Crypto Markets Start New Week in the Red – Bitcoin Continues to Bleed

08.07.2024 9:30 2 min. read Alexander Stefanov

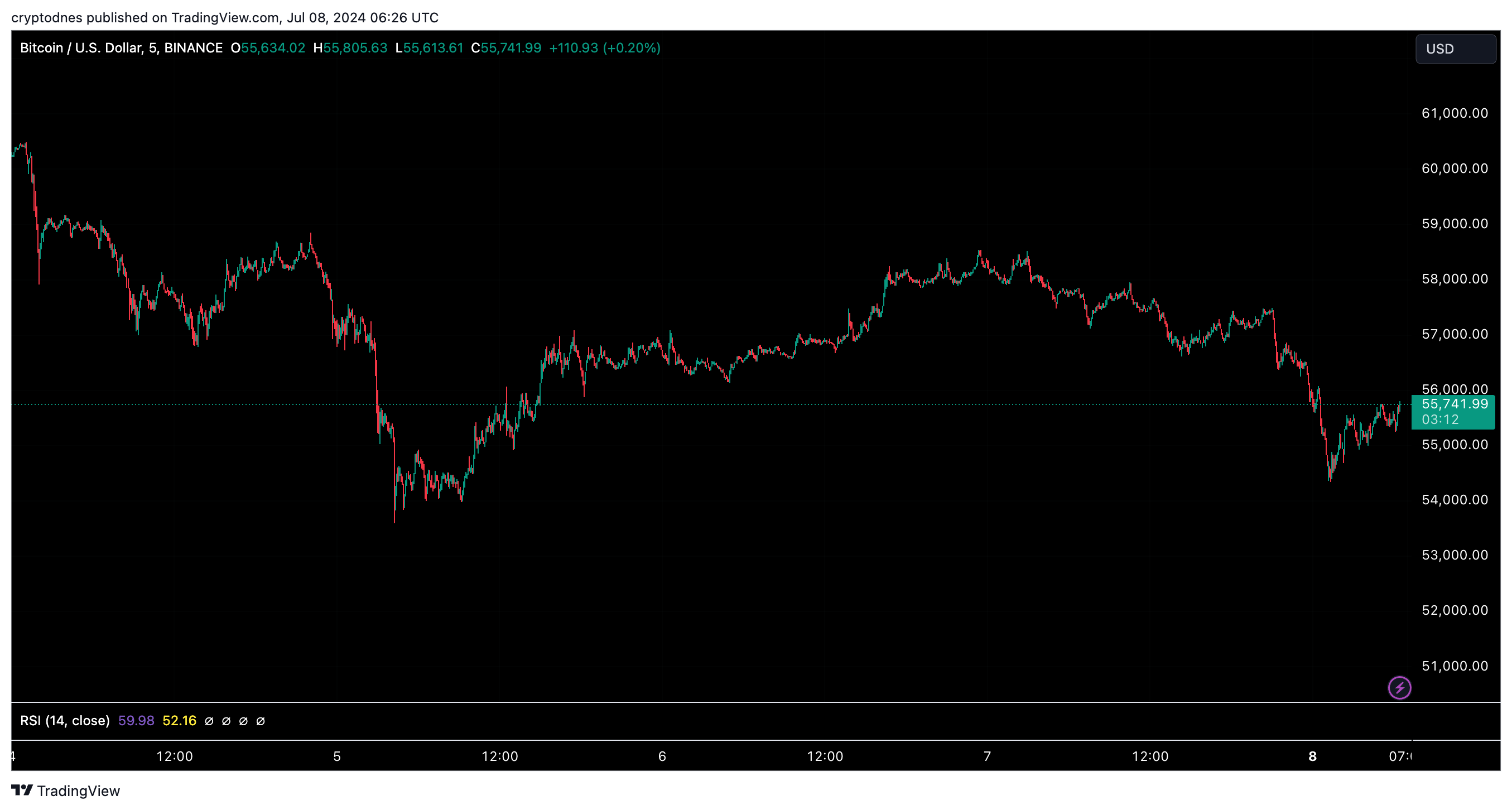

Last week Bitcoin and the wider crypto market experienced a significant down trend and this week might not be so different.

Last week saw major corrections across the board, with Bitcoin leading the herd. Today we can see this downtrend is continuing with Bitcoin and most altcoins being in the red.

At the time of writing Bitcoin (BTC) is trading at $55,741 after a 4% decline in the past 24 hours and a volume ot $25.6 billion. During the past 7 days alone the leading cryptocurrency lost 12.55%.

Although it showed some signs of recovering, trading between $57,000 and $58,000 during the weekend, the bearish santiment remains strong.

This is also illustrated by TradingView’s 1-day technical analysis – the summary points to “sell” at 14, the moving averages show “strong sell” at 13, while oscillators remain “neutral” at 9.

According to data from CoinGlass, $279.63 million were liquidated in the past 24 hours – $166.18 million in longs and $113.45 million in short positions).

Ethereum (ETH) also dropped below $3,000 and is currently trading $2,910 after a 4% price drop during the last day and $14.09 billion in trading volume. For the past week ETH lost 16.5% of its valuation.

The biggest losers today are two popular memecoins – Pepe (PEPE) and Dogwifhat (WIF).

PEPE lost 11.5% during the past 24 hours and is currently trading at $0.00008293, while WIF dropped by 11% and is now priced at $1.66. During the past 7 days both altcoins lost 30% and 28%, respectively.

The total market cap of all cryptocurrencies is now $2.03 trillion after a 3.88% decline.

Fears of continuied selling preassure from the German governemnt, which started selling their Bitcoin holdings last week, as well as the start of the Mt. Gox repayment plan furthers fuels the FUD and may lead to more price corrections this week.

-

1

Top 10 Trending Cryptocurrencies Today, According to CoinGecko

04.07.2025 15:31 3 min. read -

2

Second Largest Bank in Spain Rolls out in-app Bitcoin and Ethereum Trading

07.07.2025 15:30 2 min. read -

3

How Much Profit Would you Make if you Invested $3,000 in Shiba Inu One Year Ago?

09.07.2025 22:00 2 min. read -

4

SPX6900 Price Prediction: SPX Holders Jump and Trading Volumes Explode – Is $2 In Sight?

09.07.2025 17:44 3 min. read -

5

2 Altcoins Gaining Strength as Bitcoin Enters New Phase

08.07.2025 13:00 2 min. read

Top Trending Cryptocurrencies Today: Qubic, Conflux, and Tezos

The crypto market is seeing a burst of activity, with several altcoins outperforming the broader market.

Altcoins Drain Bitcoin Liquidity as Correlation Breakdown Sparks Caution

According to a new market update from Alphractal, altcoins have been outperforming Bitcoin in recent days—drawing liquidity away from the leading cryptocurrency and triggering key warning signals.

Here is What New Crypto Traders Should Focus on, According to Top Analyst

Entering any fast-paced financial market can be overwhelming for newcomers. The promise of high returns often tempts beginners to jump into risky opportunities without fully understanding the dynamics at play.

Is the Crypto Market Topping Out? Key Signals to Watch

The crypto market is heating up as bullish momentum sweeps across altcoins, raising a critical question: is this rally sustainable, or is a correction looming?

-

1

Top 10 Trending Cryptocurrencies Today, According to CoinGecko

04.07.2025 15:31 3 min. read -

2

Second Largest Bank in Spain Rolls out in-app Bitcoin and Ethereum Trading

07.07.2025 15:30 2 min. read -

3

How Much Profit Would you Make if you Invested $3,000 in Shiba Inu One Year Ago?

09.07.2025 22:00 2 min. read -

4

SPX6900 Price Prediction: SPX Holders Jump and Trading Volumes Explode – Is $2 In Sight?

09.07.2025 17:44 3 min. read -

5

2 Altcoins Gaining Strength as Bitcoin Enters New Phase

08.07.2025 13:00 2 min. read