Coinbase Lost a Significant Part of its Market Share

11.09.2024 10:30 1 min. read Kosta Gushterov

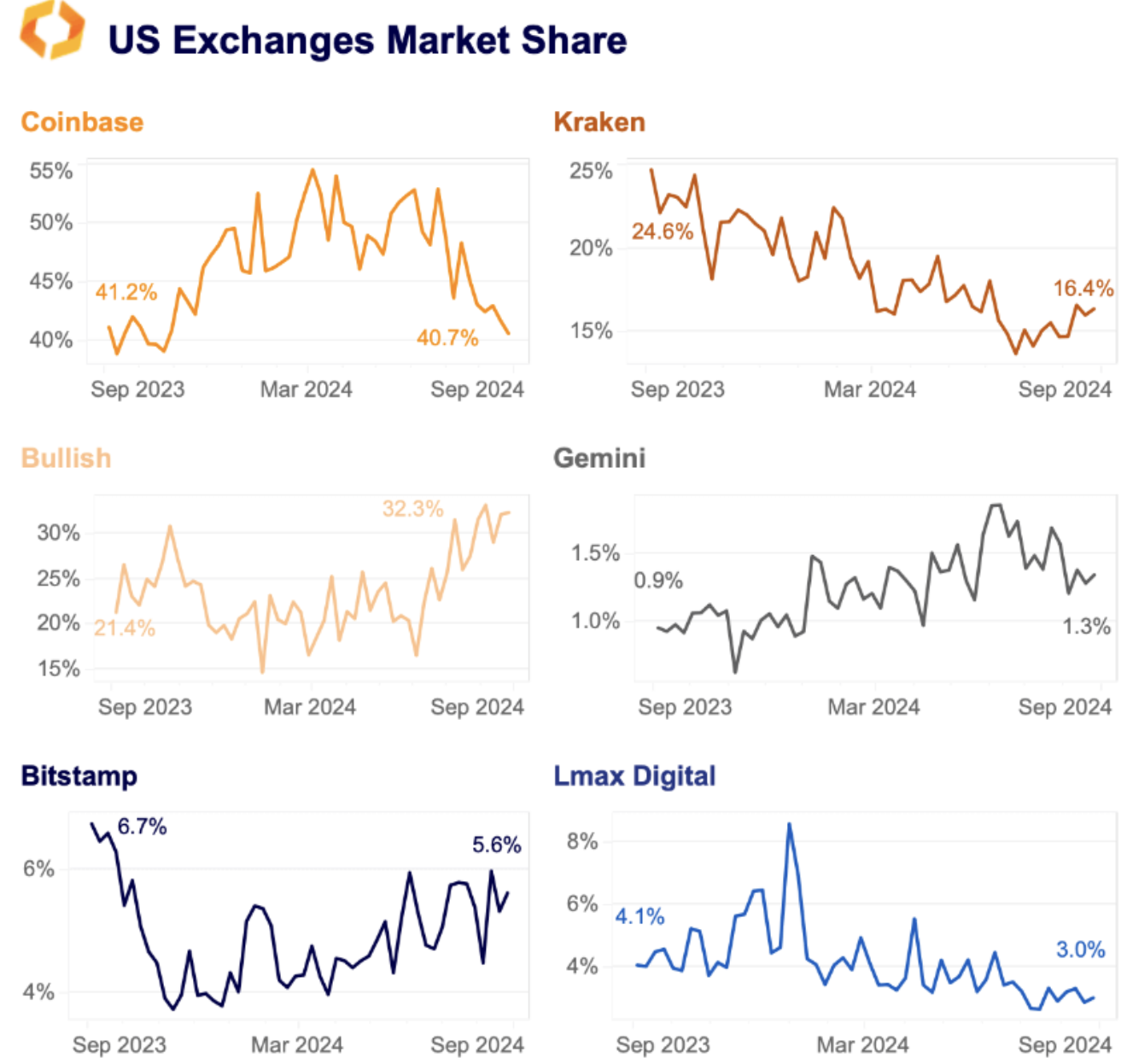

According to a report by Kaiko dated September 9, Coinbase has experienced a significant decline in its market share as smaller exchanges gain ground.

Earlier this year, Coinbase held over 50% of the crypto market in the U.S., reaching 55% in March. However, by the beginning of September, its share had fallen to 41%, a sharp drop from 53% in June.

A major beneficiary of this shift is Bullish, whose market share doubled from 17% to 33% during the same period. Unlike Coinbase, which focuses on retail investors, Bullish is targeted at institutional clients.

According to Kaiko, the top three crypto exchanges in the U.S. now control nearly 90% of the market, compared to 66% in April 2021. In contrast, the share of smaller exchanges has dropped from 34% to just 11%.

This change is attributed to stricter regulations, lower trading activity during the bear market of 2022-2023, and the dominance of large players like Coinbase and Kraken in institutional trading. The collapse of FTX in 2022 and regulatory actions against Binance.US further accelerated this trend.

-

1

Trump Imposes 50% Tariff on Brazil: Political Tensions and Censorship at the Center

10.07.2025 7:00 2 min. read -

2

Key Crypto Events to Watch in the Next Months

20.07.2025 22:00 2 min. read -

3

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read -

4

UAE Regulators Dismiss Toncoin Residency Rumors

07.07.2025 11:12 2 min. read -

5

Majority of U.S. Crypto Investors Back Trump’s Crypto Policy, Survey Finds

05.07.2025 18:09 2 min. read

Two Upcoming Decisions Could Shake Crypto Markets This Week

The final days of July could bring critical developments that reshape investor sentiment and influence the next leg of the crypto market’s trend.

Winklevoss Slams JPMorgan for Blocking Gemini’s Banking Access

Tyler Winklevoss, co-founder of crypto exchange Gemini, has accused JPMorgan of retaliating against the platform by freezing its effort to restore banking services.

Robert Kiyosaki Warns: ETFs Aren’t The Real Thing

Renowned author and financial educator Robert Kiyosaki has issued a word of caution to everyday investors relying too heavily on exchange-traded funds (ETFs).

Bitwise CIO: The Four-Year Crypto Cycle is Breaking Down

The classic four-year crypto market cycle—long driven by Bitcoin halvings and boom-bust investor behavior—is losing relevance, according to Bitwise CIO Matt Hougan.

-

1

Trump Imposes 50% Tariff on Brazil: Political Tensions and Censorship at the Center

10.07.2025 7:00 2 min. read -

2

Key Crypto Events to Watch in the Next Months

20.07.2025 22:00 2 min. read -

3

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read -

4

UAE Regulators Dismiss Toncoin Residency Rumors

07.07.2025 11:12 2 min. read -

5

Majority of U.S. Crypto Investors Back Trump’s Crypto Policy, Survey Finds

05.07.2025 18:09 2 min. read