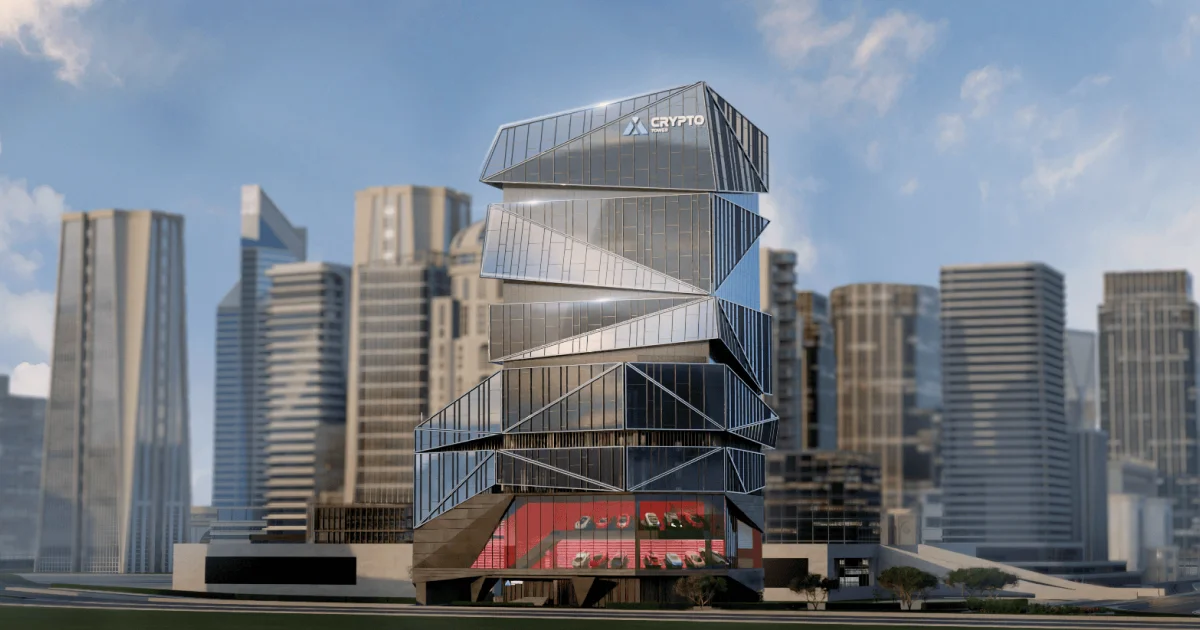

Dubai Unveils Plans for the World’s First Crypto Tower

16.01.2025 11:00 1 min. read Alexander Stefanov

The UAE, a pioneer in blockchain technology, continues its leadership through Dubai’s ambitious new project: a 17-story Crypto Tower in the Jumeirah Lake Towers (JLT) district.

Announced by the Dubai Multi Commodities Centre (DMCC) and REIT Development, the tower aims to attract blockchain developers, startups, and investors, strengthening Dubai’s status as a global hub for digital innovation.

The Crypto Tower will reserve nine floors for crypto startups and established companies, three floors for incubators and venture capital firms, and one for AI innovation.

It will also feature a 10,000-square-foot indoor event space, an NFT art gallery, a gold bullion shop, an exotic car showroom, and a 5,000-square-foot vault.

READ MORE:

XRP Reached its Highest Level in 6 Years

The project emphasizes blockchain integration, with on-chain systems managing expenses and tenant interactions to enhance transparency.

Over 150,000 square feet of leasable space will be available when construction concludes in early 2027, setting the stage for Dubai’s continued dominance in the blockchain space.

-

1

Ripple Faces Legal Setback as Court Rejects Bid to Ease Penalties

26.06.2025 16:54 1 min. read -

2

Coinbase Surges 43% in June, Tops S&P 500 After Regulatory Wins and Partnerships

29.06.2025 21:00 2 min. read -

3

Ripple Has Applied for a National Banking License

03.07.2025 7:00 2 min. read -

4

What Will Happen With the Stock Market if Trump Reshapes the Fed?

29.06.2025 13:00 2 min. read -

5

Top 10 Biggest Crypto Developments This Week

12.07.2025 22:00 3 min. read

Charles Schwab to Launch Bitcoin and Ethereum Trading Soon, CEO Confirms

Charles Schwab is preparing to roll out spot Bitcoin and Ethereum trading, according to CEO Rick Wurster during the firm’s latest earnings call.

BlackRock Moves to Add Staking to iShares Ethereum ETF Following SEC Greenlight

BlackRock is seeking to enhance its iShares Ethereum Trust (ticker: ETHA) by incorporating staking features, according to a new filing with the U.S. Securities and Exchange Commission (SEC) submitted Thursday.

IMF Disputes El Salvador’s Bitcoin Purchases, Cites Asset Consolidation

A new report from the International Monetary Fund (IMF) suggests that El Salvador’s recent Bitcoin accumulation may not stem from ongoing purchases, but rather from a reshuffling of assets across government-controlled wallets.

Sberbank Moves to Dominate Russia’s Crypto Custody Sector

Sberbank, Russia’s largest state-owned bank, is preparing to launch custody services for digital assets, marking a significant expansion into the country’s evolving crypto landscape.

-

1

Ripple Faces Legal Setback as Court Rejects Bid to Ease Penalties

26.06.2025 16:54 1 min. read -

2

Coinbase Surges 43% in June, Tops S&P 500 After Regulatory Wins and Partnerships

29.06.2025 21:00 2 min. read -

3

Ripple Has Applied for a National Banking License

03.07.2025 7:00 2 min. read -

4

What Will Happen With the Stock Market if Trump Reshapes the Fed?

29.06.2025 13:00 2 min. read -

5

Top 10 Biggest Crypto Developments This Week

12.07.2025 22:00 3 min. read