China’s Economic Outlook for 2025: Stimulus Efforts and Rising Tariff Threats

27.11.2024 18:30 2 min. read Alexander Stefanov

China's economic outlook for 2025 is currently shaped by two conflicting forces: a policy shift aimed at stimulating the economy and the looming threat of a new trade war with the U.S.

As Beijing moves to stabilize the economy through fiscal support, including a significant debt restructuring plan, U.S. President Trump has vowed to ramp up tariffs on Chinese goods, potentially stoking a new trade conflict. JPMorgan’s latest analysis examines the potential impacts of these developments.

The Chinese government recently announced a comprehensive debt restructuring plan to address local government debt, which totals RMB 14.3 trillion. This includes a one-time resolution of RMB 6 trillion, with additional payments stretched across future years.

This move is expected to provide some relief to local governments and may help improve business sentiment by alleviating pressure on the public sector. Further measures, such as raising local government debt quotas and supporting the housing market, are likely as part of China’s broader fiscal strategy for 2025. These efforts aim to combat deflation, stabilize investment, and boost consumption.

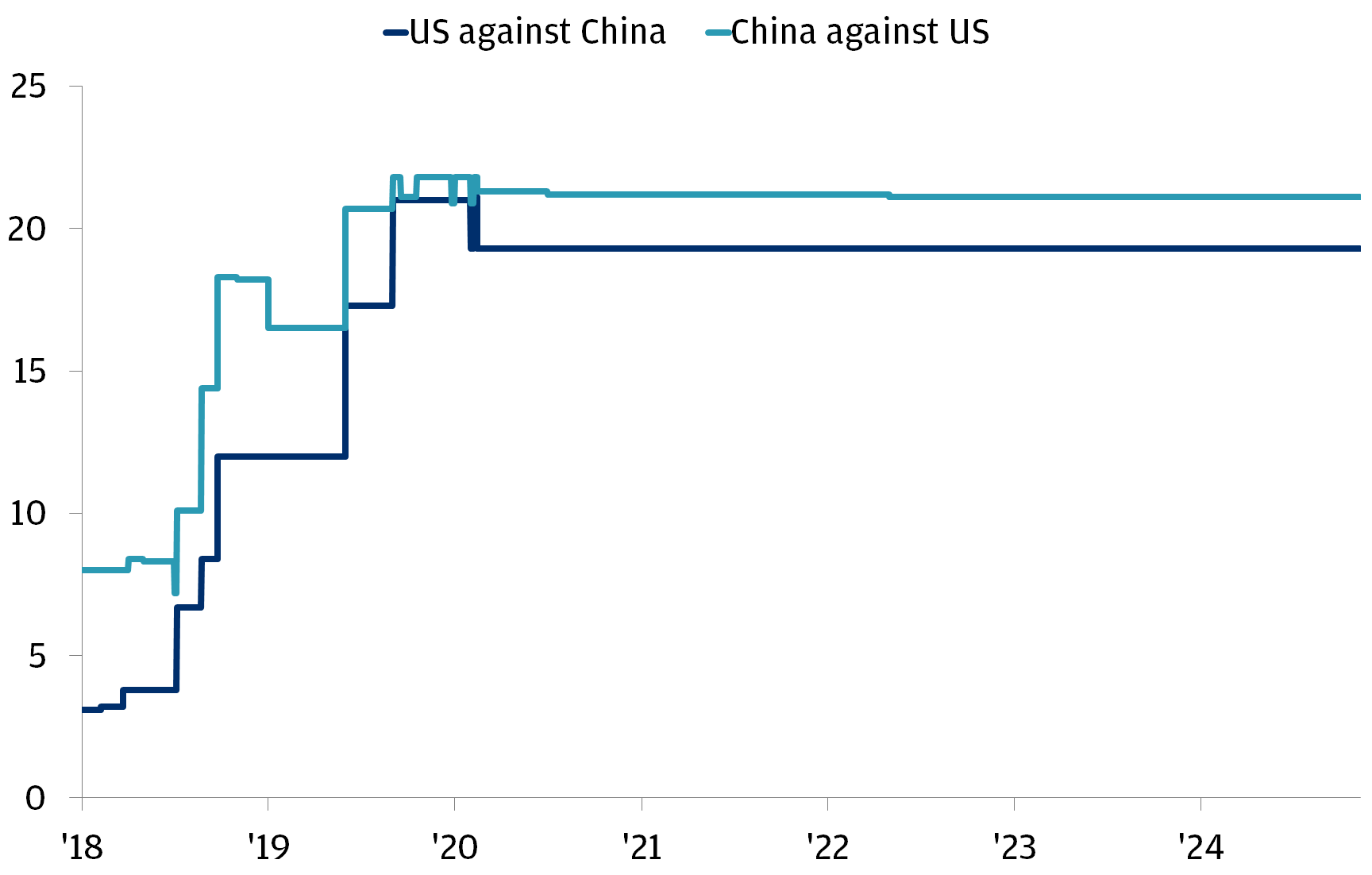

On the other hand, the U.S. administration’s plans to raise tariffs on Chinese imports present a significant risk to China’s economy. Analysts are divided on how much these tariffs will impact GDP growth, with estimates suggesting a 1-1.5 percentage point drag if tariffs increase to 60%.

While China’s exports to the U.S. account for only 15% of its total exports, the U.S. remains China’s largest trading partner, making these tariffs potentially disruptive. Furthermore, while the possibility of transshipment—goods rerouted through third countries—may mitigate some of the damage, the broader economic impact could be severe if trade tensions escalate further.

JPMorgan notes that the U.S.’s decision to implement tariffs is still uncertain, with speculation that they may serve more as a negotiating tool than a long-term strategy. Should the tariffs be enacted, however, China would likely face significant economic challenges. With global trade uncertain and domestic consumption subdued, China’s reliance on exports to drive growth has never been more apparent.

The intersection of these two forces—China’s fiscal stimulus and the threat of U.S. tariffs—will shape the nation’s economic trajectory in 2025. While fiscal policies can offer some cushioning, the full impact of the tariffs remains highly uncertain, and the potential for economic decoupling between the U.S. and China looms large.

-

1

U.S. PCE Inflation Rises for First Time Since February, Fed Rate Cut Likely Delayed

27.06.2025 18:00 1 min. read -

2

Key U.S. Economic Events to Watch Next Week

06.07.2025 19:00 2 min. read -

3

Gold Beats U.S. Stock Market Over 25 Years, Even With Dividends Included

13.07.2025 15:00 1 min. read -

4

U.S. Announces Sweeping New Tariffs on 30+ Countries

12.07.2025 16:30 2 min. read -

5

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

15.07.2025 16:15 2 min. read

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

U.S. inflation accelerated in June, dealing a potential setback to expectations of imminent Federal Reserve rate cuts.

Gold Beats U.S. Stock Market Over 25 Years, Even With Dividends Included

In a surprising long-term performance shift, gold has officially outpaced the U.S. stock market over the past 25 years—dividends included.

U.S. Announces Sweeping New Tariffs on 30+ Countries

The United States has rolled out a broad set of new import tariffs this week, targeting over 30 countries and economic blocs in a sharp escalation of its trade protection measures, according to list from WatcherGuru.

Key U.S. Economic Events to Watch Next Week

After a week of record-setting gains in U.S. markets, investors are shifting focus to a quieter yet crucial stretch of macroeconomic developments.

-

1

U.S. PCE Inflation Rises for First Time Since February, Fed Rate Cut Likely Delayed

27.06.2025 18:00 1 min. read -

2

Key U.S. Economic Events to Watch Next Week

06.07.2025 19:00 2 min. read -

3

Gold Beats U.S. Stock Market Over 25 Years, Even With Dividends Included

13.07.2025 15:00 1 min. read -

4

U.S. Announces Sweeping New Tariffs on 30+ Countries

12.07.2025 16:30 2 min. read -

5

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

15.07.2025 16:15 2 min. read