Cryptocurrency Ownership Grows Among Retail Investors Globally

10.10.2024 20:00 2 min. read Alexander Stefanov

Retail engagement with cryptocurrencies has significantly increased since 2020, according to a recent report from the International Organization of Securities Commissions (IOSCO) released on October 9.

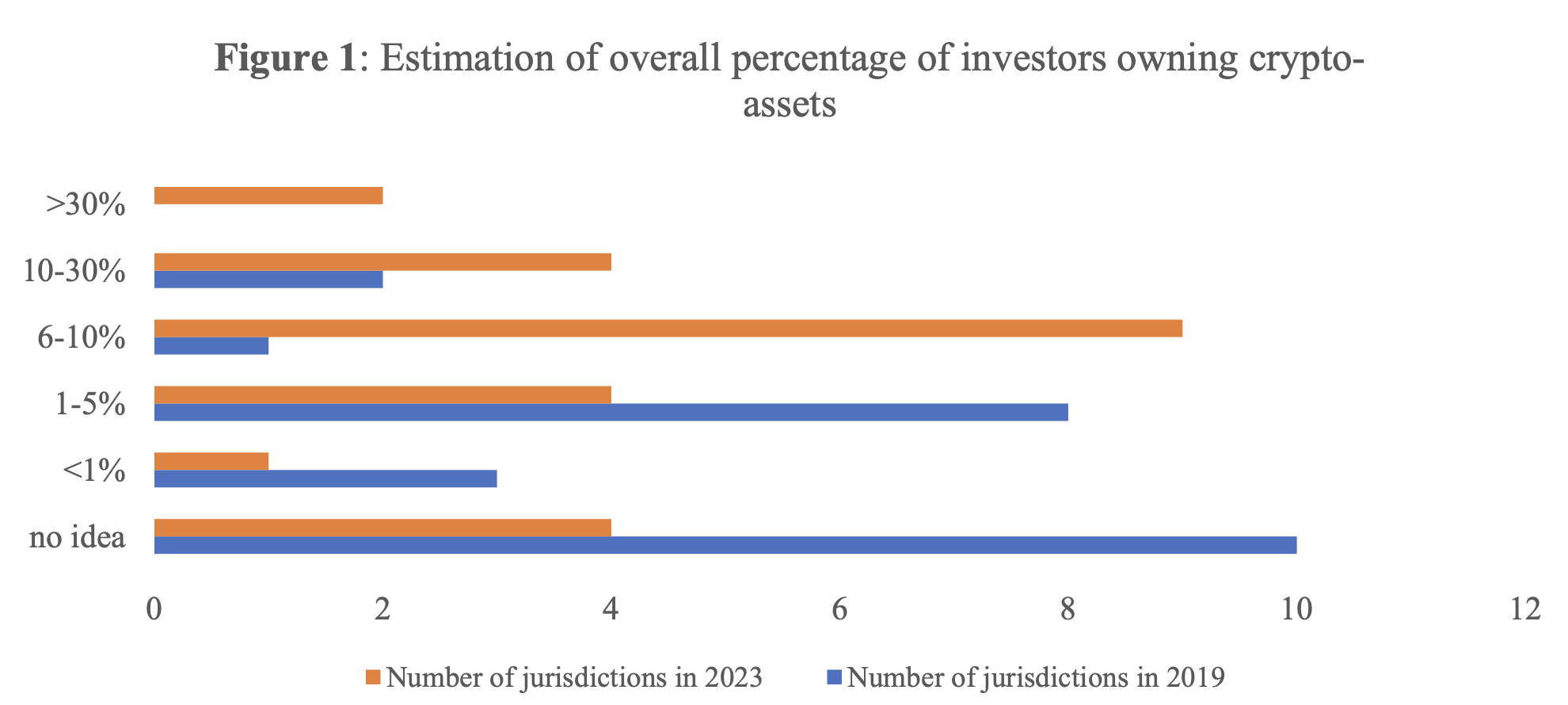

The study revealed that 15 of the 24 jurisdictions surveyed noted that over 10% of retail investors now hold crypto assets, with six jurisdictions reporting ownership levels exceeding 30%. This marks a sharp rise from 2020, when many areas estimated that only 1% to 5% of investors were involved in the crypto space.

IOSCO attributes this growth to heightened interest among retail investors, although it raises alarms about persistent challenges such as market instability, insufficient investor education, regulatory gaps, and a rise in fraudulent activities. These concerns echo those outlined in IOSCO’s previous report from 2020.

The report also points to increased risks in the crypto market since 2020, including significant bankruptcies, a bear market that saw asset values decline by up to 73%, and a spike in fraud and cybercrime. Yet, despite these issues, enthusiasm for crypto remains strong among retail investors.

Younger demographics, particularly men under 40, are leading the charge in crypto investments. In the United States, nearly 60% of individuals under 35 have considered investing in cryptocurrencies, with over half having already made investments. Among Generation Z (ages 18 to 25), approximately 44% have initiated their investment journey with cryptocurrencies.

The report highlights that new investors are more inclined to enter the crypto market than seasoned investors, driven by factors such as fear of missing out (FOMO), speculation, low entry costs, and influence from peers or social media.

-

1

XRP Could Beat Solana to the ETF Finish Line, Analysts Say

12.06.2025 17:00 2 min. read -

2

Trump Family Reaches Resolution on Memecoin Dispute, Eyes Major Token Purchase

08.06.2025 14:00 2 min. read -

3

Pi Price Prediction: Can Pi Coin Retest All-Time Lows?

13.06.2025 20:10 3 min. read -

4

Plasma’s ICO: A $500M Frenzy Sparks Fairness Debate

10.06.2025 22:00 2 min. read -

5

South Korea’s New President Pushes for Domestic Stablecoins

11.06.2025 16:00 2 min. read

Strategy Boosts Bitcoin Holdings to 597,325 BTC with Latest Purchase

Bitcoin giant Strategy has added another 4,980 BTC to its reserves in a purchase worth approximately $531.9 million, according to Executive Chairman Michael Saylor.

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

According to renowned market veteran Peter Brandt, trading isn’t the path to prosperity for the vast majority of people.

TRON (TRX) Eyes Breakout as Bollinger Bands Signal Squeeze

According to a new analysis from CryptoQuant, TRON (TRX) may be gearing up for a breakout as tightening Bollinger Bands point to an imminent expansion in volatility.

Why Bitcoin Is Stuck Despite Wall Street Demand

Charles Edwards, founder and CEO of Capriole Investments, has offered a fresh perspective on Bitcoin’s stalled price movement near the $100,000 mark, despite growing institutional enthusiasm.

-

1

XRP Could Beat Solana to the ETF Finish Line, Analysts Say

12.06.2025 17:00 2 min. read -

2

Trump Family Reaches Resolution on Memecoin Dispute, Eyes Major Token Purchase

08.06.2025 14:00 2 min. read -

3

Pi Price Prediction: Can Pi Coin Retest All-Time Lows?

13.06.2025 20:10 3 min. read -

4

Plasma’s ICO: A $500M Frenzy Sparks Fairness Debate

10.06.2025 22:00 2 min. read -

5

South Korea’s New President Pushes for Domestic Stablecoins

11.06.2025 16:00 2 min. read