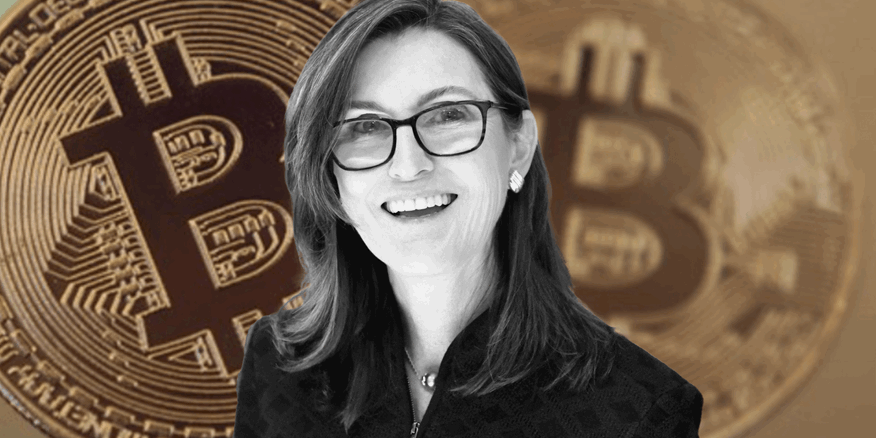

Cathie Wood Sees a Bullish Breakout Ahead for Bitcoin and Stocks

06.05.2025 10:00 1 min. read Alexander Stefanov

Cathie Wood, head of ARK Invest, believes markets may be on the verge of a surprising rebound, despite widespread concerns about economic slowdown.

In her latest investor update, Wood suggests that some of the biggest fears weighing on investors—rising interest rates, market concentration, and inflated valuations—are beginning to fade.

Rather than bracing for a downturn, she argues, we could be heading into a period of renewed optimism driven by productivity gains.

While many economists continue to predict a looming recession, Wood envisions a different outcome: a broader recovery powered by innovation and efficiency, signaling the possible end of what she calls a “rolling recession.”

Turning to Bitcoin, Wood highlighted a long-term chart comparing BTC to gold. Despite gold’s recent surge, which briefly dragged the ratio down, the overall trend still favors Bitcoin, she says. In her view, BTC has simply been cooling off after a sharp rise last year—behaving more like a tech stock than a defensive asset.

According to Wood, the correction hasn’t derailed the upward momentum. With gold now at historic highs, Bitcoin may be poised to reassert its strength, particularly if investors begin to favor risk assets again.

-

1

Mysterious $8.6B Bitcoin Transfer Sparks Speculation Over Satoshi-Era Wealth

05.07.2025 15:00 3 min. read -

2

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

30.06.2025 15:00 2 min. read -

3

Bitcoin Tops Crypto Social Buzz as $110,000 Milestone Fuels Market Debate

04.07.2025 8:15 3 min. read -

4

10,000 Dormant Bitcoin Moved After 14 Years: Volatility Ahead?

04.07.2025 20:00 2 min. read -

5

UniCredit to Launch Structured Product Tied to BlackRock’s Spot Bitcoin ETF

01.07.2025 17:53 1 min. read

Here is Why Stablecoins Are Booming, According to Tether CEO

In a recent interview with Bankless, Tether CEO Paolo Ardoino shed light on the growing adoption of stablecoins like USDT, linking their rise to global economic instability and shifting generational dynamics.

U.S. Dollar Comes Onchain as GENIUS Act Ushers in Digital Era

In a statement that marks a major policy shift, U.S. Treasury Secretary Scott Bessent confirmed that blockchain technologies will play a central role in the future of American payments, with the U.S. dollar officially moving “onchain.”

JPMorgan Lawsuit Threatens Crypto Access and Open Banking Rights

JPMorgan and other major U.S. banks are under fire for a lawsuit aimed at dismantling the Consumer Financial Protection Bureau’s (CFPB) newly established “Open Banking Rule.”

UK to Sell Almost $7B in Seized Bitcoin as Treasury Eyes Crypto Boost

The United Kingdom’s Home Office is preparing to liquidate a massive cache of seized cryptocurrency—at least $7 billion worth of Bitcoin—according to a new report by The Telegraph.

-

1

Mysterious $8.6B Bitcoin Transfer Sparks Speculation Over Satoshi-Era Wealth

05.07.2025 15:00 3 min. read -

2

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

30.06.2025 15:00 2 min. read -

3

Bitcoin Tops Crypto Social Buzz as $110,000 Milestone Fuels Market Debate

04.07.2025 8:15 3 min. read -

4

10,000 Dormant Bitcoin Moved After 14 Years: Volatility Ahead?

04.07.2025 20:00 2 min. read -

5

UniCredit to Launch Structured Product Tied to BlackRock’s Spot Bitcoin ETF

01.07.2025 17:53 1 min. read