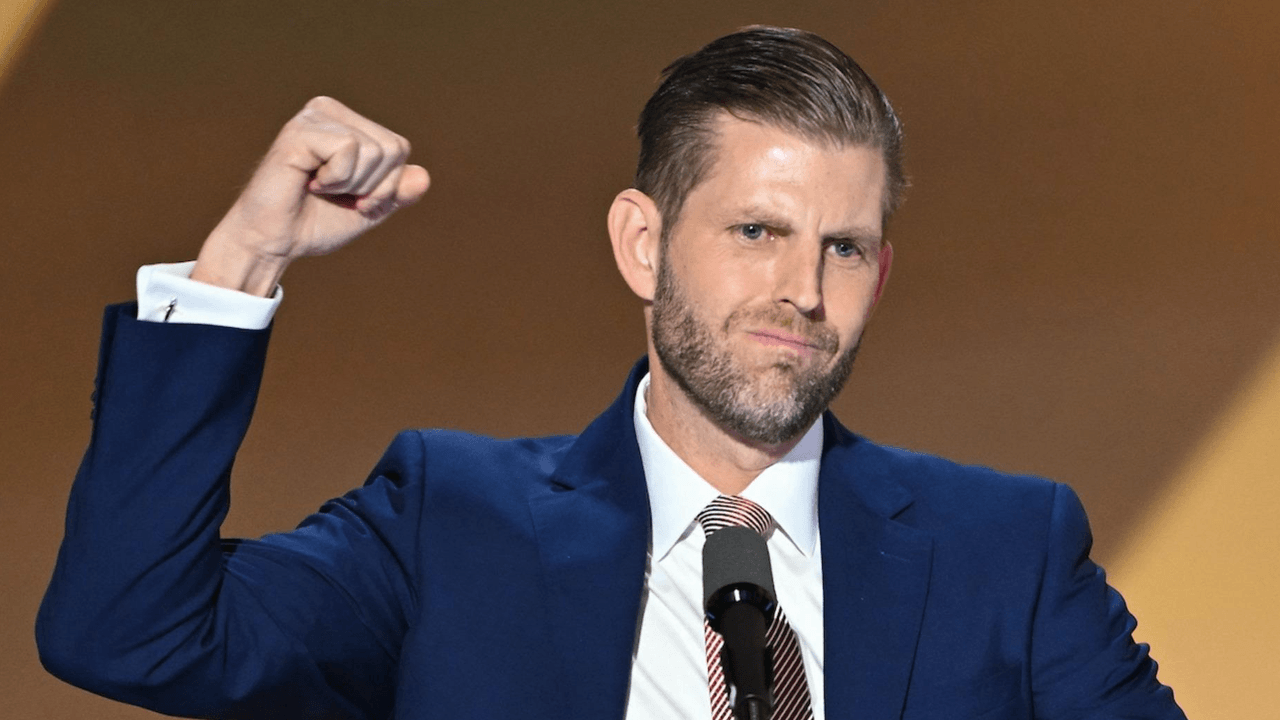

U.S. President Donald Trump continues to draw attention for his pro-cryptocurrency stance—and now his son, Eric Trump, is turning the spotlight to Ethereum.

In a recent post on X, Eric Trump backed a bold valuation thesis suggesting ETH is significantly undervalued in today’s market.

A bullish signal from the Trump circle

Eric Trump, director of Bitcoin mining company American Bitcoin and an open supporter of crypto, retweeted a post by analyst Ted Pillows, who argued that Ethereum is tracking global liquidity and should already be priced above $8,000.

Pillows based his argument on the correlation between Ethereum’s historical price trends and M2 money supply growth. He described ETH as one of the most promising opportunities in the market right now—an opinion Eric Trump echoed with a simple but direct response: “I agree.”

Agreed! $ETH https://t.co/3vUn5kOiT0

— Eric Trump (@EricTrump) July 24, 2025

Eric has previously stated that his crypto portfolio includes Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and Sui (SUI), signaling broader interest in Layer-1 assets.

Short-term headwinds temper long-term optimism

While the Trump family’s crypto enthusiasm fuels market buzz, analysts are sounding cautious notes about Ethereum’s near-term outlook. Markus Thielen, head of research at 10X Research, warned this week that ETH may be facing an unstable period as borrowing costs rise sharply.

Thielen pointed to data from Aave, a leading Ethereum-based lending platform. Since July 8, Aave’s ETH borrow utilization has surged from 86% to 95%, pushing variable interest rates higher. This spike in borrowing demand has made it less profitable to borrow ETH—signaling potential strain on the network.

“If this dynamic doesn’t cool down,” Thielen warned, “it could trigger a meaningful pullback in Ethereum, especially if funding rates and positioning stay tight.”

He also noted that while technical indicators now show signs of overvaluation, his longer-term view remains optimistic. Thielen expects more favorable market conditions—and a return to upside momentum for ETH—sometime after September.

Conclusion

As institutional demand grows and figures like Eric Trump publicly support Ethereum’s long-term case, the spotlight on ETH continues to intensify. But with borrowing pressures building and volatility rising, the next few weeks may test how far sentiment alone can carry the market.

-

1

Binance Could Introduce Golden Visa Option for BNB Investors Inspired by TON

07.07.2025 8:00 1 min. read -

2

Pepe Price Prediction: PEPE Could Rise Another 10% If It Breaks This Key Level

16.07.2025 17:26 3 min. read -

3

Ethereum and Solana 2025 Update: Upgrades, Growth, and What’s next

12.07.2025 14:30 2 min. read -

4

Top 10 Trending Altcoins Right Now, According to CoinGecko Data

13.07.2025 17:30 3 min. read -

5

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read

Ethereum: What The Last Move Tells us About the Next One

Ethereum is showing strength in the face of broader market weakness, holding firm even as Bitcoin and other major assets trend downward.

PENGU Price Eyes Bounce From Key Support Level – What’s Next?

Pudgy Penguins’ native token $PENGU is attracting renewed attention from traders after showing consistent support at a key technical level.

Sui Price Prediction: As DeFi TVL Jumps by 42% – Will SUI Hit $5 Soon?

Sui (SUI) has gone up by 34% in the past 30 days as the project’s DeFi ecosystem has been growing rapidly this year. This favors a bullish SUI price prediction as it indicates increased adoption by developers. Data from DeFi Llama shows that the total value locked (TVL) within the Sui blockchain has expanded by […]

10 Crypto Unlocks to Watch in the Next 14 hours

A wave of token unlocks is set to hit the crypto market within the next 14 hours, potentially shaking up price dynamics for several low- and mid-cap projects.

-

1

Binance Could Introduce Golden Visa Option for BNB Investors Inspired by TON

07.07.2025 8:00 1 min. read -

2

Pepe Price Prediction: PEPE Could Rise Another 10% If It Breaks This Key Level

16.07.2025 17:26 3 min. read -

3

Ethereum and Solana 2025 Update: Upgrades, Growth, and What’s next

12.07.2025 14:30 2 min. read -

4

Top 10 Trending Altcoins Right Now, According to CoinGecko Data

13.07.2025 17:30 3 min. read -

5

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read