Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

BTC’s Consolidation Creates Opportunity for Cutoshi’s Token Scarcity to Spark a New Bull Run

17.02.2025 9:01 4 min. read Alexander StefanovWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

Bitcoin’s price has oscillated between $96,200 and $100,000 this week, mirroring the stabilization period that precedes fundamental changes in markets.

While experts debate whether BTC will break through $122,000 or drop below $95,500, this stability presents fertile ground for future tokens like Cutoshi (CUTO) to find an audience.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

Let’s break down the current offerings of both BTC and Cutoshi.

BTC’s Strategic Pause

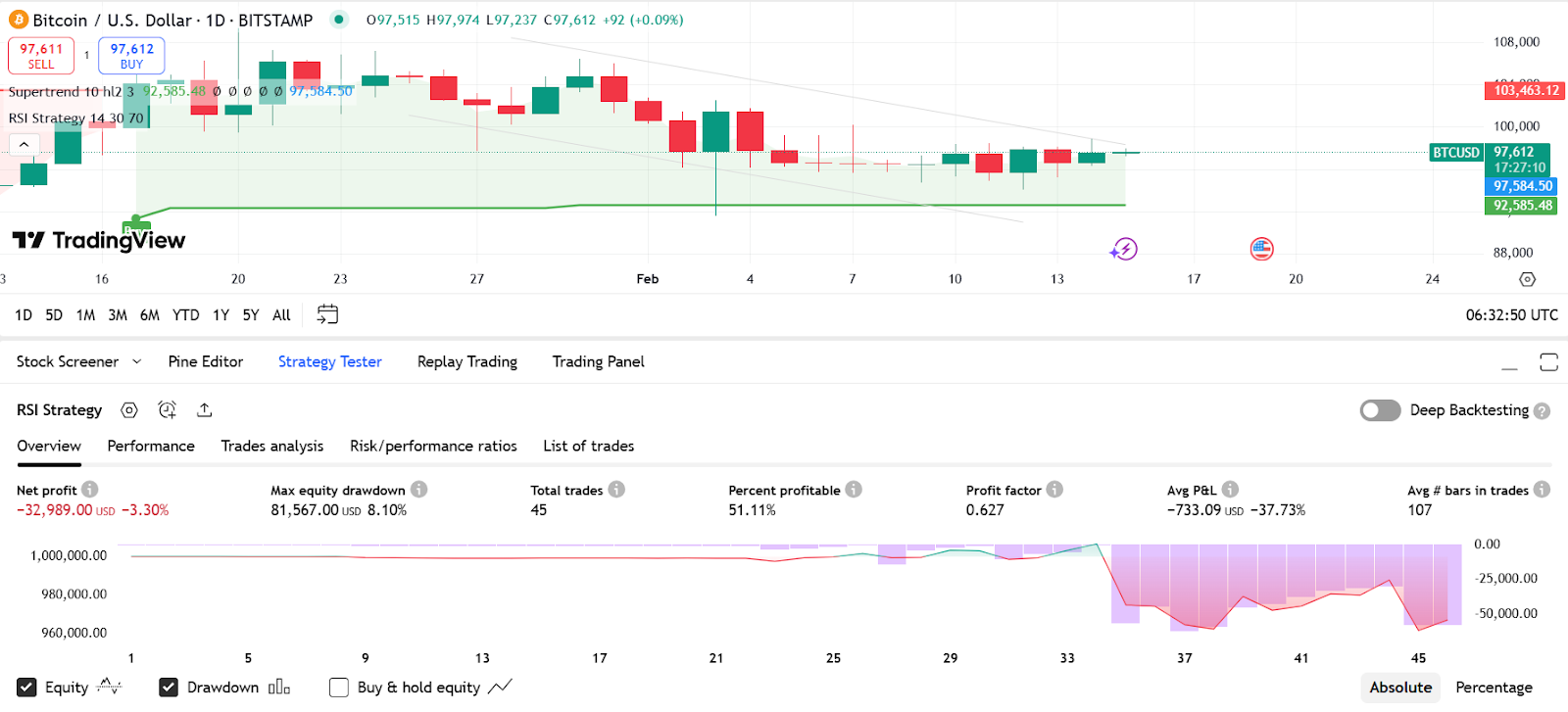

Source: Tradingview (BTC to USD)

BTC trades at $97,558.94, an increase of 0.8% over the last 24 hours, as markets absorb recent volatility. BTC’s consolidation patterns resemble those seen before previous bull cycles, according to an RSI of 58, indicating possible momentum. However, underlying uncertainties, including ongoing geopolitical tensions and ETF inflows reducing to $802 million per week, remain, leaving buyers wary. Past BTC data indicates that these kinds of consolidation tend to lead to explosive breakouts. For instance, BTC surged 105% in 15 weeks before stabilizing, a pattern that could repeat if it holds above $90,000.

Cutoshi Fuels the MemeFi Ecosystem

Cutoshi (CUTO) blends meme culture with decentralized finance (DeFi) utilities, inspired by Satoshi Nakamoto’s vision of financial freedom. Unlike typical meme coins, Cutoshi offers a multi-chain decentralized exchange (DEX), yield farming, and an educational platform—tools designed to onboard everyday users into DeFi. Verified by Solidproof, its ecosystem rewards participation: users earn $CUTO tokens by completing quests or providing liquidity, while a built-in burn mechanism reduces supply over time.

Scarcity Meets Opportunity

While BTC’s infinite supply debate resurfaces, Cutoshi’s deflationary model stands out. With a fixed supply of 440 million tokens—7% already burned—$CUTO becomes scarcer as adoption grows. This scarcity mirrors BTC’s early days but with added DeFi incentives.

The presale has raised $1.7 million at $0.031 per token, signaling strong early interest. Analysts compare its trajectory to Shiba Inu’s 2021 rally, noting the token burns and CEX listings could drive similar demand. Currently, Cutoshi is offering a 35% deposit bonus for 5 days owing to Valentine’s week!

BTC vs. $CUTO: Divergent Paths, Shared Potential

BTC remains the crypto benchmark, but its consolidation phase pushes investors toward niche opportunities. Cutoshi’s appeal lies in its hybrid nature: playful branding backed by tangible utilities. For example, its DEX charges 0.25% fees, redistributing 80% to liquidity providers—a feature PancakeSwap users already value. Meanwhile, BTC’s stability offers a safe harbor, but it’s 141% annual gain leaves less room for exponential growth than newer tokens.

Cutoshi also taps into Satoshi Nakamoto’s ethos of decentralization. Its academy educates users on blockchain basics, addressing the knowledge gap that hinders mass DeFi adoption. This focus on utility over hype positions $CUTO as a deflationary memecoin with staying power, contrasting meme rivals reliant solely on social trends.

BTC vs. Cutoshi: Where to Bet in 2025?

BTC’s consolidation isn’t a stall—it’s a setup. History shows such phases end with rallies, and savvy investors diversify into high-potential tokens during these lulls. Unlike BTC, Cutoshi’s presale progress and tokenomics suggest it could emerge as a Next Shiba Inu Rival, especially as its DEX and farming mechanisms go live.

Yes, BTC still remains the kingpin of crypto portfolios—but projects like Cutoshi, inspired by Satoshi Nakamoto, represent the next wave of utility. In a market where even stable giants pause, scarcity-driven tokens thrive, and Cutoshi could be the breakout memeFi needs.

Need more expert reviews on the Lucky Cat? Checkout this video: CUTOSHI: A New Meme Token in the DeFi Ecosystem with Real Utility // Active Presale

Cutoshi Stage 4 Presale Live

- Price: $0.031 per $CUTO

- Supply: 440,000,000 tokens (ERC-20)

- Website: https://cutoshi.com

- Telegram: https://t.me/cutoshicommunity

- X (Twitter): https://x.com/CutoshiToken

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Best Crypto to Buy Now as USA Strikes Iran, Ethereum Price Dips

23.06.2025 14:35 7 min. read -

2

Bitcoin Hyper Raises $1.5 Million for First Bitcoin Layer 2: Best Crypto Presale?

24.06.2025 17:52 5 min. read -

3

Best Crypto to Buy for Q3? BTC Bull Token Enters Final Week of Presale

24.06.2025 17:53 5 min. read -

4

Snorter Token ($SNORT) Price Prediction, ChatGPT Forecasts 10x by end of 2025

28.06.2025 11:07 4 min. read -

5

Is BTC Bull Token the Best Crypto Presale? Bitcoin Airdrops, Token Burns, and BTCBULL Rewards

25.06.2025 10:40 4 min. read

Best Crypto Presale to Buy in July: Why BTC Bull Token is Set for Massive Gains

The BTC Bull Token presale is almost over. With less than five days left, this is the last chance for buyers to secure a lower price before the token goes live. The project’s raised amount will breach the $8 million mark any minute now, showing a notable uptick in investor support in the final presale […]

Best Crypto to Buy Now After Trump’s $220 Million Bitcoin Power Play

When Eric Trump’s American Bitcoin secured a $220 million injection from private backers to snap up Bitcoin and state‑of‑the‑art mining rigs, it marked more than just a hefty capital raise. This move highlights the widening gap between traditional finance and crypto’s institutional frontier, where major investors are racing to legitimize digital gold. 🔺 Eric Trump-Backed Mining […]

Best Crypto to Buy Now as Big‑Money Bitcoin Wallets Hit New Highs

Coinbase Institutional’s latest report reveals a striking uptick in high‑value Bitcoin holdings, with wallets surpassing the $1 million mark jumping sharply since early 2024. This milestone underscores growing corporate conviction in BTC’s resilience and long‑term upside. This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products, or other […]

Best Crypto Presales That Could Explode in Q3

Everyone’s on the lookout for the next big crypto project before it blows up. That’s why we’ve been researching some of the best crypto presales happening right now, trying to find the ones that could really shake up the market. Four exciting tokens have popped up that are definitely worth a look for Q3. Let’s […]

-

1

Best Crypto to Buy Now as USA Strikes Iran, Ethereum Price Dips

23.06.2025 14:35 7 min. read -

2

Bitcoin Hyper Raises $1.5 Million for First Bitcoin Layer 2: Best Crypto Presale?

24.06.2025 17:52 5 min. read -

3

Best Crypto to Buy for Q3? BTC Bull Token Enters Final Week of Presale

24.06.2025 17:53 5 min. read -

4

Snorter Token ($SNORT) Price Prediction, ChatGPT Forecasts 10x by end of 2025

28.06.2025 11:07 4 min. read -

5

Is BTC Bull Token the Best Crypto Presale? Bitcoin Airdrops, Token Burns, and BTCBULL Rewards

25.06.2025 10:40 4 min. read