Crypto Theft Surges to $2.1B in 2025: State Actors Lead Historic Wave of Attacks

27.06.2025 16:30 2 min. read Kosta Gushterov

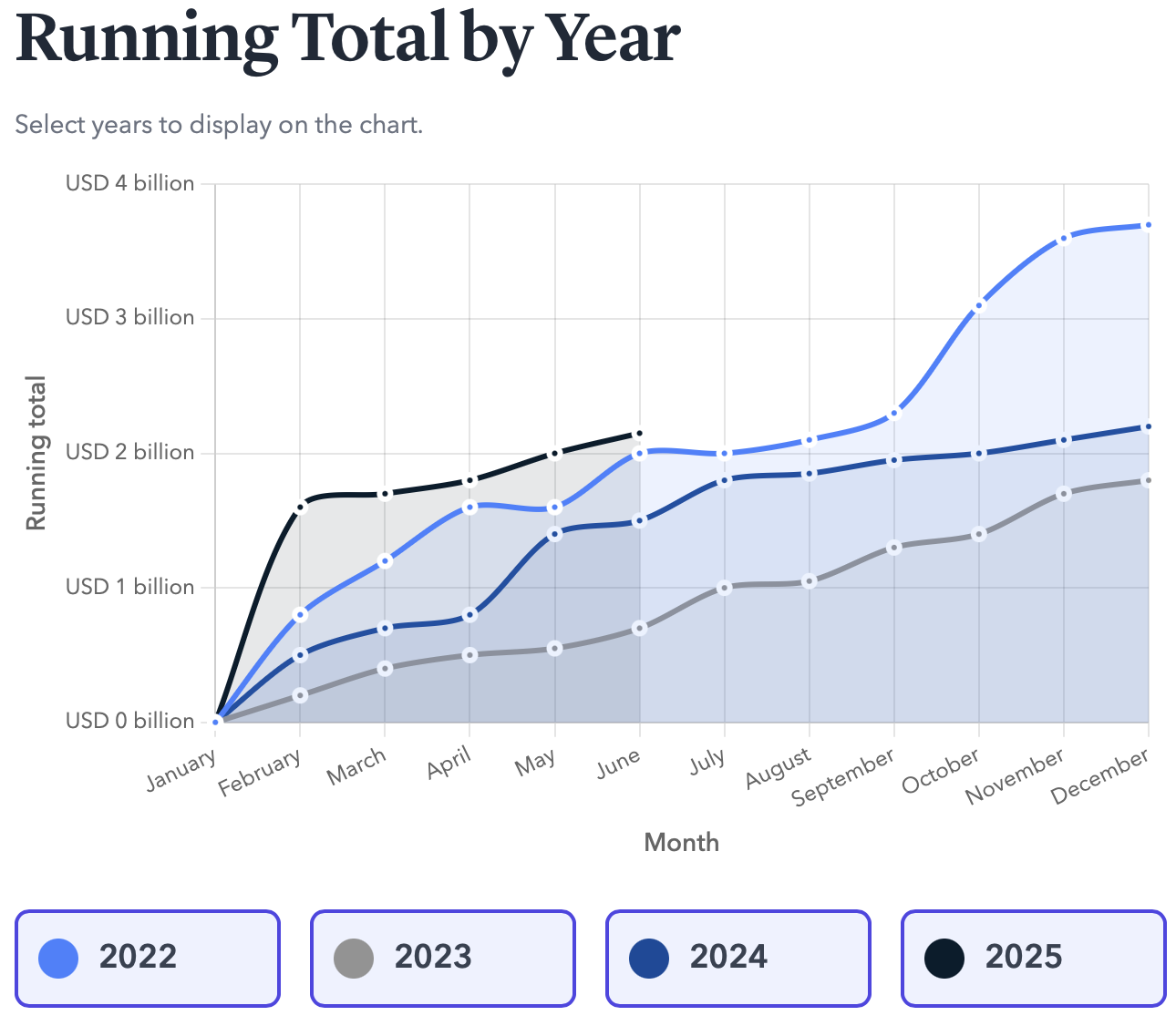

The first half of 2025 has become the most damaging six-month period in crypto history, with over $2.1 billion stolen across 75+ separate incidents, according to new data.

According to recent report this marks a 10% increase over the previous H1 record set in 2022, and nearly equals the total crypto losses from all of 2024.

The $1.5B Bybit Breach: A Game-Changer

At the heart of 2025’s explosive figures is the $1.5 billion attack on Bybit, the Dubai-based exchange, in February. North Korea is assessed to be behind the breach, making it the largest crypto hack ever recorded. This single event contributed almost 70% of all funds stolen this year, pushing the average hack size to $30 million, double that of H1 2024.

But the trend extends beyond one event. Each month except March posted losses exceeding $100 million, reinforcing a broader, sustained threat to the crypto sector.

North Korea and the Rise of State-Sponsored Crypto Theft

According to analysts, North Korean-linked threat actors are responsible for $1.6 billion of the $2.1 billion total, cementing the regime’s role as crypto’s most prolific nation-state adversary. These funds are believed to support sanctions evasion and strategic programs like nuclear weapons development, making cryptocurrency theft a core tool of DPRK statecraft.

The landscape is broadening. On June 18, Israel-linked cyber group Gonjeshke Darande (Predatory Sparrow) allegedly breached Iran’s largest exchange, Nobitex, stealing over $90 million. Unlike traditional heists, the stolen assets were transferred to unspendable “vanity” addresses, suggesting symbolic or political motives rather than financial gain.

Infrastructure Attacks Dominate the Threat Landscape

More than 80% of funds stolen in H1 2025 came from infrastructure-level breaches — including private key thefts, front-end exploits, and compromised access points. These attacks are typically high-impact and often aided by social engineering or insider access.

Meanwhile, protocol exploits, such as flash loan and reentrancy attacks, made up 12% of losses. These continue to expose DeFi vulnerabilities, underscoring persistent smart contract risks.

A Call for Global Cybersecurity Coordination

2025 marks a turning point in crypto cybersecurity. With nation-state actors escalating both scale and sophistication, traditional defenses are no longer enough. Experts call for:

- Robust multi-layered protections: MFA, cold storage, and continuous audits

- Insider threat detection and social engineering countermeasures

- Global collaboration between law enforcement, financial intel units, and firms like TRM Labs

As crypto increasingly intersects with national security, the stakes grow higher. The first half of 2025 sends a clear warning: digital assets are now targets in geopolitical conflicts, and defending them requires a unified, global response.

-

1

SEC Charges Georgia-based First Liberty and Owner in $140 Million Ponzi Scheme

12.07.2025 17:00 2 min. read -

2

Ex-NCA Officer Jailed for Stealing 50 BTC From Dark Web Criminal

17.07.2025 20:00 3 min. read -

3

Crypto Platform Suffers $12 Million Exploit Across Multiple Blockchain Networks

24.07.2025 20:23 2 min. read -

4

CoinDCX Suffers $44M Breach, Customer Funds Remain Secure

20.07.2025 10:00 1 min. read -

5

Justice Department Ends Kraken’s Co-founder Probe, Returns Seized Devices

23.07.2025 11:00 1 min. read

Crypto Platform Suffers $12 Million Exploit Across Multiple Blockchain Networks

WOO X, a popular cryptocurrency trading platform, has been hit by a serious security breach.

$3.1 Billion Lost: Hacken’s 2025 Report Reveals Web3 Security Crisis

The first half of 2025 has already become the most damaging period in Web3 security history, according to Hacken’s newly released Half-Year Security Report.

Justice Department Ends Kraken’s Co-founder Probe, Returns Seized Devices

The U.S. Department of Justice has officially ended its investigation into Kraken co-founder Jesse Powell, according to a Fortune report.

CoinDCX Suffers $44M Breach, Customer Funds Remain Secure

Indian crypto exchange CoinDCX has confirmed a $44 million security breach involving one of its internal liquidity accounts.

-

1

SEC Charges Georgia-based First Liberty and Owner in $140 Million Ponzi Scheme

12.07.2025 17:00 2 min. read -

2

Ex-NCA Officer Jailed for Stealing 50 BTC From Dark Web Criminal

17.07.2025 20:00 3 min. read -

3

Crypto Platform Suffers $12 Million Exploit Across Multiple Blockchain Networks

24.07.2025 20:23 2 min. read -

4

CoinDCX Suffers $44M Breach, Customer Funds Remain Secure

20.07.2025 10:00 1 min. read -

5

Justice Department Ends Kraken’s Co-founder Probe, Returns Seized Devices

23.07.2025 11:00 1 min. read