Top New Cryptocurrencies to Buy in 2025 – Best New Crypto Coins

Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

We may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

New cryptocurrencies are launching every week – but most won’t last a full market cycle. Still, some offer more than just hype. Whether it’s utility, innovation, or strong early traction, the projects below have shown signals worth watching in 2025.

That doesn’t mean they’re safe bets. New crypto coins come with risk – smart investors manage exposure, use reliable tools, and always stick to an exit plan.

If you’re looking for the best new crypto coins in 2025, stay until the end of the guide to learn what you need to watch out for, and which new coins may be your next golden opportunity.

Best New Cryptocurrencies Essential Highlights

- New crypto coins can deliver big returns, but only when backed by real products and timing.

- Smart investors ignore hype and focus on supply, audits, traction, and actual project utility.

- Use CoinMarketCap, Best Wallet, and DEXTools to track listings, trading data, and presales.

- Manage risk – set entry and exit points, diversify holdings, and never overcommit capital.

Best New Crypto To Buy in 2025

- Bitcoin Layer 2 for scalability and faster transactions

- High APY staking with governance rights

- Uses SVM tech to enhance Bitcoin’s capabilities

Bank card

Bank card ETH

ETH USDT

USDT- +1 more

- 80% presale allocation

- Fixed hard cap of $5M

- Start price at 0.006400 USD

- Staking rewards at a rate of 17.71 $T6900 tokens

ETH

ETH USDT

USDT BNB

BNB- +1 more

- Telegram-native platform with instant sniping and copy trading

- Honeypot and rugpull detection for safer trades

- Low fees with fast execution on token launches

ETH

ETH SOL

SOL Bank card

Bank card

- Boosts staking yields on Best Wallet platform

- Early access to exclusive new projects

- Reduces fees within the Best Wallet ecosystem

Bank card

Bank card ETH

ETH USDT

USDT- +1 more

- AI-powered tools for content creation and marketing

- Staking rewards with creator benefits

- Supports community-driven monetization

USDT

USDT ETH

ETH USDC

USDC- +2 more

Моre About The Best New Crypto Coins to Buy in 2025

The global cryptocurrency market will experience a CAGR of 11% between 2025 and 2026, so crypto enthusiasts are looking for their chances to invest in established and upcoming tokens.

Let’s see the best new cryptos right now and why they may be a good option right now.

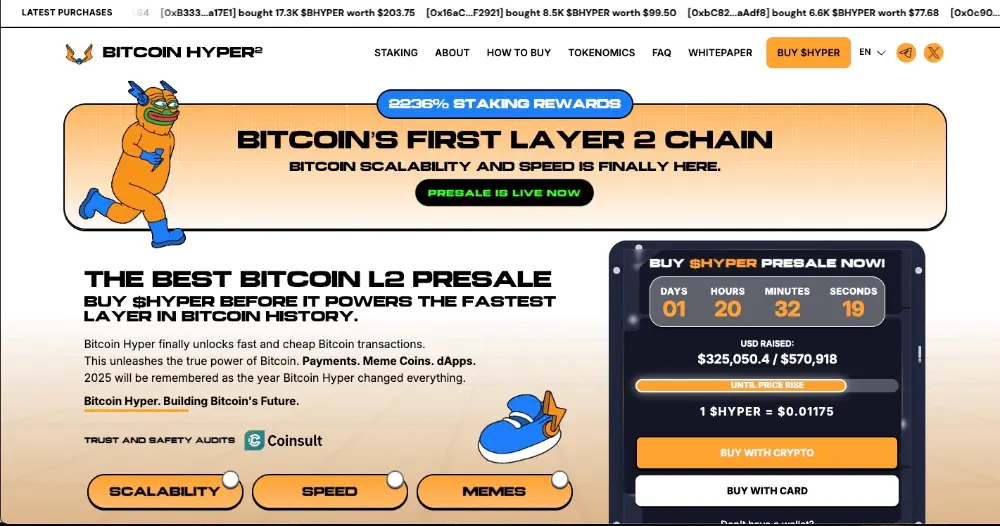

1. Bitcoin Hyper (HYPER) – Bitcoin Layer 2 With DeFi Staking

Bitcoin Hyper looks like a meme at first glance, but under the hood it’s a Bitcoin Layer 2 project designed for speed, smart contracts, and staking rewards – all powered by Solana’s infrastructure.

The pitch is simple: give Bitcoin the capabilities of a modern DeFi chain without touching its core layer. HYPER offers high APY staking (up to 2,000%) and is already audited by Coinsult and SolidProof. Over $300K was raised during presale, and listings on multiple chains are expected by the end of 2025.

It’s early-stage and high-risk, but it appeals to investors looking for BTC-themed projects with actual utility.

Highlight feature: Bitcoin-branded Layer 2 offering staking and Solana-level performance.

2. Token6900 – An Ethereum-meme coin with low market cap

The crypto market is relentless, but every now and then, a token like Token6900 cuts through the noise. This one ditches all the corporate pretenses, going all-in on meme energy, community-driven launches, and staking rewards that are genuinely impressive (if they last). It’s the type of coin that lives and dies on Telegram and X, not in whitepapers.

During our testing, what stood out was how accessible Token6900 is to regular buyers – no whales, no confusing DEX hoops, just a straightforward presale and real-time tracking in Best Wallet.

If you like the adrenaline of new launches, keep your eye on projects that build organic buzz and drop the corporate speak. Token6900 is proof that sometimes all you need is a good joke and a hyped-up crowd.

Highlight feature: Low hard cap

3. Snorter Bot (SNORT) – Telegram Bot That Trades Meme Coins for You

Snorter Token isn’t just another meme coin – it’s the native token of a trading tool built into Telegram. The token powers the sniper bot that scans for new token launches on Solana and automatically buys in early, targeting low-cap meme coins before the crowd arrives.

Beyond automation, Snorter offers rug pull detection, copy trading, and low execution fees. Early data shows an 85% success rate in avoiding honeypots, a key edge for short-term speculators. The bot is already active, and the presale raised over $400K – suggesting growing demand for degenerate-friendly automation. With buying Snorter Token and holding it, early investors can also benefit from up to 853% APY staking rewards.

Expansion to Ethereum, Base, and Polygon is on the roadmap, making Snorter more than just a Solana gimmick.

Highlight feature: Meme coin with built-in Telegram sniping and anti-rug alerts.

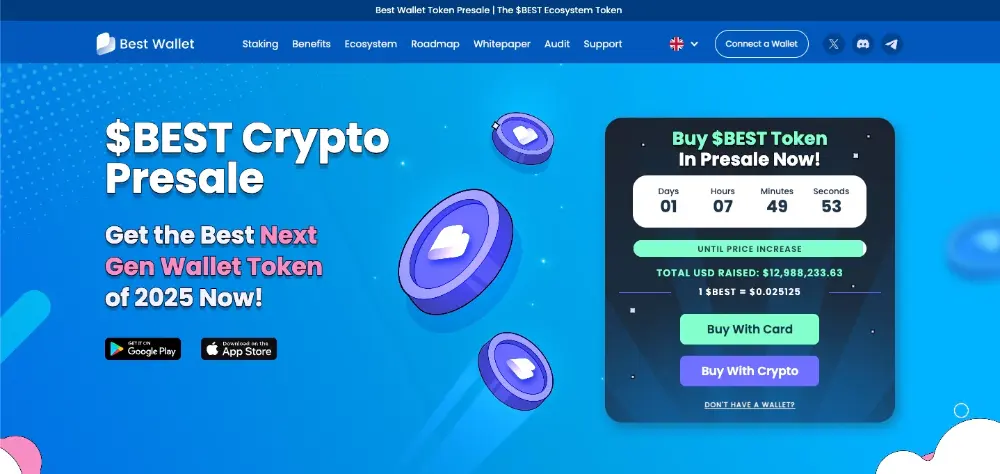

4. Best Wallet Token (BEST) – Utility Coin for a Multi-Chain Wallet

Best Wallet Token is tied to the Best Wallet ecosystem – a crypto app that combines storage, discovery, and presale access in one place. The token itself fuels premium features like reduced swap fees, early presale access, and token launch tools.

It’s positioned as a utility coin, not a meme, with practical value for users managing portfolios across Ethereum, Solana, and BNB Chain. The project raised over $13 million in its presale, with high user retention already on the wallet app.

BEST is designed for long-term integration across DeFi tools, making it more stable than hype-driven coins – but still speculative.

Highlight feature: Multi-chain wallet token with real product integration and presale access.

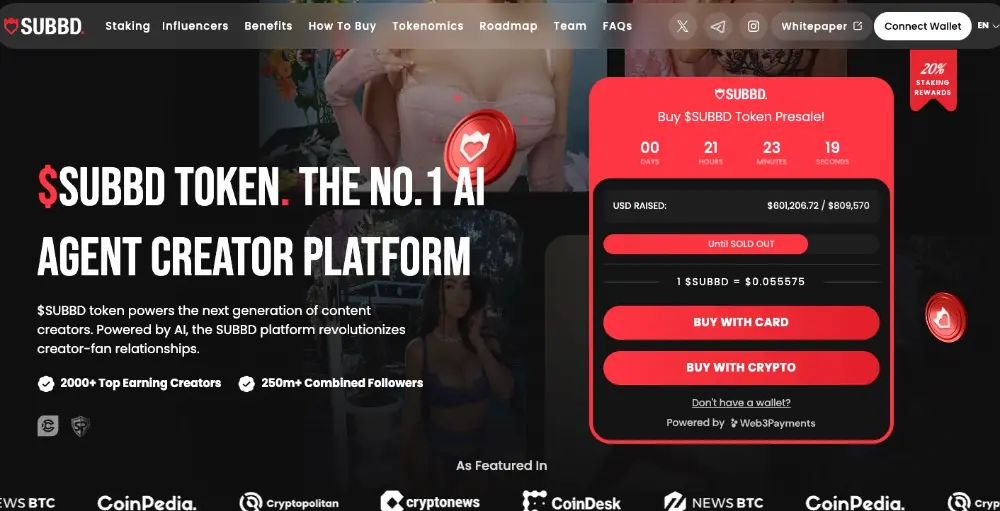

5. Subbd (SUBBD) – AI Tools for the Creator Economy

Subbd is a crypto project targeting the creator space, using AI to help influencers scale content without constant manual input. With Subbd, creators can mint AI personas that automate content drops, fan interactions, and even subscription management.

The token powers access to advanced tools inside the platform and offers staking at around 20% APY. Subbd positions itself as a decentralized alternative to Web2 platforms like Patreon or OnlyFans – without the high fees and gatekeeping.

It’s still early, but interest is growing, especially among digital-native communities looking for better monetization paths.

Highlight feature: AI-powered crypto tools for creators to automate and monetize content.

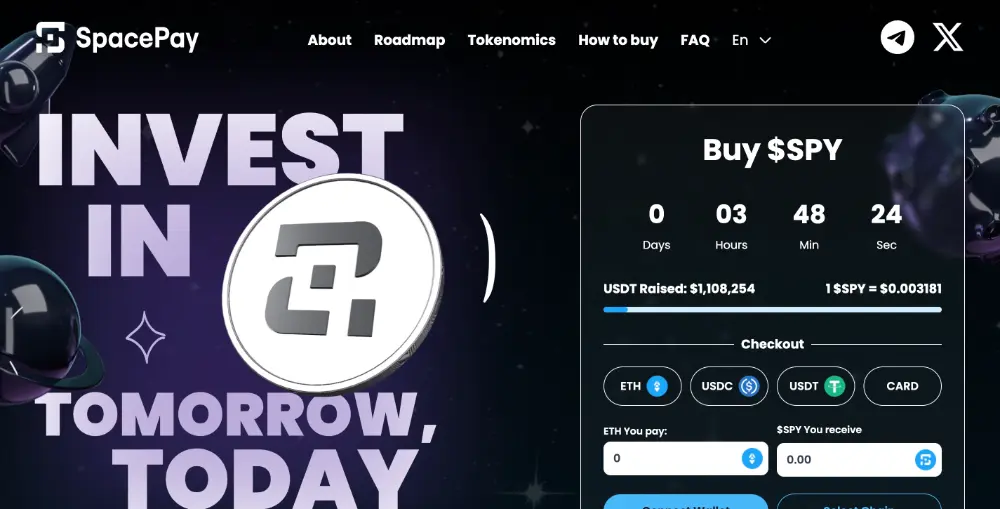

6. SpacePay (SPY) – Crypto Payments That Work in the Real World

SpacePay is one of the few new crypto coins focused on real merchant adoption. Instead of building another DeFi protocol, it integrates with traditional POS systems to let businesses accept crypto – without changing hardware or workflows.

Transactions settle with 0.5% fees, and the SPY token fuels the network, offering cashback and staking rewards. The platform already secured pilot programs with several retailers and raised over $1 million in its presale.

Its success depends on continued partnerships and merchant adoption, but the low-fee model gives it a solid entry point.

Highlight feature: Point-of-sale crypto payments with merchant integration and cashback rewards.

Visit SpacePay

7. YieldNest (YND) – Restaking Simplified for Mainstream Users

YieldNest is a DeFi project that repackages complex restaking strategies into a single, easy-to-manage token. Instead of juggling multiple protocols and risk parameters, users can gain exposure to diversified strategies through YND – backed by EigenLayer integrations and AI-generated allocations.

It’s part of the growing restaking narrative, but with a UI and token model aimed at mainstream DeFi users. The platform supports liquid staking, auto-compounding, and will soon offer multi-chain compatibility.

For investors looking to earn passive rewards without micromanaging, YieldNest simplifies the backend without compromising on yield.

Highlight feature: Aggregated restaking rewards through a single token with AI optimization.

Top 10+ New Crypto Coins to Buy in 2025

Looking for the most promising new crypto coins in 2025? Here’s a quick overview of the top upcoming projects right now.

- Bitcoin Hyper (HYPER) – BTC-themed Layer 2 using SVM technology to deliver fast transactions, staking rewards, and multi-chain DeFi utility across emerging ecosystems.

- Token6900 ($T6900) – Ethereum-based meme token launched mid-2025, combining absurdist branding with real staking rewards and one of the most retail-friendly presales of the year.

- Snorter Bot (SNORT) – Telegram-native trading bot token that enables instant sniping, copy-trading, MEV protection, and swap execution directly within the chat interface.

- Best Wallet Token (BEST) – Powers a multi-chain wallet ecosystem, boosting staking yields, unlocking early presale access, and reducing in-app transaction costs for active users.

- Subbd (SUBBD) – AI-based content automation platform that helps creators generate, monetize, and manage digital content with staking and governance utilities.

- SpacePay (SPY) – Bridges crypto and real-world commerce by enabling payments from 300+ wallets through traditional POS terminals, backed by the utility-rich $SPY token.

- MIND of Pepe (MIND) – Ethereum-based AI meme coin with a self-learning agent, up to 327% APY, full audit clearance, and now live on multiple CEXs after a $10M+ presale.

- YieldNest (YND) – Streamlined access to diversified restaking and DeFi strategies through a single token, removing complexity for passive yield seekers.

- Harry Hippo (HIPO) – Play-to-earn meme token with ~600% APY staking, gamified NFT mechanics, and plans for AI-integrated gameplay and major exchange listings

- Guardians of the Car ($GOCAR) – Solana-based meme token that rewards users for sharing driving data, aiming to reduce accidents with AI-powered mobility tools.

- Cogni AI (COGNI) – Lets users create custom AI agents with on-chain automation, combining chatbots, staking, and multi-chain token deployment.

- InfluencerPepe (INPEPE) – High-yield Web3 meme token built for the influencer economy, enabling fast, global payouts and verified creator interactions.

- Lightchain AI (LCAI) – Layer-1 blockchain with AI-integrated Proof-of-Intelligence, powering decentralized AI apps; raised $20M+ in presale.

- Bittensor (TAO) – Decentralized AI network rewarding machine learning model contributions with TAO tokens on its native chain.

What Makes a New Cryptocurrency Worth Investing in?

Most new crypto coins disappear within months – or never leave Telegram. But a handful manage to build real communities, traction, and even sustainable price action. If you’re hunting for the next 1000x crypto, here’s what actually matters.

Strong Use Case (Even If It’s Meme-Driven)

Utility doesn’t mean boring. Meme coins can work – if they solve something or offer a real function. For example, some coins use meme branding but add value as Layer 2 tokens. That blend of narrative and product tends to outperform tokens built only on hype.

When a project answers “why would anyone use this?” without needing a whitepaper, it’s off to a good start.

Solid Tokenomics and Audit Transparency

Token supply should be capped, presale allocations should be balanced, and there should be some form of vesting. Fair launches don’t mean zero marketing – they mean clear incentives for all sides. Look for third-party audits from Coinsult, SolidProof, or InterFi to reduce the chance of rug pulls or backdoor exploits.

If tokenomics and security look rushed, assume the project is too.

Crypto Data Platforms Announcing The New Cryptocurrency

CoinMarketCap’s Recently Added page lists new cryptocurrencies added each week – often before they hit major news cycles.

It’s a great place to scout low-cap tokens before social media catches on. You can also combine this with volume analysis on DEXTools or presale insights from Best Wallet for a more complete picture.

What To Look For in Upcoming New Cryptos in 2025?

Hundreds of new cryptocurrency projects launch every month, but only a few gain real traction. If you’re planning to buy early or track crypto presales before tokens hit the market, here’s what to consider – and what helps separate a top investment from quick exit scams.

- Defined Use Case With a Real Problem to Solve: A strong new crypto doesn’t just exist to exist. Look for a clear use case – whether it’s improving trading platforms, lowering DeFi fees, or enabling digital payments across multiple networks like Ethereum or Solana.

- Balanced Token Supply and Launch Structure: Projects with fair token distribution, moderate initial market cap, and lockups for team/investors tend to perform better over time. Oversupply or lack of vesting usually signals short-term thinking.

- Security and Contract Transparency: Smart contracts should be audited by independent firms, especially if the project promises staking, finance tools, or integrations across exchanges. Poor security can tank even the best ideas.

- Active Social Presence and Organic Growth: Twitter, Telegram, and even Discord can reveal how much actual community momentum a project has. Fake followers and inactive chats are red flags. Healthy social engagement often correlates with stronger price performance post-launch.

- Data Availability and Trading Potential

Platforms like CoinMarketCap and DEXTools can help track volume, liquidity, and price trends. If a token has no accessible trading data or isn’t listed anywhere, its market potential is limited – at least in the short term.

The Biggest Benefits of New Cryptocurrency Releases

Every cycle, the biggest gains tend to come from new cryptocurrency releases – not just established coins (although XRP was a good exception last year). While they carry risk, new tokens often unlock unique opportunities that seasoned projects can’t offer anymore.

Early Entry = Higher Upside Potential

New crypto coins typically launch with small market caps, giving early investors a better shot at exponential returns. You’re not buying into a billion-dollar token – you’re entering when the fully diluted value might still be under $5M. For high-risk portfolios, this early access is where asymmetric upside lives. Of course, it’s also where most of the volatility sits. The key is identifying strong fundamentals before price discovery fully kicks in.

Innovation Happens at the Edge

The newest crypto projects are often where real innovation happens first. Whether it’s using restaking for passive income, combining DeFi with AI, or introducing cross-chain compatibility from day one, these tokens tend to test new ideas faster than legacy protocols. Investors who track early adoption of tech trends – like Layer 2 scaling or decentralized creator platforms – get exposure to concepts before they go mainstream. It’s a riskier space, but it’s where the next wave of functionality tends to emerge.

Access to Exclusive Features and Rewards

Many new cryptocurrencies offer early adopters more than just price exposure. From staking APYs to whitelist allocations and governance voting, new releases often include strong incentives for holding and participating. Presales may include discounted rates, while launchpads and platforms like Best Wallet or Pinksale give investors tools to manage and monitor these benefits. If you’re active in these early stages, the reward structure is often skewed in your favor – at least until the broader market catches up.

Are There Risks With New Crypto Coins?

Yes – and they’re often bigger than with established tokens. While new crypto coins offer potential upside, they also come with limited data, unpredictable performance, and higher vulnerability to scams or contract failures. Investors need to evaluate not just hype, but also smart contracts, token supply, and the credibility of the developers behind the project.

Limited Testing and Unproven Smart Contracts

Many new crypto coins launch with smart contracts that haven’t been thoroughly tested in the wild. Bugs, exploits, or rushed code can lead to lost funds or halted trading. Audits help, but they’re not always present – especially with smaller or stealth-launched projects.

Without contract transparency or version history, it’s difficult to judge long-term security. This adds an extra layer of risk compared to older protocols with battle-tested code.

Anonymous Teams and Developer Drop-Off

Some tokens are built by anonymous developers with no past record, making it hard to assess whether they’ll stick around post-launch. Others lose momentum when the hype dies, with devs abandoning updates and support after a few weeks.

Without an experienced team or visible roadmap, new crypto coins often struggle to meet their early expectations. Always consider the project’s leadership before investing heavily.

Low Liquidity and Exchange Risks

New crypto coins typically aren’t listed on major exchanges right away, which limits liquidity and increases slippage. Price movements can be extreme – even a small sell-off may cause a significant dip.

Until a token is listed on a reliable exchange, performance often depends on local media attention or influencer-driven spikes. If those dry up, momentum disappears just as fast, and so follow the market cap.

Final Words

New cryptocurrency projects can deliver major upside – but also come with real risks. The key is knowing what to look for: strong use case, smart tokenomics, audit transparency, and organic community growth. It doesn’t matter if you’re tracking presales or sniping tokens post-launch, stick to the basics: manage risk, take profits, and only invest what you can afford to lose.

Best New Cryptocurrency FAQs

How do I buy new crypto coins before listing?

Where can I find new crypto coins early?

What are the newest cryptocurrencies?

Which crypto has 1000x potential?

What is the next hot crypto in 2025?

What is the best new crypto to buy now?

References

- https://www.statista.com/outlook/fmo/digital-assets/cryptocurrencies/worldwide

- https://coinmarketcap.com/new/

- https://finance.yahoo.com/news/xrp-ripple-down-34-buy-150300371.html

- https://www.coingecko.com/en/new-cryptocurrencies