Changpeng Zhao Seeks Advice on Managing $1M in Unexpected Donations

23.02.2025 14:00 2 min. read Alexander Stefanov

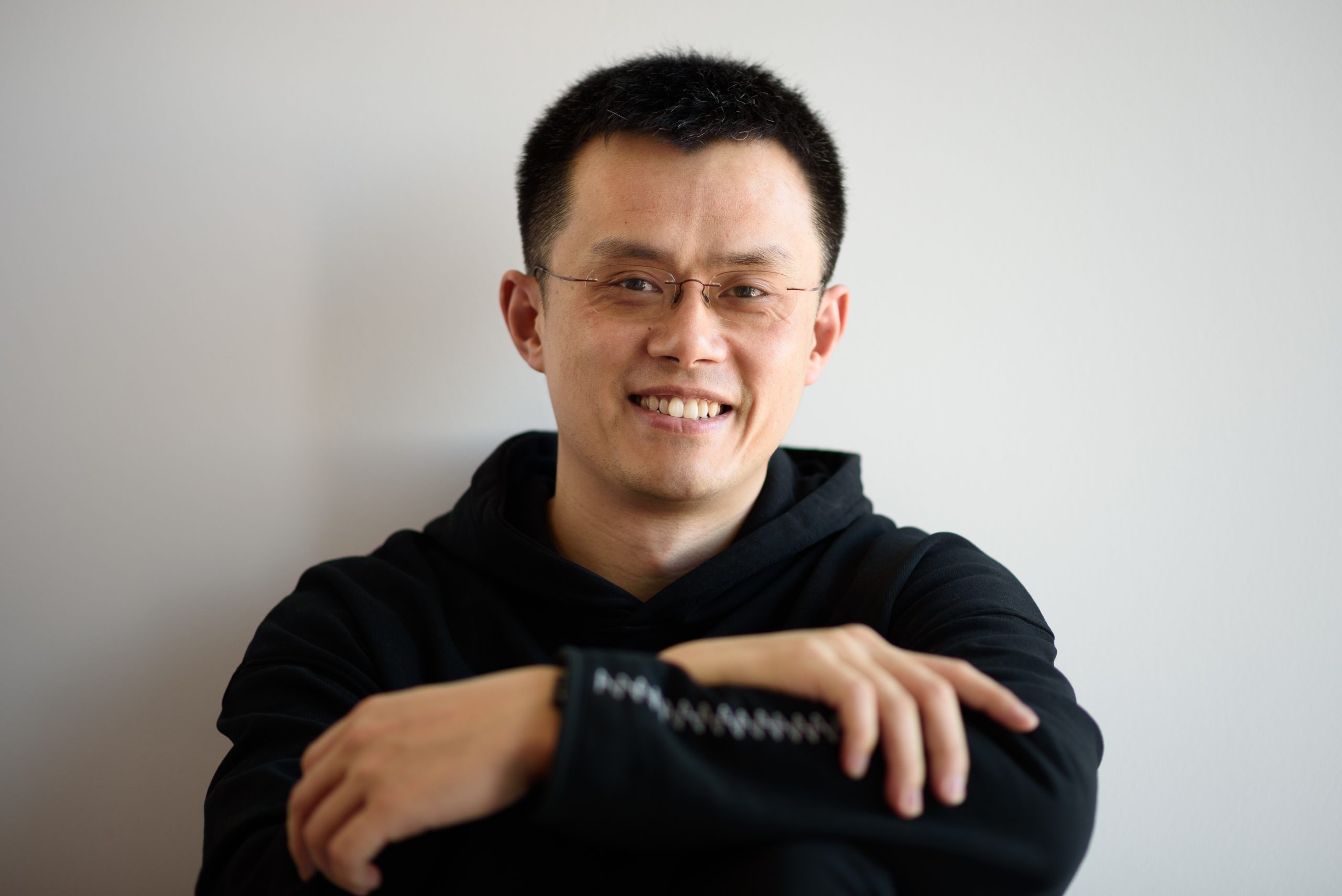

Changpeng Zhao (CZ), the founder of Binance, recently reached out to the cryptocurrency community for guidance on how to manage over $1 million that had accumulated in a donation wallet address he once used.

Originally, this wallet had received a donation of about $100,000 (roughly 150 BNB), but it had since grown significantly through additional contributions from users.

Zhao clarified in a post on X (formerly Twitter) that he would not be keeping any of the funds personally. Instead, he sought input on the best way to distribute or use the funds. In his message, he floated a few possibilities, such as adding the money to liquidity pools, conducting an airdrop, donating to charity, or even sending the funds to a destruction address, and welcomed other suggestions.

To minimize spam, Zhao restricted replies to users he follows and warned against spamming the thread. He also emphasized that any action taken should serve the broader community, not individuals, and rejected personal fund requests.

This donation initiative was inspired by a college student who had been using his own funds—rumored to be around $50,000—to support the BNB ecosystem and help others. Impressed by the student’s selflessness, Zhao had initially donated around $100,000 to further the cause.

Zhao’s donation wallet holds various tokens, including 862,084 BNB, 10.143 million BROCCOLI, and other assets like HOLD, SIREN, and GOUT, with the total value exceeding $1 million. He shared the breakdown of the wallet’s holdings, which also feature tokens such as BABYBROCCOLI, ZHOA, and QUACK, alongside others.

-

1

Here is Why the Fed May Cut Rates Earlier Than Expected, According to Goldman Sachs

08.07.2025 15:00 2 min. read -

2

What Brian Armstrong’s New Stats Reveal About Institutional Crypto Growth

29.06.2025 15:00 2 min. read -

3

Donald Trump Signs “One Big Beautiful Bill”: How It Can Reshape the Crypto Market

05.07.2025 9:56 2 min. read -

4

Market Odds of a U.S. Recession in 2025 Drop in Half Since May

05.07.2025 18:30 2 min. read -

5

Toncoin Launches UAE Golden Visa Program Through $100,000 Staking Offer

06.07.2025 12:04 2 min. read

U.S. Public Pension Giant Boosts Palantir and Strategy Holdings in Q2

According to a report by Barron’s, the Ohio Public Employees Retirement System (OPERS) made notable adjustments to its portfolio in Q2 2025, significantly increasing exposure to Palantir and Strategy while cutting back on Lyft.

Key Crypto Events to Watch in the Next Months

As crypto markets gain momentum heading into the second half of 2025, a series of pivotal regulatory and macroeconomic events are poised to shape sentiment, liquidity, and price action across the space.

Here is Why Stablecoins Are Booming, According to Tether CEO

In a recent interview with Bankless, Tether CEO Paolo Ardoino shed light on the growing adoption of stablecoins like USDT, linking their rise to global economic instability and shifting generational dynamics.

U.S. Dollar Comes Onchain as GENIUS Act Ushers in Digital Era

In a statement that marks a major policy shift, U.S. Treasury Secretary Scott Bessent confirmed that blockchain technologies will play a central role in the future of American payments, with the U.S. dollar officially moving “onchain.”

-

1

Here is Why the Fed May Cut Rates Earlier Than Expected, According to Goldman Sachs

08.07.2025 15:00 2 min. read -

2

What Brian Armstrong’s New Stats Reveal About Institutional Crypto Growth

29.06.2025 15:00 2 min. read -

3

Donald Trump Signs “One Big Beautiful Bill”: How It Can Reshape the Crypto Market

05.07.2025 9:56 2 min. read -

4

Market Odds of a U.S. Recession in 2025 Drop in Half Since May

05.07.2025 18:30 2 min. read -

5

Toncoin Launches UAE Golden Visa Program Through $100,000 Staking Offer

06.07.2025 12:04 2 min. read