Can Stellar bounce again? XLM returns to crucial retest zone

26.07.2025 18:00 2 min. read Kosta Gushterov

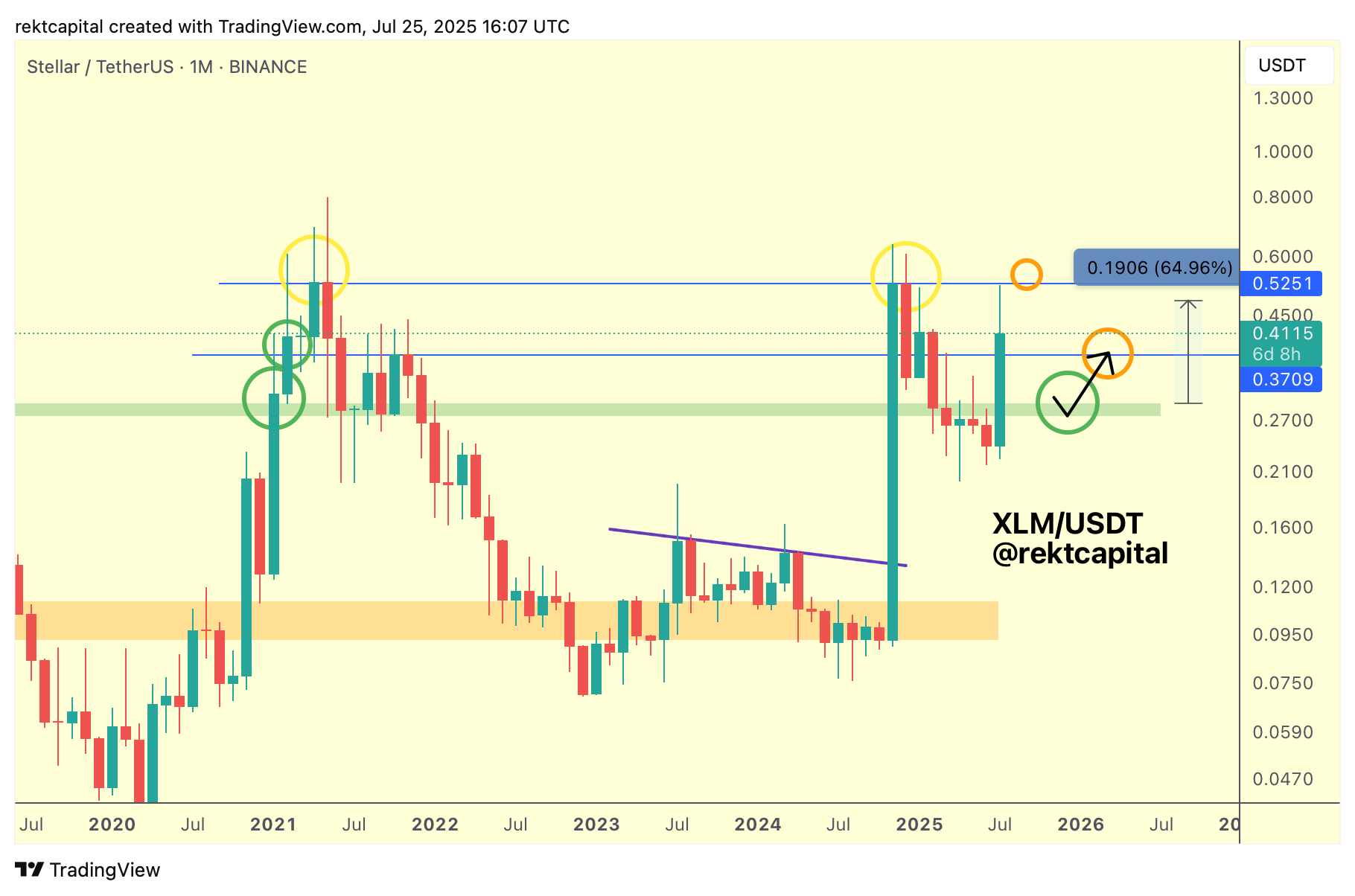

Stellar (XLM) is once again approaching a decisive technical moment after facing a familiar rejection at the $0.52 resistance zone.

According to crypto analyst RektCapital, the altcoin may soon revisit the $0.37 level, a historical area that has played a critical role in past market cycles.

XLM recently rallied over +64% after breaking out from a long-term weekly downtrending channel, a move that energized bullish sentiment across its trading pairs. However, as RektCapital noted in his previous Altcoin Newsletter, the $0.52 resistance remains a major obstacle—one that has turned away Stellar multiple times in the past.

The latest rejection at this level closely mirrors price behavior seen during late 2020 and early 2021. In those cycles, a successful retest of support led to a fresh rally and a second attempt at the range high. In contrast, failed retests—such as those observed in late 2024—were followed by deeper downside moves.

With Stellar now hovering just above the $0.37 mark, the market’s attention turns to whether this level can hold as support. A confirmed retest would align with bullish historical precedents and potentially launch XLM back toward the $0.52 high. However, volatility during such a move could still lead to downside wicks before stability resumes.

RektCapital emphasizes the importance of context in interpreting these moves. While history doesn’t guarantee a repeat, it often rhymes—making this current retest attempt a pivotal technical moment for Stellar bulls and bears alike.

Traders will be watching closely as XLM’s next steps could either reignite the breakout or signal renewed consolidation if $0.37 fails to hold.

-

1

Ethereum and Solana 2025 Update: Upgrades, Growth, and What’s next

12.07.2025 14:30 2 min. read -

2

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

3

XRP Surges Toward $3: Main Factors Driving the Rally

16.07.2025 12:18 2 min. read -

4

Stellar (XLM) Surges 60% in 7 Days Amid Breakout and Partnerships

17.07.2025 14:33 2 min. read -

5

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

Altcoin Breakout: ResearchCoin, Electroneum, and REI Network Lead The Rally

A wave of bullish momentum is sweeping through smaller-cap altcoins, with ResearchCoin (RSC), Electroneum (ETN), and REI Network (REI) all recording substantial 24-hour gains.

ETF Speculation and Legal Clarity Renew Optimism for XRP and Solana

XRP is drawing fresh investor attention as optimism builds around its legal standing and potential exchange-traded products (ETPs).

Ethereum: What The Last Move Tells us About the Next One

Ethereum is showing strength in the face of broader market weakness, holding firm even as Bitcoin and other major assets trend downward.

-

1

Ethereum and Solana 2025 Update: Upgrades, Growth, and What’s next

12.07.2025 14:30 2 min. read -

2

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

3

XRP Surges Toward $3: Main Factors Driving the Rally

16.07.2025 12:18 2 min. read -

4

Stellar (XLM) Surges 60% in 7 Days Amid Breakout and Partnerships

17.07.2025 14:33 2 min. read -

5

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read