Crypto Wallet Moves Bitcoin Stash After a Decade of Inactivity

20.08.2024 16:30 1 min. read Alexander Stefanov

A Bitcoin wallet that had been dormant for 10.8 years recently moved 24 BTC, marking a significant gain.

Data from Whale Alert reveals that a Bitcoin wallet, untouched since November 2013, has been activated. The 24 BTC in the wallet, initially valued at around $10,915, is now worth approximately $1.46 million—a gain of 13,245%.

The reason for this sudden move is unclear, but it may indicate the holder is cashing out after a lengthy period of inactivity. Despite the large gain, this amount is small relative to the overall Bitcoin market.

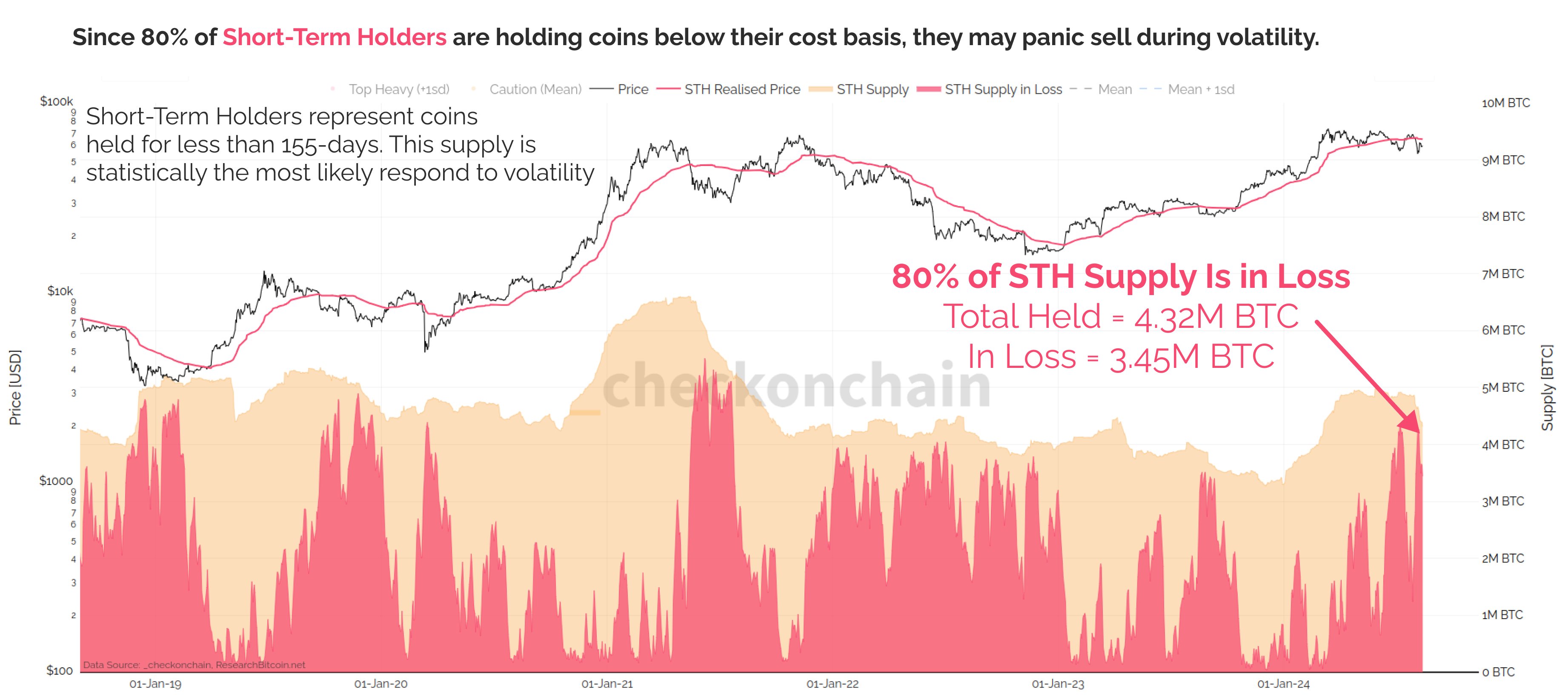

Additionally, analyst Checkmate noted that 80% of Bitcoin held by short-term investors (those who bought within the last 155 days) are currently at a loss.

This could lead to potential sell-offs, but these losses represent only about 4% of Bitcoin’s total market cap.

-

1

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

2

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

3

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

4

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read -

5

Bitcoin Reaches New All-Time High Above $116,000

11.07.2025 7:56 1 min. read

Ethereum Flashes Golden Cross Against Bitcoin: Will History Repeat?

Ethereum (ETH) has just triggered a golden cross against Bitcoin (BTC)—a technical pattern that has historically preceded massive altcoin rallies.

Bitcoin Banana Chart Gains Traction as Peter Brandt Revisits Parabolic Trend

Veteran trader Peter Brandt has reignited discussion around Bitcoin’s long-term parabolic trajectory by sharing an updated version of what he now calls the “Bitcoin Banana.”

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

-

1

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

2

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

3

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

4

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read -

5

Bitcoin Reaches New All-Time High Above $116,000

11.07.2025 7:56 1 min. read