ECB May Cut Interest Rates Next Month Amid Ongoing Inflation Concerns

23.08.2024 15:00 1 min. read Alexander Stefanov

Speculation is mounting that the European Central Bank (ECB) might lower interest rates next month, with September becoming a critical point of focus.

Most analysts, over 80%, are anticipating a rate cut, potentially alongside the Federal Reserve, and are even predicting another reduction in December.

The push for a rate decrease is driven by persistent inflation, which continues to exceed the ECB’s 2% target. ECB President Christine Lagarde has emphasized that any rate adjustments will hinge on future inflation reports.

Currently, the ECB’s main rates stand at 4.25% for refinancing and 3.75% for deposits, following a slight reduction in June 2024. The bank faces the dilemma of curbing inflation while avoiding further economic strain in the Eurozone, which is already experiencing slow growth and rising costs.

Martins Kazaks, a key ECB official and Latvia’s central bank head, has indicated a willingness to consider another rate cut in September but will wait for new data before making a decision. He noted that while current monetary policy has helped manage inflation, growth remains weak due to insufficient structural changes.

The ECB’s July meeting maintained a cautious stance, acknowledging ongoing inflation risks. Recent wage data suggests a potential moderation, which could help align inflation with the 2% target by 2025. Kazaks remains optimistic that achieving this goal is still feasible, even with possible additional rate cuts.

-

1

Gold Beats U.S. Stock Market Over 25 Years, Even With Dividends Included

13.07.2025 15:00 1 min. read -

2

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

15.07.2025 16:15 2 min. read -

3

U.S. Announces Sweeping New Tariffs on 30+ Countries

12.07.2025 16:30 2 min. read -

4

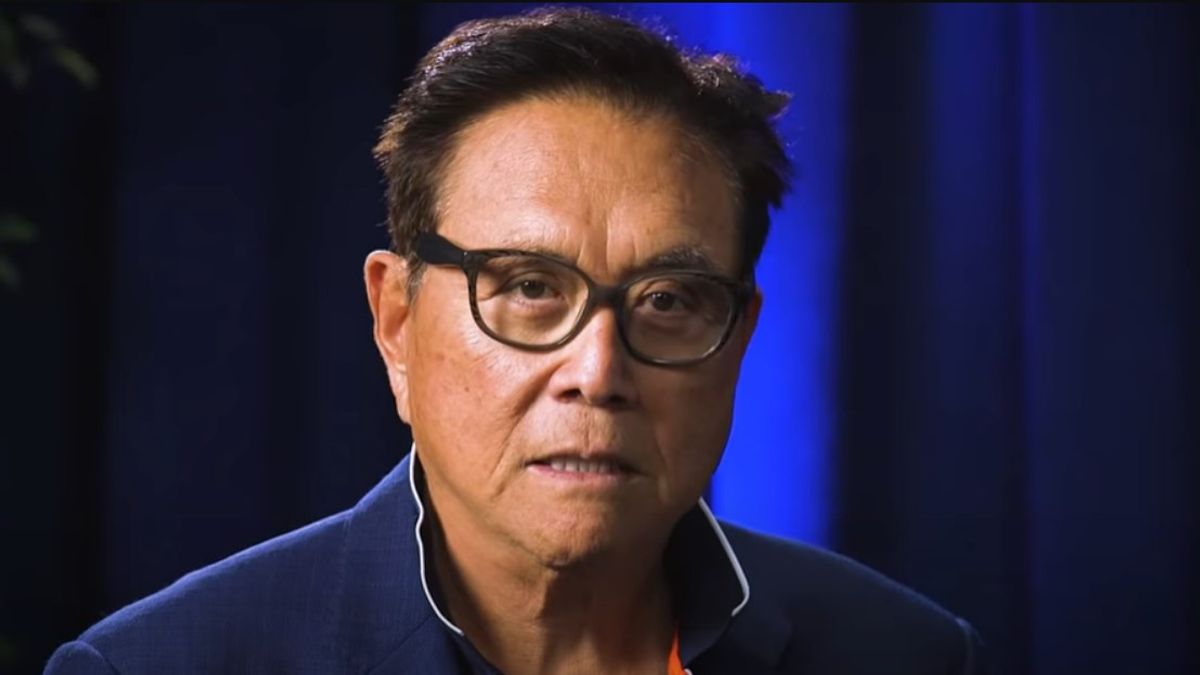

Robert Kiyosaki Predicts When The Price of Silver Will Explode

28.06.2025 16:30 2 min. read -

5

Key U.S. Economic Events to Watch Next Week

06.07.2025 19:00 2 min. read

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

U.S. inflation accelerated in June, dealing a potential setback to expectations of imminent Federal Reserve rate cuts.

Gold Beats U.S. Stock Market Over 25 Years, Even With Dividends Included

In a surprising long-term performance shift, gold has officially outpaced the U.S. stock market over the past 25 years—dividends included.

U.S. Announces Sweeping New Tariffs on 30+ Countries

The United States has rolled out a broad set of new import tariffs this week, targeting over 30 countries and economic blocs in a sharp escalation of its trade protection measures, according to list from WatcherGuru.

Key U.S. Economic Events to Watch Next Week

After a week of record-setting gains in U.S. markets, investors are shifting focus to a quieter yet crucial stretch of macroeconomic developments.

-

1

Gold Beats U.S. Stock Market Over 25 Years, Even With Dividends Included

13.07.2025 15:00 1 min. read -

2

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

15.07.2025 16:15 2 min. read -

3

U.S. Announces Sweeping New Tariffs on 30+ Countries

12.07.2025 16:30 2 min. read -

4

Robert Kiyosaki Predicts When The Price of Silver Will Explode

28.06.2025 16:30 2 min. read -

5

Key U.S. Economic Events to Watch Next Week

06.07.2025 19:00 2 min. read