Dollar Weakness Signals Major Bitcoin Move Ahead, Data Suggests

09.07.2025 21:00 2 min. read Kosta Gushterov

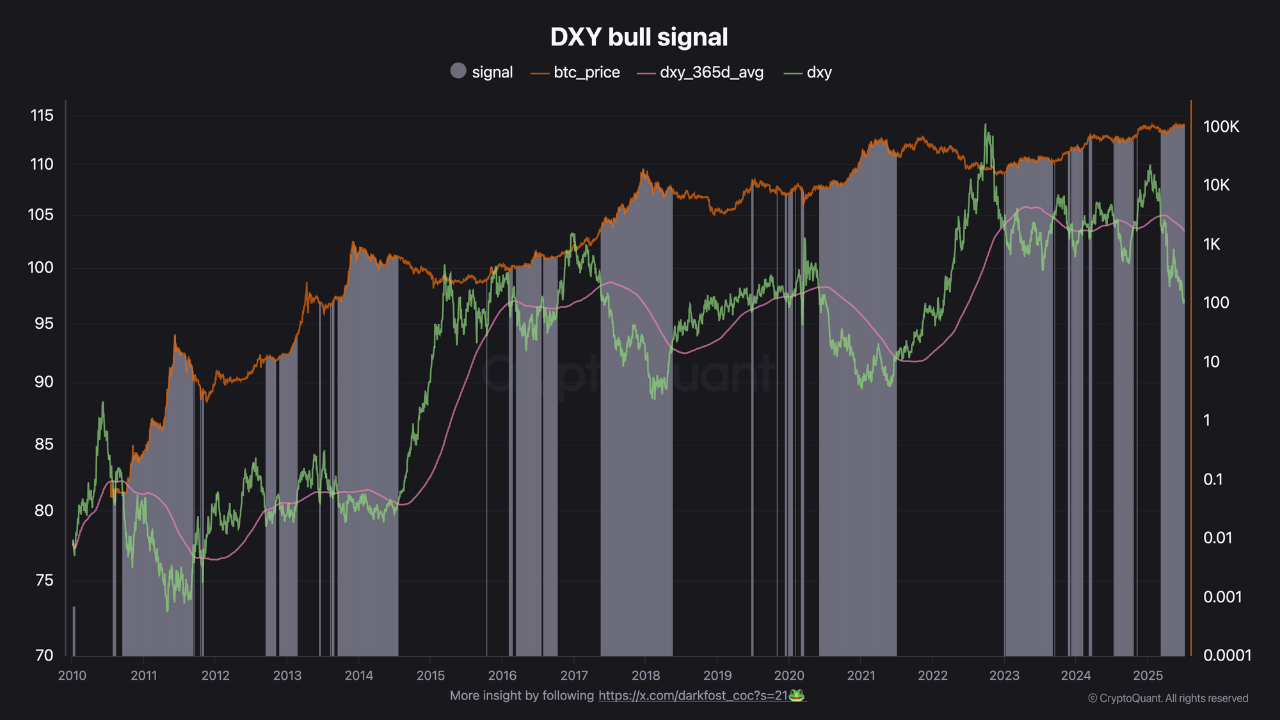

A new report from CryptoQuant highlights a historically strong inverse correlation between the U.S. dollar and Bitcoin—one that may be signaling the next leg of the crypto bull market.

According to the report, the U.S. Dollar Index (DXY) has fallen 6.5 points below its 200-day moving average, marking the largest deviation in over two decades. While that might raise alarm in macroeconomic circles, for Bitcoin it could be a bullish gift in disguise.

CryptoQuant analysts point to a well-established trend in traditional finance: when the dollar weakens, risk assets tend to thrive. As investors reassess the safety and yield of dollar-based assets, capital often rotates into alternative markets—chief among them, cryptocurrencies.

The DXY’s sustained weakness suggests a shift in investor sentiment, particularly as the U.S. debt hits record highs. As the greenback loses its safe-haven appeal, Bitcoin becomes increasingly attractive as a hedge against fiat debasement and macro instability.

Historically, Bitcoin has performed well during extended DXY downturns. The report includes a chart illustrating that whenever the DXY trades below its 365-day moving average, Bitcoin has entered either an early bull phase or a period of sustained euphoria.

Despite the technical setup, Bitcoin’s price has yet to fully reflect this macro tailwind. At the time of writing, BTC remains in consolidation territory near $109,000, even as liquidity indicators suggest increasing capital inflow potential.

This disconnect, CryptoQuant suggests, may not last. If historical patterns hold, the weakening dollar could soon catalyze a major move in Bitcoin. For market participants tracking long-term trends, the DXY’s current slump is not just a data point—it may be an early signal that liquidity is returning to crypto, priming Bitcoin for a renewed surge.

-

1

Bitcoin Price Prediction From Bernstein After the Recent All-Time High

14.07.2025 20:00 1 min. read -

2

Bitcoin Price Hits Record Highs as Exchange Balances Plunge

12.07.2025 19:00 2 min. read -

3

Top Crypto Trends Dominating Discussions This Week

15.07.2025 17:30 2 min. read -

4

Robert Kiyosaki Reacts to Bitcoin’s Surge Past $120K: “I’m Buying One More”

14.07.2025 17:00 1 min. read -

5

Over $5.8 Billion in Ethereum and Bitcoin Options Expired Today: What to Expect?

18.07.2025 16:00 2 min. read

Strategy Adds 21,021 Bitcoin at $117,000, Pushing Total Holdings Past $46 Billion

Michael Saylor, executive chairman of Strategy, has revealed that the company has acquired an additional 21,021 Bitcoin for approximately $2.46 billion, paying an average price of $117,256 per BTC.

Bitcoin Funding Rates Stay Elevated—Rally Ahead or Shakeout Coming?

As Bitcoin continues to consolidate above $100K, a critical market signal is flashing: BTC funding rates remain elevated, even as price action cools.

Billionaire Ray Dalio Revealed What his Portfolio Says About the Future of mMoney

Billionaire investor Ray Dalio, founder of Bridgewater Associates, has suggested that a balanced investment portfolio should include up to 15% allocation to gold or Bitcoin, though he remains personally more inclined toward the traditional asset.

Where Is The Smart Entry Point For Bitcoin Bulls?

With Bitcoin hovering near $119,000, traders are weighing their next move carefully. The question dominating the market now is simple: Buy the dip or wait for a cleaner setup?

-

1

Bitcoin Price Prediction From Bernstein After the Recent All-Time High

14.07.2025 20:00 1 min. read -

2

Bitcoin Price Hits Record Highs as Exchange Balances Plunge

12.07.2025 19:00 2 min. read -

3

Top Crypto Trends Dominating Discussions This Week

15.07.2025 17:30 2 min. read -

4

Robert Kiyosaki Reacts to Bitcoin’s Surge Past $120K: “I’m Buying One More”

14.07.2025 17:00 1 min. read -

5

Over $5.8 Billion in Ethereum and Bitcoin Options Expired Today: What to Expect?

18.07.2025 16:00 2 min. read