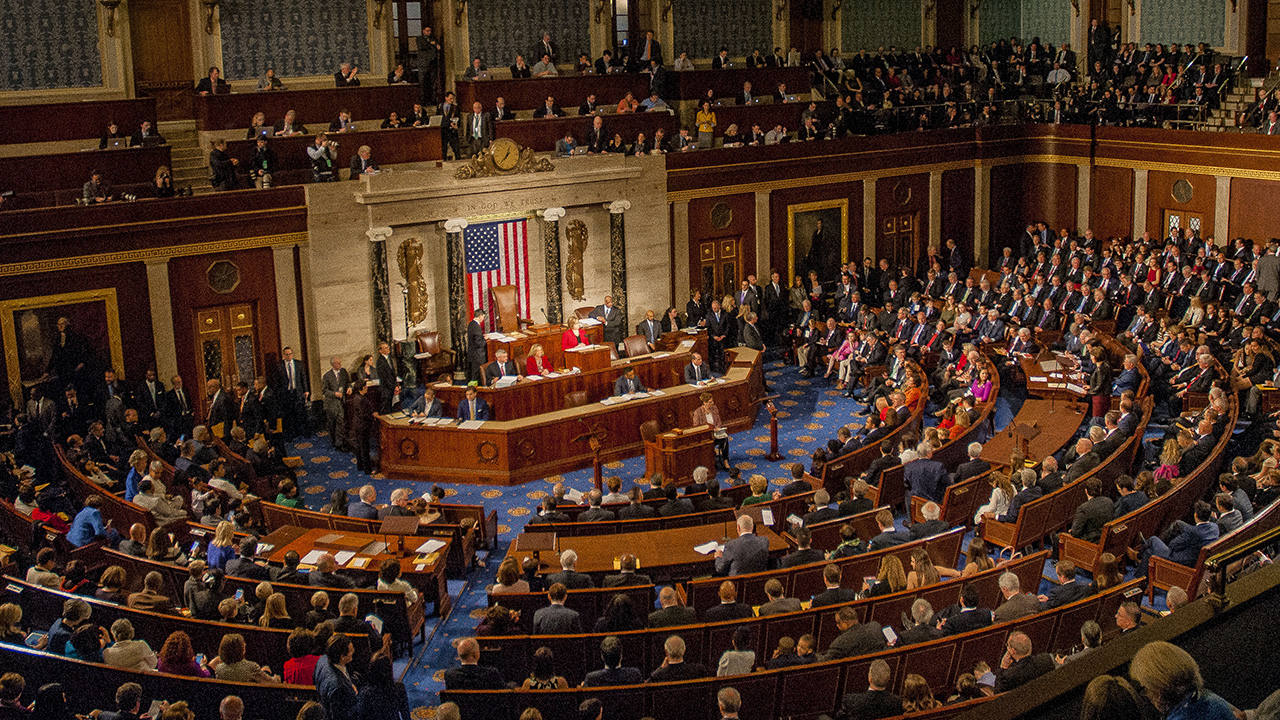

Congress Calls on SEC to Allow Banks to Custody Crypto

25.09.2024 21:00 1 min. read Alexander Stefanov

In a recent letter to Securities and Exchange Commission (SEC) Chairman Gary Gensler, 42 US Congressmen urged the SEC to allow banks to offer cryptocurrency custody services.

The letter comes in the wake of the SEC’s decision in July this year to allow public companies to exclude customers’ crypto holdings from their balance sheets, provided they manage the associated risks.

The letter, led by Representatives Patrick McHenry, Cynthia Loomis, French Hill and Tim Scott, criticizes SEC Accounting Bulletin No. 121 (SAB 121). The Congressmen claim that SAB 121 was issued without consultation with key regulators and does not accurately represent the legal and economic responsibilities of custodians. They warned that this misrepresentation could expose consumers to greater financial risk.

SAB 121 requires companies that hold cryptocurrencies for customers to list those assets as liabilities, making cryptocurrency custody less attractive to banks.

The letter highlights concerns about the SEC’s guidance, stating that the use of official guidance to implement policy changes violates the Administrative Procedure Act. The Representatives urged the SEC to rescind SAB 121 and work with Congress to provide safe and secure custodial services for digital assets.

-

1

House Clears Path for Landmark Crypto Bills: Vote Set for Thursday

17.07.2025 9:15 2 min. read -

2

Australia Tests CBDCs in 24 Separate Real-World Finance Use Cases

10.07.2025 19:00 2 min. read -

3

U.S. House Passes Sweeping Clarity and GENIUS Acts

17.07.2025 23:29 1 min. read -

4

Senate Confirms Crypto-Linked Nominee Jonathan Gould to Head OCC

11.07.2025 9:00 2 min. read -

5

U.S. Regulators Define Crypto Custody Rules for Banks

15.07.2025 9:00 1 min. read

Nigeria Signals Greenlight for Stablecoin Innovation Under New Regulatory Vision

Nigeria is taking a decisive step toward embracing stablecoin adoption, as the country’s Securities and Exchange Commission (SEC) outlined its readiness to support digital currency innovation—under clear regulatory conditions.

South Korea Urges Asset Managers to Limit Exposure to Crypto Stock Like Coinbase,MicroStrategy

South Korea’s top financial watchdog has issued informal guidance urging local asset managers to scale back their investments in crypto-related stocks, according to a Korean Herald report.

SEC Reverses Bitwise ETF Approval Just Hours After Greenlight

In a surprising move on Tuesday, the U.S. Securities and Exchange Commission (SEC) initially approved Bitwise’s proposal to convert its cryptocurrency index fund into a full-fledged exchange-traded fund (ETF)—only to halt the decision just hours later.

Senate Republicans Unveil Crypto Market Bill to Expand CLARITY Act

Senators Tim Scott, Cynthia Lummis, Bill Hagerty, and Bernie Moreno (R-OH) have released a discussion draft of a new digital asset market structure bill—framed as the Senate counterpart to the CLARITY Act.

-

1

House Clears Path for Landmark Crypto Bills: Vote Set for Thursday

17.07.2025 9:15 2 min. read -

2

Australia Tests CBDCs in 24 Separate Real-World Finance Use Cases

10.07.2025 19:00 2 min. read -

3

U.S. House Passes Sweeping Clarity and GENIUS Acts

17.07.2025 23:29 1 min. read -

4

Senate Confirms Crypto-Linked Nominee Jonathan Gould to Head OCC

11.07.2025 9:00 2 min. read -

5

U.S. Regulators Define Crypto Custody Rules for Banks

15.07.2025 9:00 1 min. read