Crypto Betting Booms Ahead of U.S. Presidential Election

05.11.2024 15:30 2 min. read Kosta Gushterov

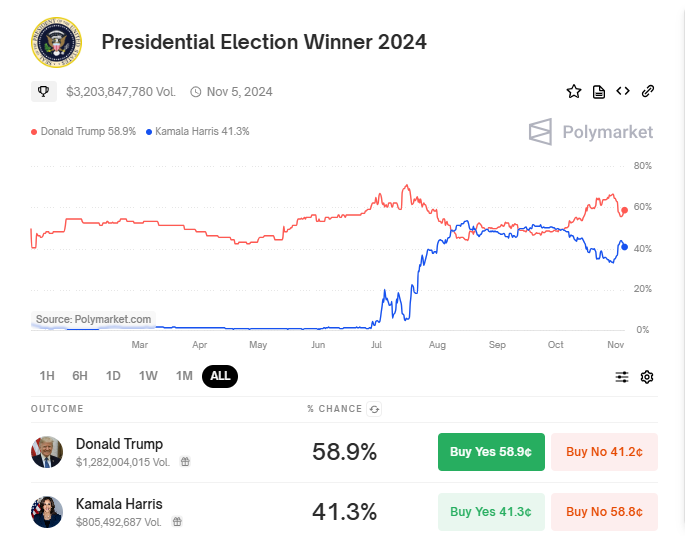

Ahead of the U.S. presidential election on Nov. 5, Polymarket has seen a major spike in activity, with its prediction market volume climbing to an impressive $3.2 billion.

This surge underscores the intense interest in the election, with many bettors showing confidence in Donald Trump’s potential victory over Kamala Harris.

Polymarket’s data currently assigns Trump a 58.3% chance of winning, compared to Harris at 41.8%. Wagers on Trump now total $1.279 billion, surpassing Harris’s $804.7 million, with a single high-stakes bet of $15 million placed in Trump’s favor. Polymarket has outlined that payouts will be determined based on a consensus among three major outlets—Associated Press, Fox News, and NBC News. If they don’t align, the final outcome will hinge on the official inauguration.

Interest in election predictions on Polymarket has soared. Between September and October, trading volumes rose 368%, reaching a high of $2.5 billion. This rapid growth speaks to the enthusiasm around forecasting the election, as well as the larger trend of using prediction markets to gauge political outcomes. Bloomberg’s integration of Polymarket data into its terminal in August further signaled a shift, and Robinhood’s new event contracts rolled out in October highlight the rising appeal of this alternative asset.

Despite its success, Polymarket is facing some scrutiny. Questions have surfaced over potential market manipulation in Trump’s favor, with instances of “wash trading” possibly inflating his odds. In response, Polymarket has enhanced its monitoring of user accounts, especially those linked to unusual trading behavior.

As Election Day nears, the dynamics on Polymarket will be closely watched. Whether this intense betting activity accurately reflects the political landscape or simply a speculative surge remains to be seen, but Polymarket’s ascent illustrates the expanding influence of prediction markets in political forecasting.

-

1

Chinese Tech Firms Turn to Crypto for Treasury Diversification

26.06.2025 17:00 1 min. read -

2

U.S. Bank Advises Clients to Drop These Cryptocurrencies

29.06.2025 10:00 2 min. read -

3

FTX Halts Recovery Payments in 49 Countries: Here Is the List

04.07.2025 18:00 2 min. read -

4

What Are the Key Trends in European Consumer Payments for 2024?

29.06.2025 8:00 2 min. read -

5

What Brian Armstrong’s New Stats Reveal About Institutional Crypto Growth

29.06.2025 15:00 2 min. read

U.S. Public Pension Giant Boosts Palantir and Strategy Holdings in Q2

According to a report by Barron’s, the Ohio Public Employees Retirement System (OPERS) made notable adjustments to its portfolio in Q2 2025, significantly increasing exposure to Palantir and Strategy while cutting back on Lyft.

Key Crypto Events to Watch in the Next Months

As crypto markets gain momentum heading into the second half of 2025, a series of pivotal regulatory and macroeconomic events are poised to shape sentiment, liquidity, and price action across the space.

Here is Why Stablecoins Are Booming, According to Tether CEO

In a recent interview with Bankless, Tether CEO Paolo Ardoino shed light on the growing adoption of stablecoins like USDT, linking their rise to global economic instability and shifting generational dynamics.

U.S. Dollar Comes Onchain as GENIUS Act Ushers in Digital Era

In a statement that marks a major policy shift, U.S. Treasury Secretary Scott Bessent confirmed that blockchain technologies will play a central role in the future of American payments, with the U.S. dollar officially moving “onchain.”

-

1

Chinese Tech Firms Turn to Crypto for Treasury Diversification

26.06.2025 17:00 1 min. read -

2

U.S. Bank Advises Clients to Drop These Cryptocurrencies

29.06.2025 10:00 2 min. read -

3

FTX Halts Recovery Payments in 49 Countries: Here Is the List

04.07.2025 18:00 2 min. read -

4

What Are the Key Trends in European Consumer Payments for 2024?

29.06.2025 8:00 2 min. read -

5

What Brian Armstrong’s New Stats Reveal About Institutional Crypto Growth

29.06.2025 15:00 2 min. read