Cryptocurrency Miners Find New Cash Flows in AI Sector

18.07.2024 13:00 1 min. read Kosta Gushterov

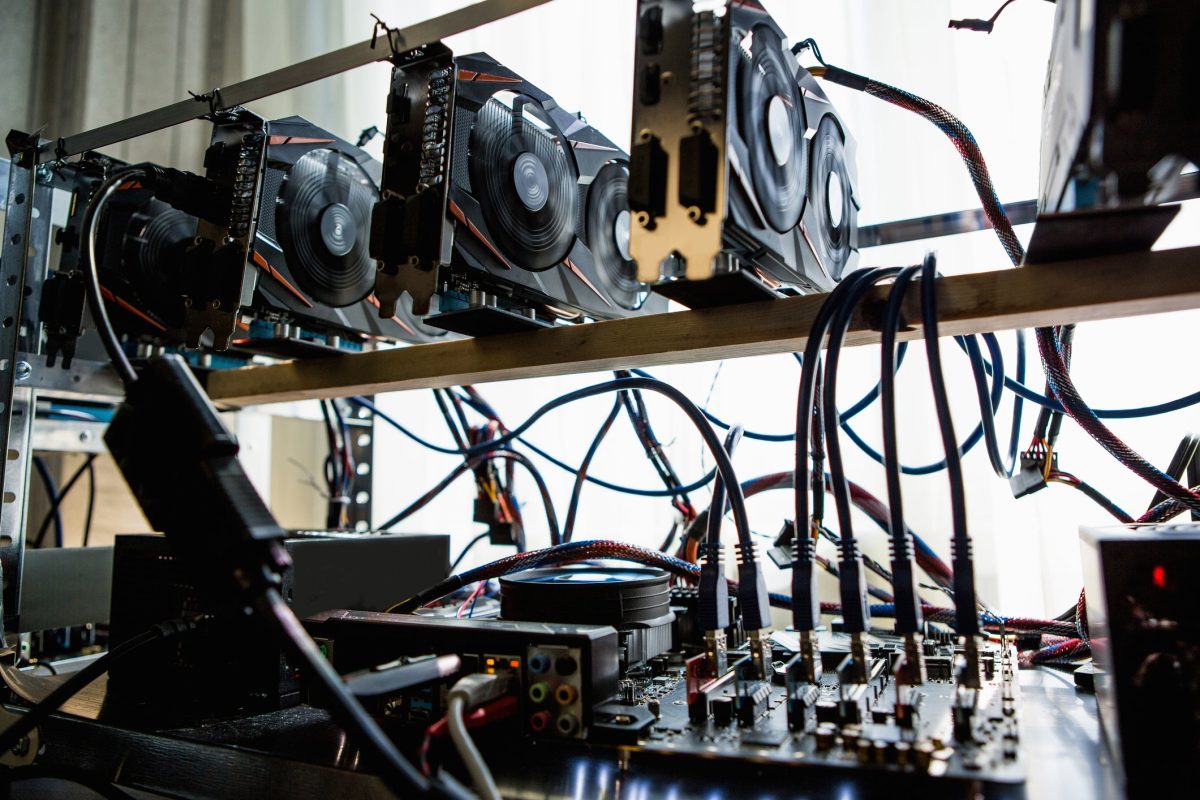

Cryptocurrency miners are turning to AI for new revenue streams due to challenges in their traditional operations.

The miners are reportedly using their advanced computing facilities to support artificial intelligence (AI), coping with high energy costs and diminishing returns in cryptocurrency mining.

Core Scientific, Bitcoin’s largest miner, is leading this shift. The company’s CEO, Adam Sullivan, highlighted a significant deal with AI cloud services provider CoreWeave that is expected to generate $4.7 billion over 12 years. CoreWeave, which switched from cryptocurrency mining to AI, achieved a $19 billion valuation in May after raising $7.5 billion in debt financing.

AI companies need significant energy and computing resources, making the existing infrastructure of cryptomining a lucrative option. J.P. Morgan analysts say that building HPC data centers can take 3-5 years until miners’ configurations are ready for use.

High performance computing (HPC) is the ability to process data and perform complex calculations at high speed.

Other miners such as TeraWulf Inc. and Hut 8 Corp. are also expanding into AI, with TeraWulf developing a new HPC project and Hut 8 receiving a $150 million investment to develop AI infrastructure.

-

1

Weekly Recap: Key Shifts and Milestones Across the Crypto Ecosystem

06.07.2025 17:00 4 min. read -

2

Trump Imposes 50% Tariff on Brazil: Political Tensions and Censorship at the Center

10.07.2025 7:00 2 min. read -

3

Key Crypto Events to Watch in the Next Months

20.07.2025 22:00 2 min. read -

4

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read -

5

UAE Regulators Dismiss Toncoin Residency Rumors

07.07.2025 11:12 2 min. read

Two Upcoming Decisions Could Shake Crypto Markets This Week

The final days of July could bring critical developments that reshape investor sentiment and influence the next leg of the crypto market’s trend.

Winklevoss Slams JPMorgan for Blocking Gemini’s Banking Access

Tyler Winklevoss, co-founder of crypto exchange Gemini, has accused JPMorgan of retaliating against the platform by freezing its effort to restore banking services.

Robert Kiyosaki Warns: ETFs Aren’t The Real Thing

Renowned author and financial educator Robert Kiyosaki has issued a word of caution to everyday investors relying too heavily on exchange-traded funds (ETFs).

Bitwise CIO: The Four-Year Crypto Cycle is Breaking Down

The classic four-year crypto market cycle—long driven by Bitcoin halvings and boom-bust investor behavior—is losing relevance, according to Bitwise CIO Matt Hougan.

-

1

Weekly Recap: Key Shifts and Milestones Across the Crypto Ecosystem

06.07.2025 17:00 4 min. read -

2

Trump Imposes 50% Tariff on Brazil: Political Tensions and Censorship at the Center

10.07.2025 7:00 2 min. read -

3

Key Crypto Events to Watch in the Next Months

20.07.2025 22:00 2 min. read -

4

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read -

5

UAE Regulators Dismiss Toncoin Residency Rumors

07.07.2025 11:12 2 min. read