Crypto Market Crashes – $1.24 Billion in Positions Wiped Out

20.12.2024 13:29 1 min. read Alexander Zdravkov

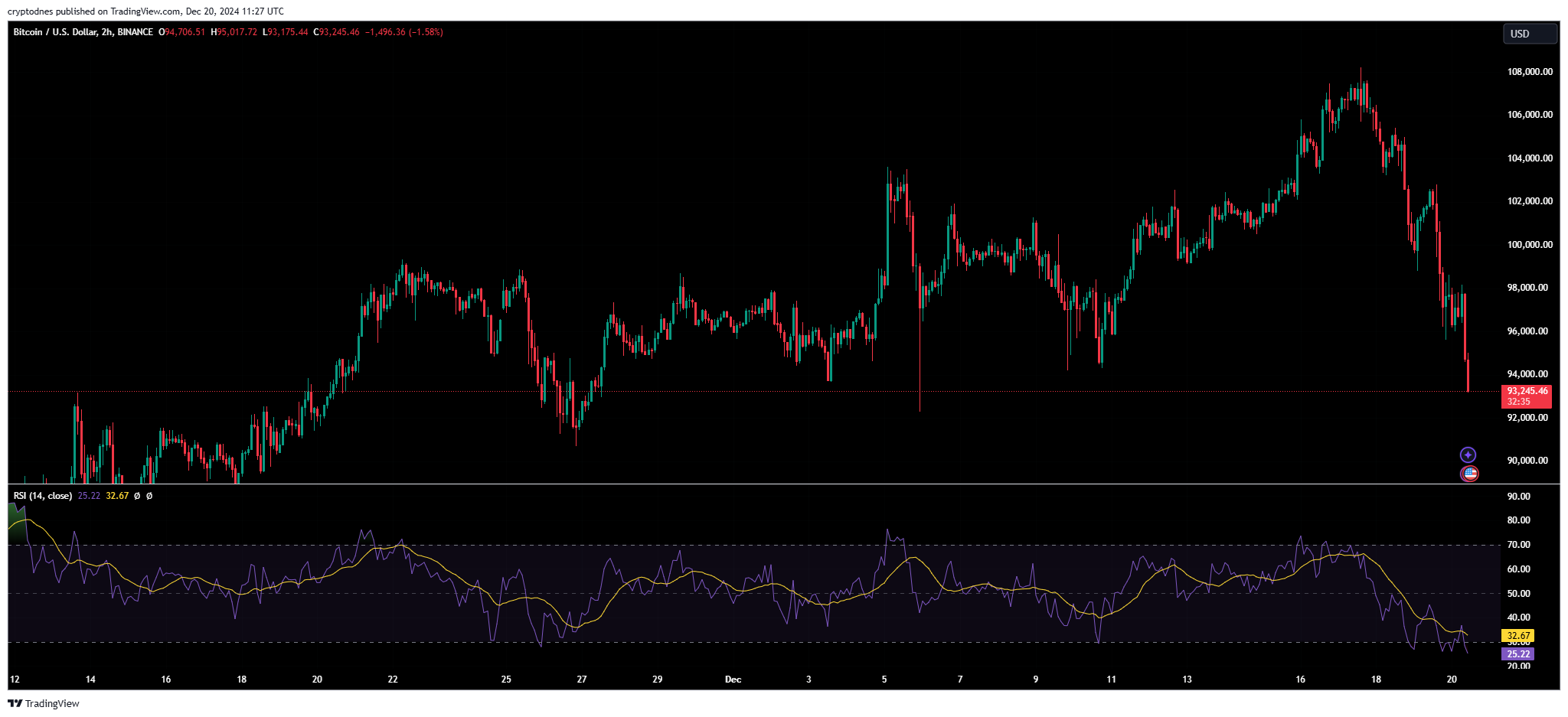

The crypto sell-off continues as the bearish trend takes form with Bitcoin and most altcoins taking major hits.

After Jerome Powell’s recent remarks on the plausability of adding Bitcoin to the U.S. national reserve, the crypto market took a serious downturn.

The negative sentiment pushed BTC to around $93,000 after the recent $108,000 peak. The top digital asset is down 9% in the past 24 hours to $107 billion market cap and has $107 billion trading volume.

Ethereum lost 15% of its value during the same period with its price currently hovering around $3,150. The altcoin is down almost 20% for the past 7 days. The 24-hour trading volume reached $69 billion with its market cap dropping to $384 billion.

The total cryptocurrency market cap has declined 10.46% and is currently $3.18 trillion.

In the past 24 hours $1.24 billion in positions were wiped out from the crypto market – $1.07 billion in longs and $163.55 million in shsorts, according to CoinGlass data. Ethereum and Bitcoin accounted for the largest amount – almost $590 million in liquidations

The 1-day technical analysis from TradingView also reflects the extremely bearish sentiment with the summary, moving averages and oscillators pointing to “sell” at 11, 8 and 3, respectively.

-

1

BNB Chain Upgrades and Token Delistings Reshape Binance Ecosystem

16.07.2025 22:00 2 min. read -

2

Most Trending Cryptocurrencies on CoinGecko After Bitcoin’s New ATH

11.07.2025 19:00 2 min. read -

3

Altcoin Supercycle? Analysts Signal ‘Banana Zone 2.0’ as Market Erupts

13.07.2025 19:00 2 min. read -

4

Solana Price Prediction: SOL Could be Ready to Move to $225 After Breakout

21.07.2025 17:14 3 min. read -

5

Ethereum Tops $3,285 for First Time Since January

17.07.2025 7:00 1 min. read

Where Is The Smart Entry Point For Bitcoin Bulls?

With Bitcoin hovering near $119,000, traders are weighing their next move carefully. The question dominating the market now is simple: Buy the dip or wait for a cleaner setup?

Matrixport Warns of Bitcoin Dip After Hitting This Target

Bitcoin has officially reached the $116,000 milestone, a level previously forecasted by crypto services firm Matrixport using its proprietary seasonal modeling.

Interactive Brokers Weighs Stablecoin Launch

Interactive Brokers, one of the world’s largest online brokerage platforms, is exploring the possibility of issuing its own stablecoin, signaling a potential expansion into blockchain-driven financial infrastructure as U.S. crypto regulation begins to ease.

BNB Coin Price Prediction: As BNB Chain Daily Transaction Volumes Explode Can It Hit $900?

Trading volumes for BNB Coin (BNB) have doubled in the past 24 hours to $3.8 billion as the price rises by 7%. This favors a bullish BNB Coin price prediction at a point when the token just made a new all-time high. BNB is the second crypto in the top 5 to make a new […]

-

1

BNB Chain Upgrades and Token Delistings Reshape Binance Ecosystem

16.07.2025 22:00 2 min. read -

2

Most Trending Cryptocurrencies on CoinGecko After Bitcoin’s New ATH

11.07.2025 19:00 2 min. read -

3

Altcoin Supercycle? Analysts Signal ‘Banana Zone 2.0’ as Market Erupts

13.07.2025 19:00 2 min. read -

4

Solana Price Prediction: SOL Could be Ready to Move to $225 After Breakout

21.07.2025 17:14 3 min. read -

5

Ethereum Tops $3,285 for First Time Since January

17.07.2025 7:00 1 min. read