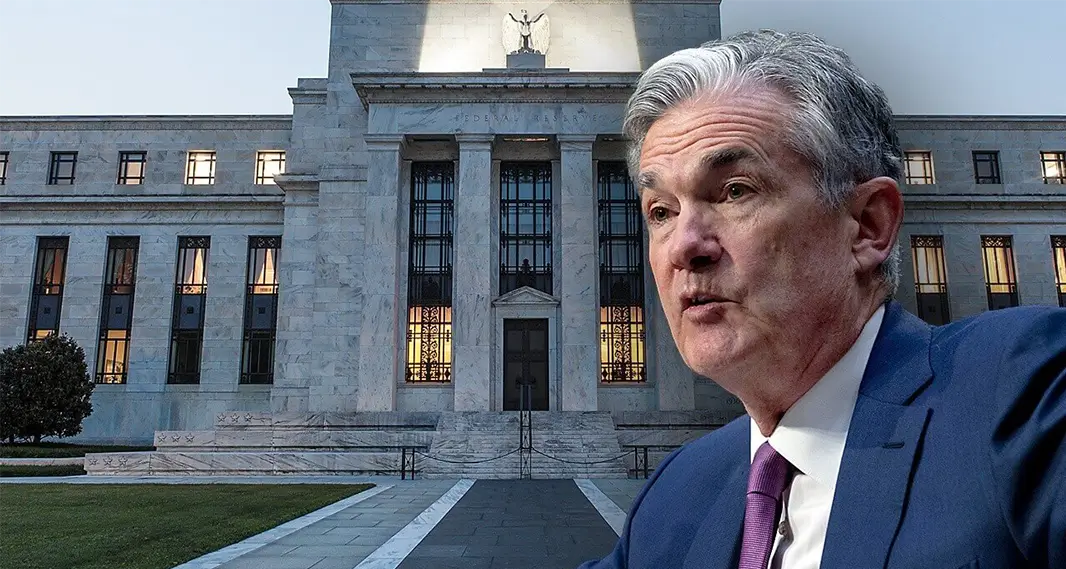

BREAKING: Fed Cuts Rates as Expected – Crypto Market in the Red

18.12.2024 21:00 2 min. read Alexander Zdravkov

The Federal Reserve has implemented a widely anticipated 25-basis-point interest rate cut, marking the third and final reduction for 2024.

This decision lowers the federal funds rate to a new target range and aligns with the central bank’s goal of cautiously easing monetary policy amid stronger-than-expected economic conditions.

Attention now shifts to the Fed’s outlook for 2025, as Chair Jerome Powell addressed questions about the future trajectory of rate cuts during his press conference. Powell acknowledged the challenges of balancing current economic strength with the need to combat persistent inflation pressures.

The updated “dot plot,” released alongside the decision, provides fresh insights into Fed officials’ predictions for the federal funds rate.

While earlier projections suggested four small rate reductions in 2025, many policymakers have signaled a potential slowdown in the pace of cuts.

September’s dot plot forecasted six cuts between 2024 and 2025, but recent inflation readings and cautious Fed commentary have cast doubt on the 2025 outlook, with expectations for next year being up to 2 rate cuts.

Crypto Market Down

Prior to the rate cut decision, the broader cryptocurrency market has been experiencing a notable decline, with almost all top 100 tokens by market cap being in the red.

Bitcoin dropped to around $104,500 after Monday’s peak of over $108,000, representing a 3% price drop in a couple of days.

Most altcoins followed BTC’s example and continued their downtrend. Memecoins, utility tokens and top altcoins experienced declines in the range of 3-10%.

-

1

U.S. PCE Inflation Rises for First Time Since February, Fed Rate Cut Likely Delayed

27.06.2025 18:00 1 min. read -

2

Key U.S. Economic Events to Watch Next Week

06.07.2025 19:00 2 min. read -

3

Gold Beats U.S. Stock Market Over 25 Years, Even With Dividends Included

13.07.2025 15:00 1 min. read -

4

U.S. Announces Sweeping New Tariffs on 30+ Countries

12.07.2025 16:30 2 min. read -

5

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

15.07.2025 16:15 2 min. read

BitGo Files Confidentially for IPO With SEC

BitGo Holdings, Inc. has taken a key step toward becoming a publicly traded company by confidentially submitting a draft registration statement on Form S-1 to the U.S. Securities and Exchange Commission (SEC).

Crypto Greed Index Stays Elevated for 9 Days — What it Signals Next?

The crypto market continues to flash bullish signals, with the CMC Fear & Greed Index holding at 67 despite a minor pullback from yesterday.

U.S. Public Pension Giant Boosts Palantir and Strategy Holdings in Q2

According to a report by Barron’s, the Ohio Public Employees Retirement System (OPERS) made notable adjustments to its portfolio in Q2 2025, significantly increasing exposure to Palantir and Strategy while cutting back on Lyft.

Key Crypto Events to Watch in the Next Months

As crypto markets gain momentum heading into the second half of 2025, a series of pivotal regulatory and macroeconomic events are poised to shape sentiment, liquidity, and price action across the space.

-

1

U.S. PCE Inflation Rises for First Time Since February, Fed Rate Cut Likely Delayed

27.06.2025 18:00 1 min. read -

2

Key U.S. Economic Events to Watch Next Week

06.07.2025 19:00 2 min. read -

3

Gold Beats U.S. Stock Market Over 25 Years, Even With Dividends Included

13.07.2025 15:00 1 min. read -

4

U.S. Announces Sweeping New Tariffs on 30+ Countries

12.07.2025 16:30 2 min. read -

5

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

15.07.2025 16:15 2 min. read