Crypto Market Faces Liquidations of Over $1 Billion in Last 24 Hours

05.08.2024 10:22 1 min. read Kosta Gushterov

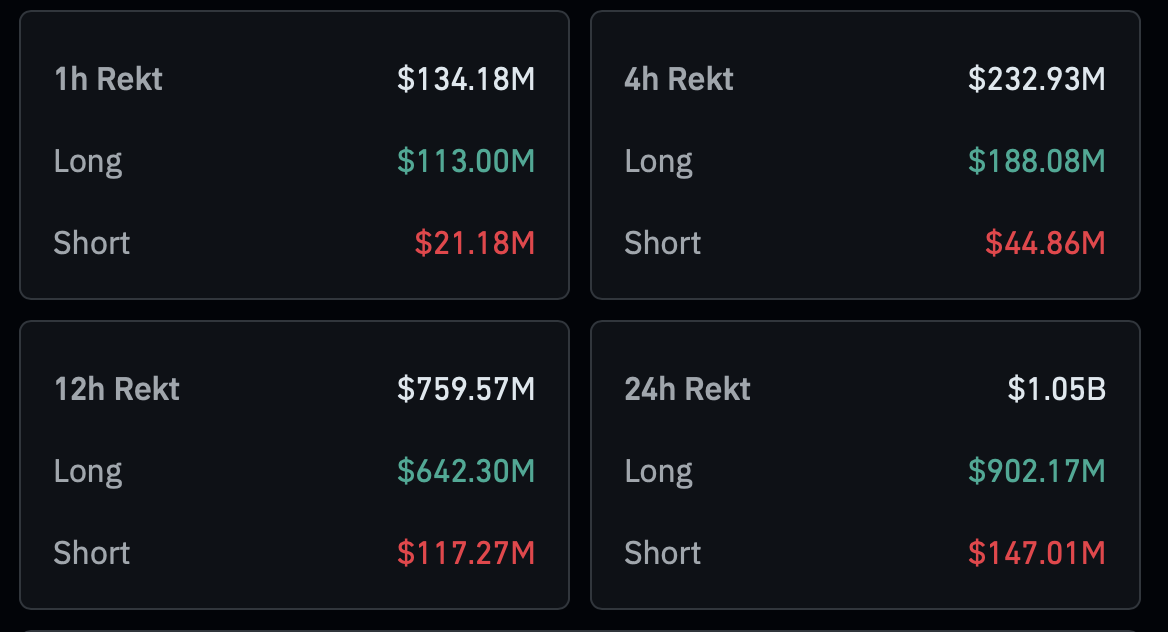

Over the past 24 hours, over $1 billion worth of crypto futures were liquidated as the market decline intensified on Sunday and continued into Monday.

Of the liquidations, over $902 million were long positions and $147 million were short positions.

This collapse was aided by speculation of Jump Trading exiting its crypto operations.

Bitcoin futures saw liquidations of over $350 million, and Ethereum futures saw liquidations of over $340 million.

More than 200,000 traders faced liquidations, with the largest single order worth $27 million on the Huobi exchange for BTC/USD trading. Data revealed that 87% of affected traders had long positions, betting on a price increase.

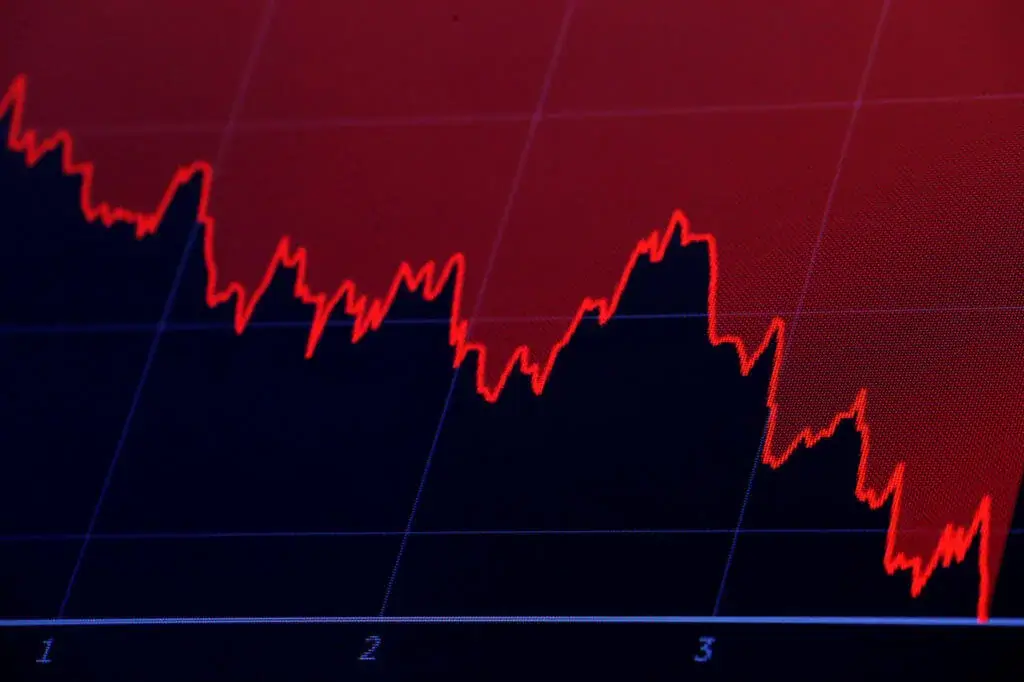

BTC saw a collapse of over 16% over the past day, falling below $50,000 briefly, while ETH dropped by up to 25% before a minor recovery.

The sharp decline triggered a “fear” signal on the crypto fear and greed index, which hit its lowest point since early July. This index assesses volatility, prices, and social media sentiment to gauge market emotions, showing potential lows when fear prevails and highs when greed dominates.

-

1

Whale Activity Alert: Which Altcoins Saw Millions Flow Into Exchanges?

09.07.2025 9:00 2 min. read -

2

Bitcoin Rises as Thousands of Altcoins Disappear

07.07.2025 13:00 2 min. read -

3

Binance Launches New Airdrop Rewards for BNB Holders

09.07.2025 18:00 2 min. read -

4

Ethereum nears key resistance as analysts predict $3,500 surge

13.07.2025 20:00 2 min. read -

5

Here is Why Institutions are Choosing Ethereum, According To Vitalik Buterin

06.07.2025 15:00 1 min. read

Here’s When the Bitcoin Cycle May Peak, Based on Past bull Markets

According to a new chart shared by Bitcoin Magazine Pro, the current Bitcoin market cycle may be entering its final stretch—with fewer than 100 days remaining before a potential market top.

Bitcoin Price Prediction: $130K in Sight After ‘Crypto Week’ Boost

Bitcoin (BTC) is once again hovering near its all-time high today as trading volumes have jumped by 13% in the past 24 hours upon breaking the $119,000 barrier, favoring a bullish Bitcoin price prediction. The top crypto has booked gains of 16% in the past 30 days and reached a new record at $123,091 earlier […]

Support Test or Breakout Ahead? Bitcoin Hovers at Key Decision Zone

Bitcoin is consolidating around $119,000 after last week’s all-time high above $123,000.

Altcoin Volume on Binance Hits Highest Level Since February

Altcoin trading volume on Binance Futures surged to $100.7 billion in a single day, reaching its highest level since February 3, 2025, according to data from CryptoQuant.

-

1

Whale Activity Alert: Which Altcoins Saw Millions Flow Into Exchanges?

09.07.2025 9:00 2 min. read -

2

Bitcoin Rises as Thousands of Altcoins Disappear

07.07.2025 13:00 2 min. read -

3

Binance Launches New Airdrop Rewards for BNB Holders

09.07.2025 18:00 2 min. read -

4

Ethereum nears key resistance as analysts predict $3,500 surge

13.07.2025 20:00 2 min. read -

5

Here is Why Institutions are Choosing Ethereum, According To Vitalik Buterin

06.07.2025 15:00 1 min. read