Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read Kosta Gushterov

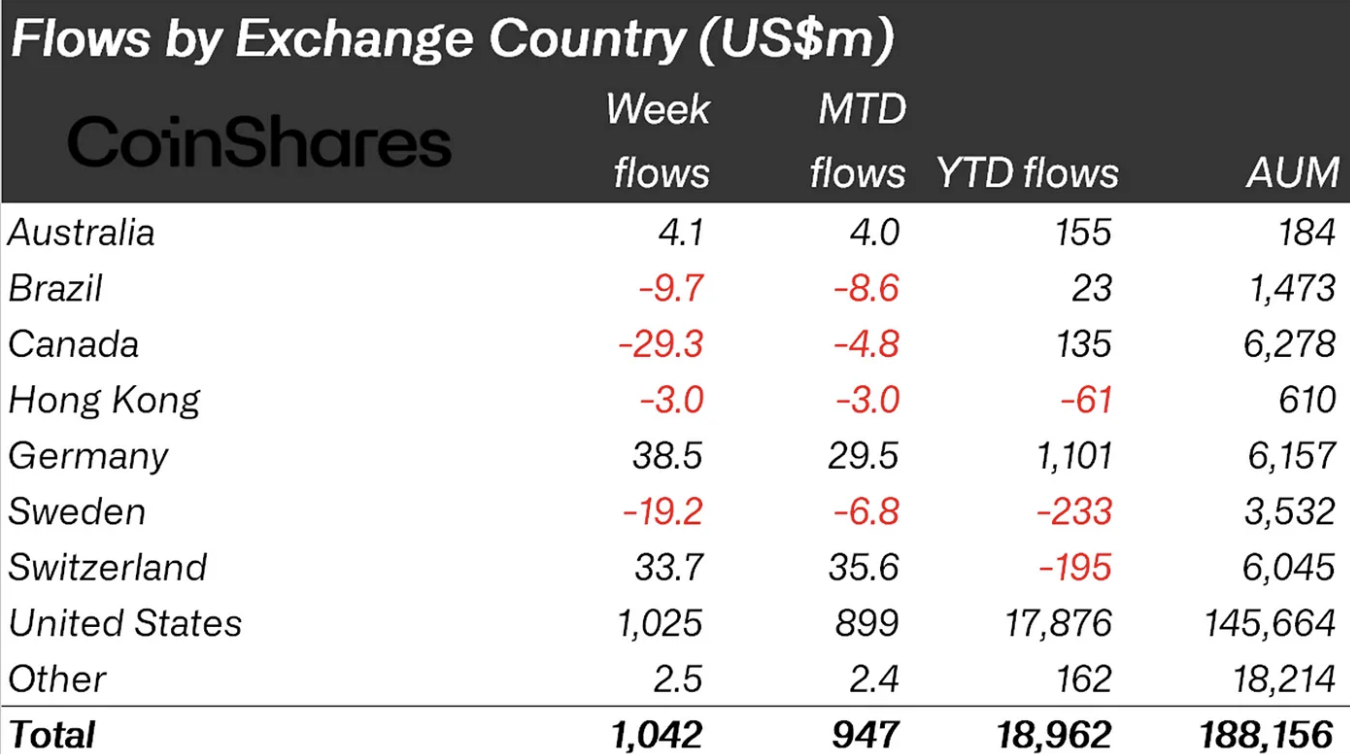

Digital asset investment products recorded $1.04 billion in inflows last week, pushing total assets under management (AuM) to a record high of $188 billion, according to the latest report from CoinShares.

This marked the 12th consecutive week of inflows and reflects growing institutional interest despite mixed market conditions.

U.S. dominates inflows as other regions diverge

The United States led global flows with $1 billion in net inflows, followed by Germany and Switzerland, which contributed $38.5 million and $33.7 million, respectively. However, the sentiment was more cautious in Canada and Brazil, which saw outflows of $29.3 million and $9.7 million. This regional split indicates growing divergence in how investors are approaching crypto exposure globally.

Ethereum sees stronger sentiment than Bitcoin

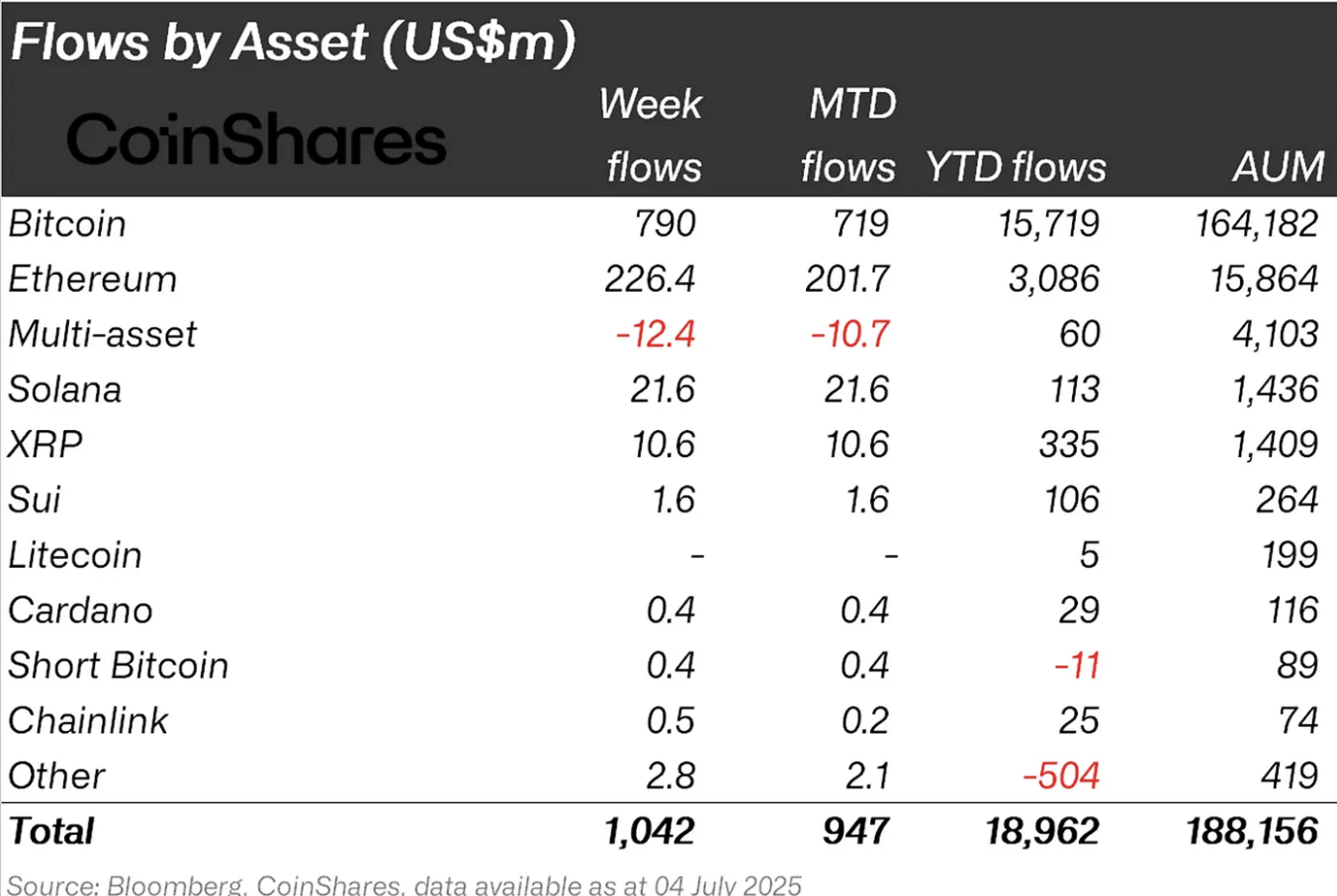

Bitcoin products attracted the bulk of capital with $790 million in inflows. Yet, this marks a slowdown from the previous three weeks, where inflows averaged $1.5 billion. Analysts interpret this moderation as caution near Bitcoin’s all-time highs.

Meanwhile, Ethereum is quietly gaining favor. The second-largest cryptocurrency saw $226 million in weekly inflows, extending its streak to 11 consecutive weeks and bringing its 11-week total to $2.85 billion. On a proportional basis, Ethereum is outperforming, with weekly inflows averaging 1.6% of AuM—double Bitcoin’s 0.8%.

Providers and assets breakdown

Among providers, iShares ETFs led with $436 million in inflows, followed by Fidelity ($248 million) and ARK 21Shares ($160 million). Grayscale, in contrast, saw $46 million in outflows.

By asset class, Bitcoin and Ethereum led, while Solana ($21.6 million) and XRP ($10.6 million) posted modest gains. Multi-asset products recorded $12.4 million in outflows, reflecting selective investor focus.

Outlook

With inflows accelerating and Ethereum showing strong momentum, the trend suggests rising institutional confidence in digital assets—especially in Ethereum’s long-term positioning as a programmable financial layer. If this pace continues, Ethereum could narrow the AuM gap with Bitcoin even further in the coming weeks.

-

1

Grayscale Reveals Which Altcoins Are Next in Line for Onclusion

11.07.2025 10:00 1 min. read -

2

List of Altcoins Seeing Strong Outflows as Binance Signals Shift

13.07.2025 11:00 2 min. read -

3

Cardano Surges Past $0.74 — Is a $1 Rally Next?

13.07.2025 18:00 2 min. read -

4

Arthur Hayes Predicts Monster Altcoin Season: Here is Why

12.07.2025 10:46 1 min. read -

5

SOL Price Tests Key Level: Can a Weekly Close Above $170 Trigger a Bull Run?

12.07.2025 16:20 2 min. read

Standard Chartered: Ethereum Treasury Firms Now Form a Distinct Investment Class

A new report from Standard Chartered highlights that publicly traded companies holding Ethereum (ETH) as a treasury asset have emerged as a unique and fast-evolving asset class, distinct from traditional crypto vehicles such as ETFs or private funds.

Strategy Adds 21,021 Bitcoin at $117,000, Pushing Total Holdings Past $46 Billion

Michael Saylor, executive chairman of Strategy, has revealed that the company has acquired an additional 21,021 Bitcoin for approximately $2.46 billion, paying an average price of $117,256 per BTC.

Bitcoin Funding Rates Stay Elevated—Rally Ahead or Shakeout Coming?

As Bitcoin continues to consolidate above $100K, a critical market signal is flashing: BTC funding rates remain elevated, even as price action cools.

Fartcoin Price Prediction: Trader Expects Big Bounce as FARTCOIN Nears $1

Fartcoin (FARTCOIN) has gone down by 17.3% in the past 24 hours and currently sits at $1.14. As the token approaches $1, one trader favors a bullish Fartcoin price prediction. DevKhabib, a pseudonymous trader whose X account is followed by nearly 46,000 users, says that he expects a big bounce off the $1 support after […]

-

1

Grayscale Reveals Which Altcoins Are Next in Line for Onclusion

11.07.2025 10:00 1 min. read -

2

List of Altcoins Seeing Strong Outflows as Binance Signals Shift

13.07.2025 11:00 2 min. read -

3

Cardano Surges Past $0.74 — Is a $1 Rally Next?

13.07.2025 18:00 2 min. read -

4

Arthur Hayes Predicts Monster Altcoin Season: Here is Why

12.07.2025 10:46 1 min. read -

5

SOL Price Tests Key Level: Can a Weekly Close Above $170 Trigger a Bull Run?

12.07.2025 16:20 2 min. read