Crypto Market Slump Has Left Traders With Millions of Dollars in Losses

05.08.2024 12:36 1 min. read Kosta Gushterov

The cryptocurrency market has recently experienced a significant downturn, resulting in large losses for many investors.

Blockchain security company PeckShield found that on Monday morning, a whale portfolio designated as “0xac4e…7597f” that had a long position in perpetual Ethereum (ETH) contracts experienced liquidations worth 7,467.5 ETH, which equates to approximately $22.3 million.

Another trader, identified by the address “0x0b5a…d8c5,” had lost close to $6 million, accompanied by 2 other Ethereum whales who lost $5.8 million and $7.38 million respectively.

These losses were part of a larger market crash that resulted in the liquidation of over $1 billion in digital assets on various exchanges.

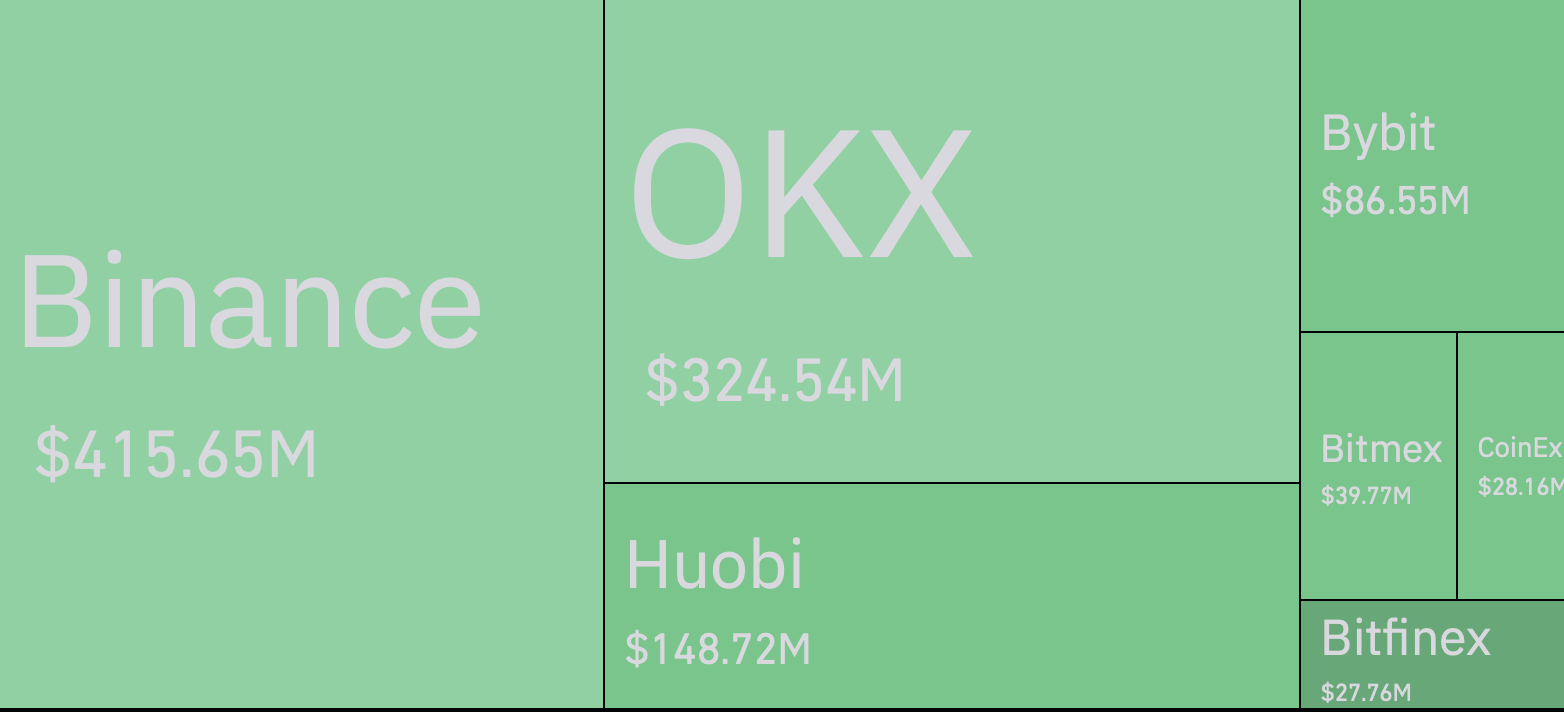

These liquidations occurred primarily on exchanges such as Binance, HTX, Bybit, BitMEX, and OKX. The largest single liquidation order took place on Huobi via the BTC/USD pair worth around $27 million.

Crypto traders on Binance lost around $415 million as the bears outnumbered the bulls over the weekend. Similarly, OKX saw losses of around $324 million, while Huobi traders lost approximately $148.7 million.

-

1

What’s Ahead for Ethereum, According to Former Core Developer

05.07.2025 19:00 2 min. read -

2

How Can You Tell When it’s Altcoin Season?

14.07.2025 14:07 2 min. read -

3

XRP Price Prediction: XRP Soars Over 30%, Can it Hit $10 in this Bull Run?

15.07.2025 0:49 5 min. read -

4

Whale Activity Alert: Which Altcoins Saw Millions Flow Into Exchanges?

09.07.2025 9:00 2 min. read -

5

Bitcoin Rises as Thousands of Altcoins Disappear

07.07.2025 13:00 2 min. read

Strategy Launches Fourth Preferred stock Offering to Fuel Bitcoin Buys

Strategy Inc. (NASDAQ: MSTR) has announced the launch of its fourth perpetual preferred stock offering, marking a new phase in the company’s ongoing efforts to expand its Bitcoin treasury holdings.

Solana Reclaims $200 as Short Squeeze, ETF hopes, and Institutional Flows Collide

Solana surged 5.6% to reclaim the $200 level for the first time since February, fueled by a confluence of bullish technical, fundamental, and institutional catalysts.

Top trending tokens today: WEMIX, Drift and TRUMP Coin

CoinMarketCap’s momentum algorithm is flashing strong upside signals for several fast-moving tokens. WEMIX, Drift, and OFFICIAL TRUMP Coin top today’s trending list, each driven by unique catalysts—from GameFi upgrades and DeFi volume surges to political tailwinds.

Public Companies Now hold Over $100 Billion in Bitcoin — 4% of Total Supply

According to new data shared by Bitcoin Magazine Pro, publicly traded companies now collectively hold over 844,822 BTC, valued at more than $100.5 billion, marking a historic milestone for institutional Bitcoin adoption.

-

1

What’s Ahead for Ethereum, According to Former Core Developer

05.07.2025 19:00 2 min. read -

2

How Can You Tell When it’s Altcoin Season?

14.07.2025 14:07 2 min. read -

3

XRP Price Prediction: XRP Soars Over 30%, Can it Hit $10 in this Bull Run?

15.07.2025 0:49 5 min. read -

4

Whale Activity Alert: Which Altcoins Saw Millions Flow Into Exchanges?

09.07.2025 9:00 2 min. read -

5

Bitcoin Rises as Thousands of Altcoins Disappear

07.07.2025 13:00 2 min. read