Cardano Hard Fork Near – What’s Next For ADA’s Price?

19.07.2024 16:45 2 min. read Alexander Stefanov

Cardano (ADA) could see significant price movements next month with the upcoming Chang Hard Fork.

Historically, Cardano’s price has reacted positively to major updates. For instance, during the Alonzo hard fork in August 2021, ADA’s value jumped 130%, but subsequent hard forks have had varied impacts.

The Valentine upgrade in February 2023, occurring during a bear market, resulted in a modest 16.9% gain, followed by a steep decline from $0.42 to $0.315 over three weeks.

Similarly, the Vasil hard fork in September 2022 saw an 11.1% increase before the price dropped again.

Currently, Cardano’s price chart shows a potential breakout from a falling wedge pattern that started in December 2023.

This breakout could signal a move towards $0.72-$0.78, representing an 80% gain.

However, trading volume has been decreasing, and the On-Balance Volume (OBV) indicator reflects this downward trend, which dampens bullish expectations.

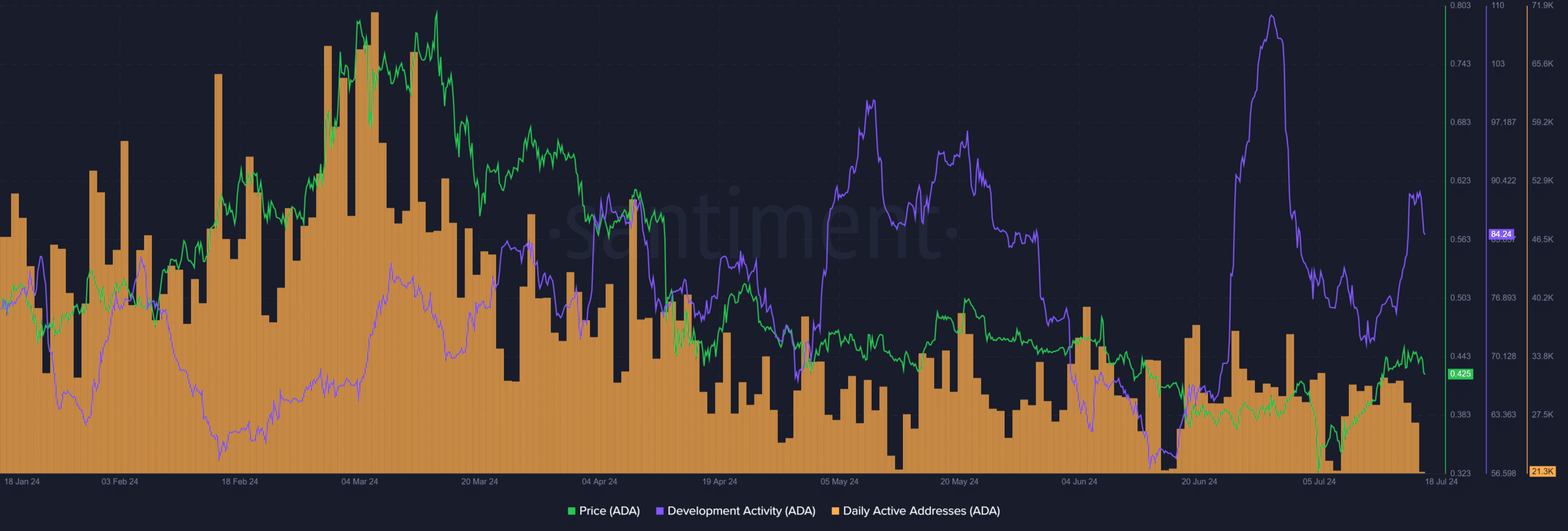

Stable daily active addresses since April suggest limited engagement, and despite increasing development activity, the significant drop in mean coin age indicates a distribution phase. This implies that without strong investor support, the Chang Hard Fork might not achieve substantial gains.

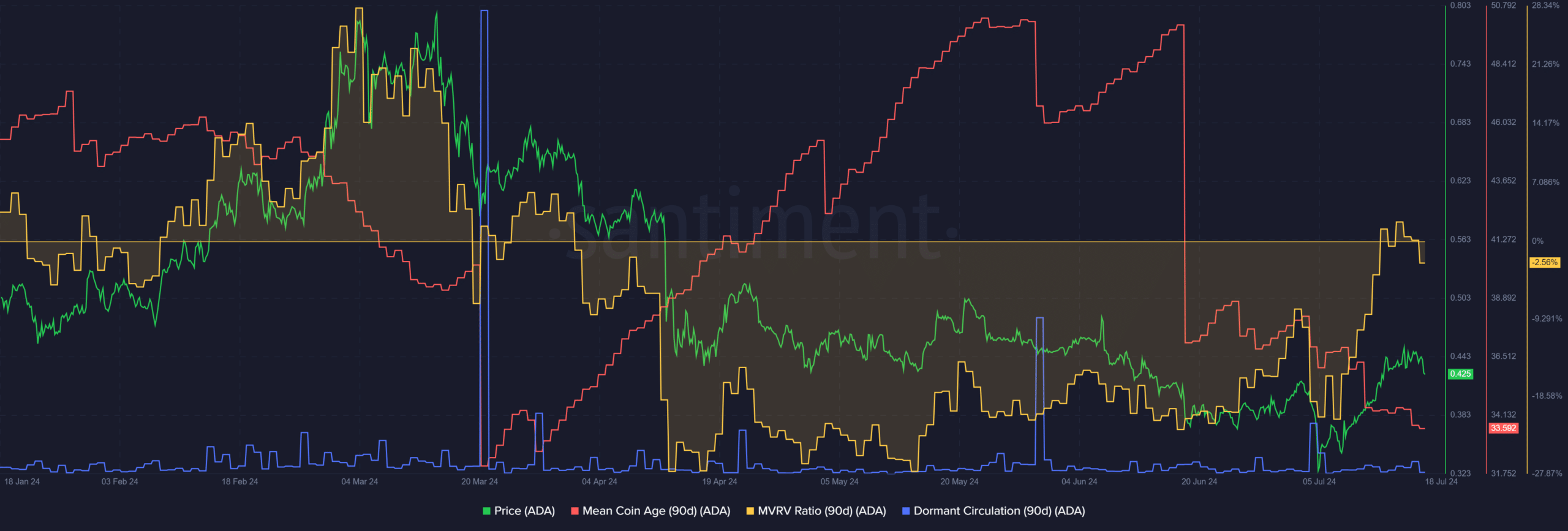

The 90-day Market Value to Realized Value (MVRV) ratio is slightly negative, showing average holders are at a minor loss.

Overall, while there are positive technical signs, the current metrics do not suggest a strong buying opportunity or sustained bullish momentum. Consistent buy volume will be crucial to initiate a significant rally.

-

1

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

2

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

3

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read

XRP Eyes Next Target as Bullish Crossover Sparks 560% Surge

XRP is back in the spotlight after crypto analyst EGRAG CRYPTO highlighted a powerful historical pattern on the weekly timeframe—the bullish crossover of the 21 EMA and 55 SMA.

Top 5 Most Trending Cryptocurrencies Today: Zora, Pudgy Penguins, SUI and More

Crypto markets are buzzing with momentum as several altcoins post double-digit gains and surging volumes.

Sui Price Jumps 14% to $4.26 amid ETF Hopes

Sui (SUI) surged 14% in the past 24 hours, reaching $4.26 as bullish technical patterns, Bitcoin’s rebound, and renewed ETF speculation pushed the altcoin higher.

HBAR Mirrors 2021 Cycle as Key Breakout Test Approaches

Hedera Hashgraph (HBAR) is closely tracking its 2021 price behavior, according to crypto analyst Rekt Capital.

-

1

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

2

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

3

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read