Dormant Bitcoin Wallet Holding $2.6M Revives After a Decade

02.10.2024 8:30 1 min. read Alexander Stefanov

A long-dormant Bitcoin wallet has been reactivated after more than 10 years, sparking interest in the crypto community.

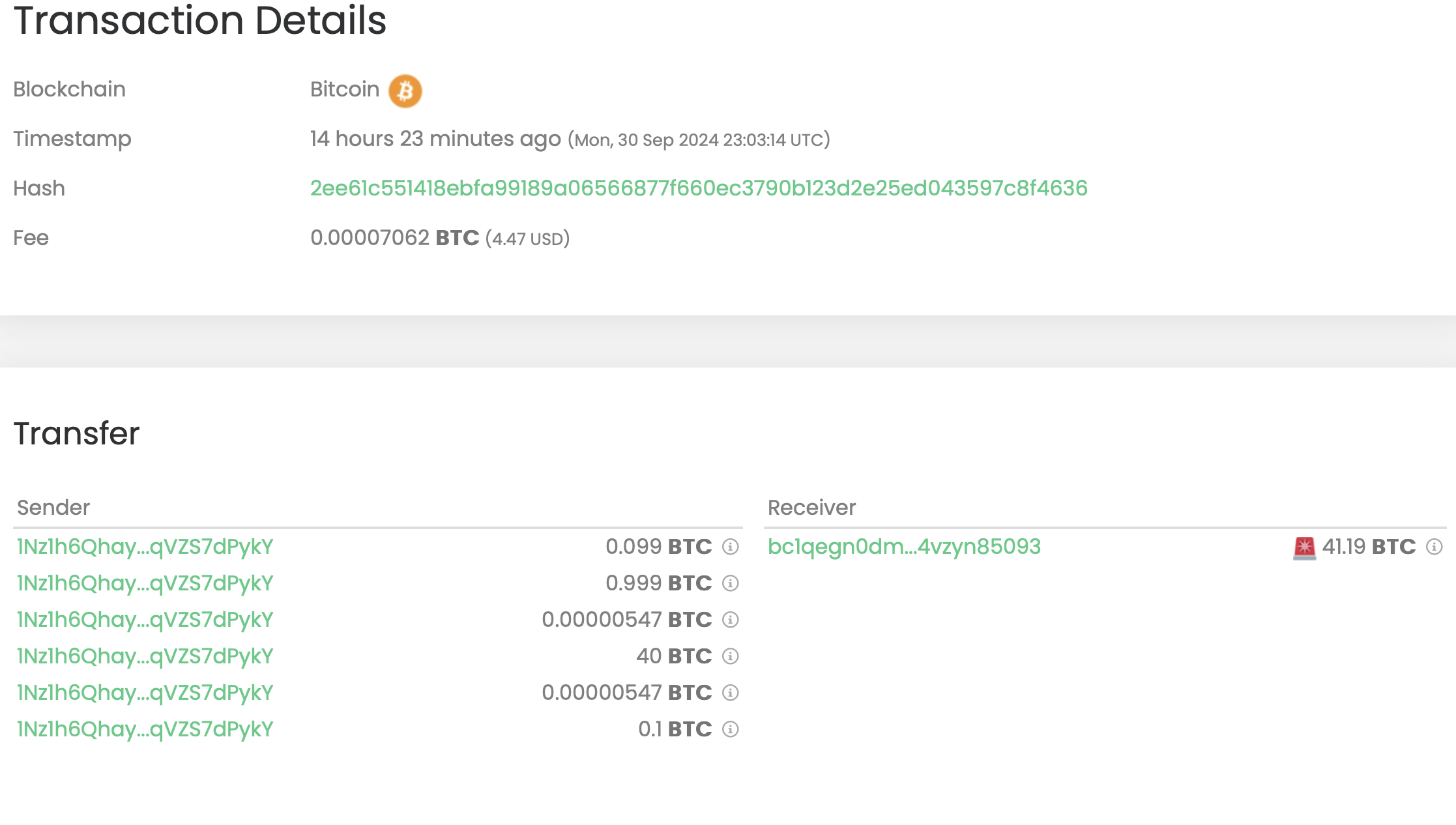

Whale Alert, a platform that tracks blockchain transactions, reported that an address holding 41 BTC, valued at over $2.6 million, suddenly became active after nearly 11 years of inactivity, transferring its entire balance to another wallet.

Interestingly, this address stayed inactive throughout Bitcoin’s major price surges, making the recent transfer a notable event tied to Bitcoin’s shifting market cycles.

Ki Yong Joo, CEO of CryptoQuant, recently explained the phases of Bitcoin’s market evolution. He described how older whales tend to reactivate their holdings first, followed by the emergence of new whales who later transition into retail investors.

Eventually, these retail holders mature into long-term players in the market. Joo also highlighted that Bitcoin inflows to exchanges remain steady, a contrast to previous bear market trends.

-

1

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

2

Michael Saylor Urges Apple to Buy Bitcoin

11.06.2025 9:00 1 min. read -

3

Bitcoin Price Prediction: Can the Genius Act Push Bitcoin to $200K?

20.06.2025 22:52 3 min. read -

4

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read -

5

Bitcoin Struggles as Selling Pressure Mounts Amid Geopolitical Turmoil

13.06.2025 15:00 2 min. read

Strategy Boosts Bitcoin Holdings to 597,325 BTC with Latest Purchase

Bitcoin giant Strategy has added another 4,980 BTC to its reserves in a purchase worth approximately $531.9 million, according to Executive Chairman Michael Saylor.

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

According to renowned market veteran Peter Brandt, trading isn’t the path to prosperity for the vast majority of people.

Why Bitcoin Is Stuck Despite Wall Street Demand

Charles Edwards, founder and CEO of Capriole Investments, has offered a fresh perspective on Bitcoin’s stalled price movement near the $100,000 mark, despite growing institutional enthusiasm.

Metaplanet Now Holds 13,350 BTC Worth $1.4 Billion

Metaplanet has expanded its Bitcoin treasury with a new acquisition of 1,005 BTC valued at approximately $108.1 million, further cementing its status as one of the largest corporate holders of the digital asset.

-

1

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

2

Michael Saylor Urges Apple to Buy Bitcoin

11.06.2025 9:00 1 min. read -

3

Bitcoin Price Prediction: Can the Genius Act Push Bitcoin to $200K?

20.06.2025 22:52 3 min. read -

4

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read -

5

Bitcoin Struggles as Selling Pressure Mounts Amid Geopolitical Turmoil

13.06.2025 15:00 2 min. read