Corporate Bitcoin Adoption Soars: 125 Public Companies Now Hold BTC

16.07.2025 20:00 2 min. read Kosta Gushterov

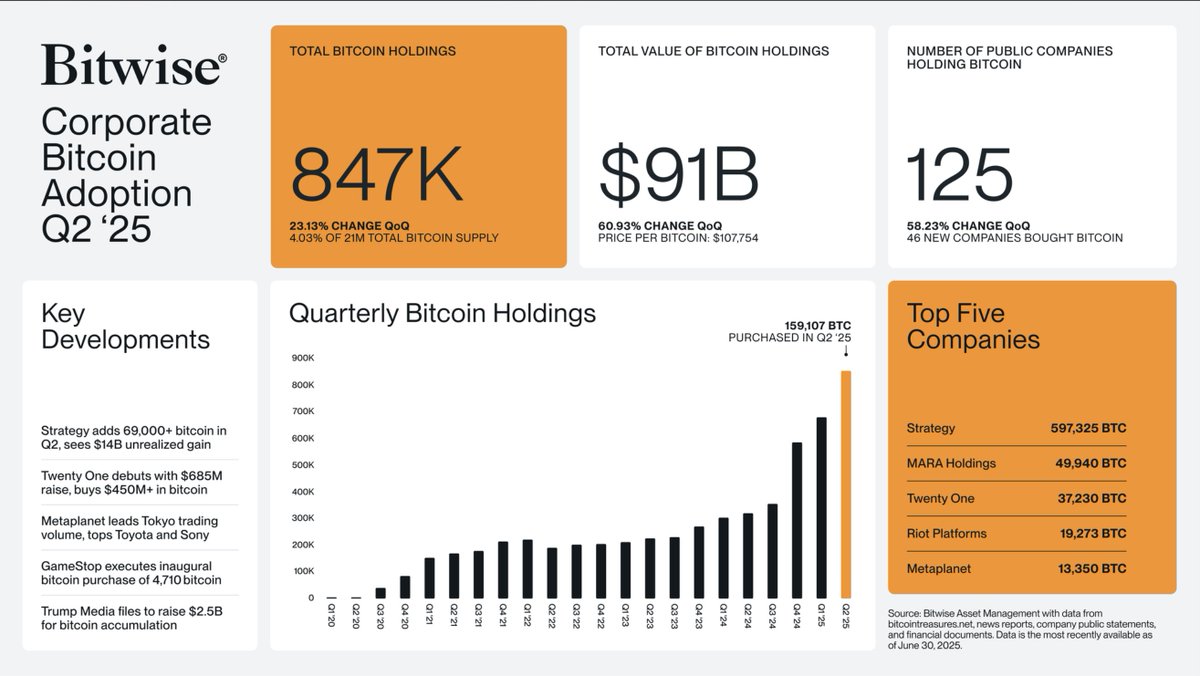

Corporate adoption of Bitcoin is gaining significant momentum, according to Bitwise Asset Management’s latest Q2 2025 report.

A total of 125 public companies now hold Bitcoin on their balance sheets, up from 79 in the previous quarter—a 58.23% increase. These firms collectively own 847,000 BTC, which accounts for 4.03% of the total Bitcoin supply.

The combined value of these holdings stands at $91 billion, reflecting a 60.93% quarter-over-quarter surge, driven in part by Bitcoin’s price averaging $107,754 during the quarter.

Top five corporate holders and record quarterly purchases

The second quarter saw 159,107 BTC added to corporate treasuries. Leading the charge is Strategy (formerly MicroStrategy), which added 69,000 BTC and now holds 597,325 BTC. MARA Holdings ranks second with 49,940 BTC, followed by newly launched Twenty One with 37,230 BTC.

Riot Platforms and Japan’s Metaplanet round out the top five with 19,273 BTC and 13,350 BTC, respectively. Notably, Metaplanet has become a dominant force in Tokyo’s trading landscape, surpassing even local giants like Toyota and Sony in market activity.

New entrants signal broadening institutional interest

Q2 also marked the debut of several major players. GameStop executed its first Bitcoin purchase, acquiring 4,710 BTC, while Twenty One raised $865 million and immediately allocated $450 million to Bitcoin.

READ MORE:

How Can You Tell When it’s Altcoin Season?

Trump Media filed plans to raise $2.5 billion for BTC accumulation. Bitwise highlighted that, despite the growth, corporate adoption remains “early stage.” With over 50,000 public companies globally and only 125 currently holding Bitcoin, the trend appears to be just beginning.

As regulatory clarity improves and digital assets gain credibility as treasury alternatives, more institutions are likely to follow suit—potentially transforming corporate finance norms in the years ahead.

-

1

Robert Kiyosaki Says Crypto Is Key to Building Wealth in a Failing System

27.06.2025 10:00 1 min. read -

2

Franklin Templeton Warns of Serious Risks in Institutional Bitcoin Treasury Strategies

03.07.2025 18:12 2 min. read -

3

Top Public Companies by Bitcoin Holdings

02.07.2025 10:00 2 min. read -

4

Billionaire Says ‘Sell Your House, Buy Bitcoin’: Fiat Collapse Is Coming

05.07.2025 12:00 2 min. read -

5

American State Bans Crypto Investments and Payments in Sweeping New Law

01.07.2025 14:33 2 min. read

Here’s How Bitcoin Reacted to the June PPI Report

Bitcoin showed a brief bullish reaction to the June U.S. Producer Price Index (PPI) release at 12:30 UTC, but the move quickly lost steam as traders digested the broader implications of the data.

Bitcoin ETFs Record $403M Inflows as BlackRock Leads Nine-Day Streak

U.S.-listed spot Bitcoin ETFs continue to post strong inflows, recording their ninth consecutive day of net positive investment activity on Tuesday.

Strategy Claims It Can Weather a Bitcoin Crash to $20K Without Trouble

Chaitanya Jain, Bitcoin strategy manager at Strategy, has pushed back against online speculation that the company’s fate is tightly bound to the price of Bitcoin.

Cantor Fitzgerald-backed SPAC Targets $4 Billion Bitcoin Purchase

Brandon Lutnick, son of U.S. Commerce Secretary Howard Lutnick, is reportedly finalizing a multibillion-dollar Bitcoin acquisition deal through a special purpose acquisition company (SPAC) backed by Cantor Fitzgerald.

-

1

Robert Kiyosaki Says Crypto Is Key to Building Wealth in a Failing System

27.06.2025 10:00 1 min. read -

2

Franklin Templeton Warns of Serious Risks in Institutional Bitcoin Treasury Strategies

03.07.2025 18:12 2 min. read -

3

Top Public Companies by Bitcoin Holdings

02.07.2025 10:00 2 min. read -

4

Billionaire Says ‘Sell Your House, Buy Bitcoin’: Fiat Collapse Is Coming

05.07.2025 12:00 2 min. read -

5

American State Bans Crypto Investments and Payments in Sweeping New Law

01.07.2025 14:33 2 min. read