BNB Coin Price Prediction: As BNB Chain Daily Transaction Volumes Explode Can It Hit $900?

28.07.2025 17:10 3 min. read Alejandro Ar

Trading volumes for BNB Coin (BNB) have doubled in the past 24 hours to $3.8 billion as the price rises by 7%. This favors a bullish BNB Coin price prediction at a point when the token just made a new all-time high.

BNB is the second crypto in the top 5 to make a new price record after Bitcoin (BTC). Since the year started, the native asset of the BNB Chain has accumulated gains of 21%.

Daily transactions in 2025 have experienced a remarkable 238% jump while, at some point in mid-June, they had expanded by 430%.

The BNB Chain is one of the cheapest alternatives to transfer assets in the crypto industry. Its transaction fees are near zero and it supports a large number of assets.

The demand for BNB comes primarily from users of the Binance platform who buy the token to get discounts on trading fees. It is also the BNB Chain utility token, meaning that it is used to pay for network fees.

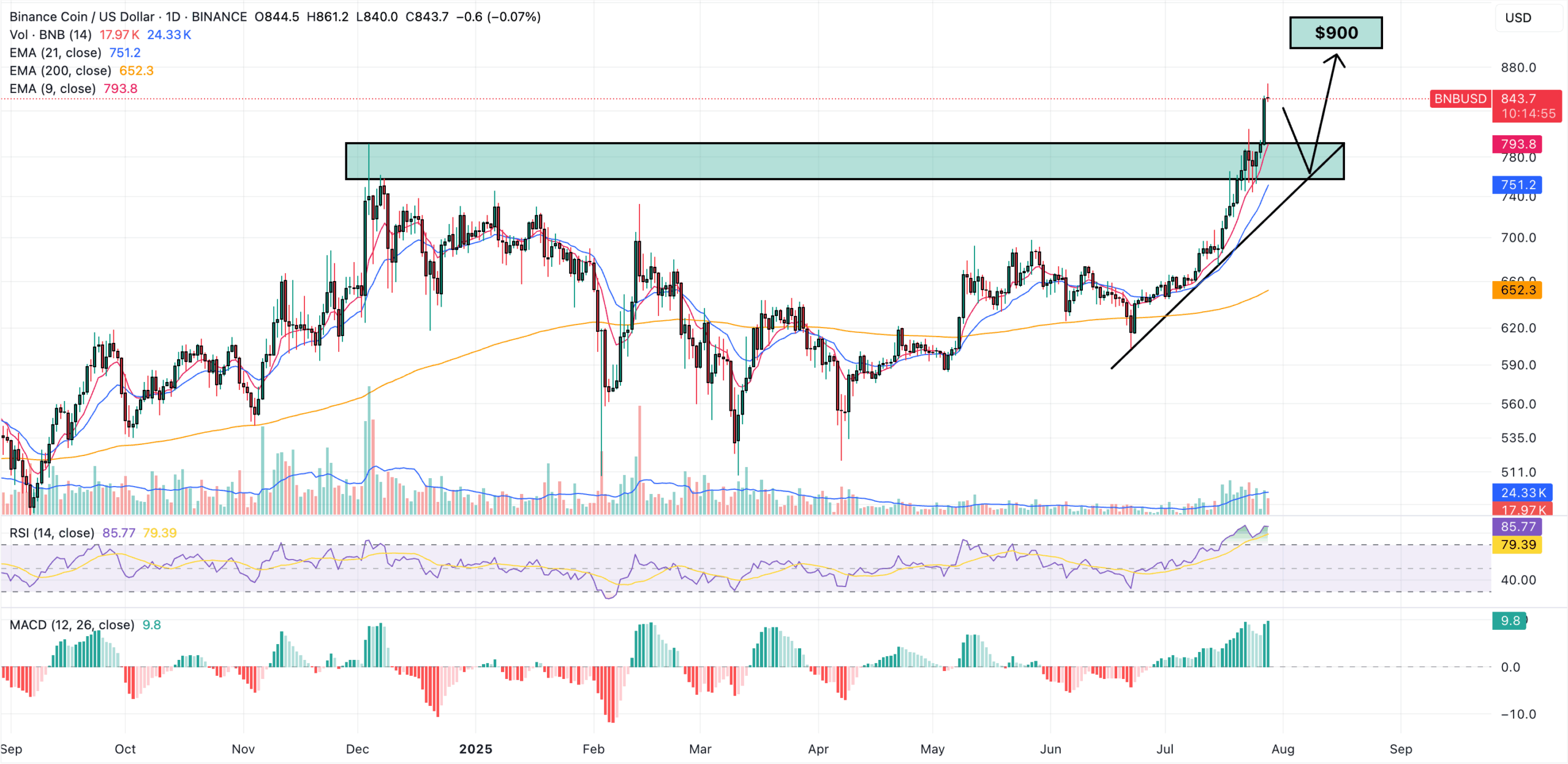

BNB Coin Price Prediction: $900 In Sight After Huge Breakout

Top traders have been sharing their forecasts for this token on X. Crypto trader BitBull predicts that the latest breakout to a new all-time high could precede a big move toward the $2,000 area.

$BNB has entered its expansion phase.

It broke above its 2-yr resistance level this week, and is now holding strong above it.@BNBChain network activity is rising, @binance continues to be the #1 exchange and companies are buying BNB for their Treasury.

All this demand is… pic.twitter.com/vnyuIUipuz

— BitBull (@AkaBull_) July 26, 2025

His bullish BNB Coin price prediction relies on historical patterns as the last time the token broke an ascending triangle in the 10-day chart, it result in a significant move from around $40 to $700 for a 1650% gain.

Looking at the daily chart, the latest breakout has been confirmed already by yesterday’s big green candle. Trading volumes have been closing most sessions above the daily average since July 16, meaning that buyers interest has increased.

The $780 level is the key support to watch at this point. The price could pullback to this former resistance to raise the necessary liquidity for the next leg up.

This area coincides with a key trend line support that should also act as a launch pad for the uptrend. If this area holds, the odds favor a move toward the $900 level.

The Relative Strength Index (RSI) has been in overbought level for a few days already, meaning that the uptrend’s strength remains quite high. Although this also increases the odds of an upcoming pullback, it also means that bulls are in full control of the price action

Apart from BNB, the best crypto presales like Bitcoin Hyper (HYPER) could deliver significant gains as this project plans to unlock the untapped potential of BTC’s DeFi.

Bitcoin Hyper (HYPER) Raises Nearly $5.5M to Launch Its Powerful Bitcoin L2

Bitcoin Hyper (HYPER) is a layer-two chain that leverages the efficiency and scalability of the Solana blockchain to kick off a new era for Bitcoin.

BTC holders will now be able to earn yield, stake, and lend their tokens via this L2. The Bitcoin Hyper Bridge is designed to receive BTC tokens and mint the corresponding amount in the Solaxy L2 instantly to access the project’s DeFi ecosystem.

Once top wallets and exchanges start to embrace this protocol, the demand for its utility token $HYPER will likely explode.

To reap the highest returns, you can buy $HYPER at its discounted presale price of $0.012425. Simply head to the Bitcoin Hyper website and connect your wallet (e.g. Best Wallet). You can either swap USDT or ETH or use a bank card to invest.

-

1

Will Ethereum and Solana Benefit from Wall Street’s Shift?

09.07.2025 19:00 2 min. read -

2

Dogecoin Price Prediction: DOGE Volumes Nearly Double – Can It Get to $1 In This Cycle?

18.07.2025 20:10 3 min. read -

3

BNB Chain Upgrades and Token Delistings Reshape Binance Ecosystem

16.07.2025 22:00 2 min. read -

4

Most Trending Cryptocurrencies on CoinGecko After Bitcoin’s New ATH

11.07.2025 19:00 2 min. read -

5

Altcoin Supercycle? Analysts Signal ‘Banana Zone 2.0’ as Market Erupts

13.07.2025 19:00 2 min. read

Interactive Brokers Weighs Stablecoin Launch

Interactive Brokers, one of the world’s largest online brokerage platforms, is exploring the possibility of issuing its own stablecoin, signaling a potential expansion into blockchain-driven financial infrastructure as U.S. crypto regulation begins to ease.

PENGU Price Soars While Whale Transfers Raise Alarms

The Pudgy Penguins’ PENGU token is under intense scrutiny after large transfers from its team wallet raised potential red flags.

BNB Hits New All-Time High Amid Token Launch Frenzy

BNB surged to a new all-time high on July 28 around $860, breaking above the critical $846 level following a sharp 7% intraday move.

Binance Launches RWUSD Product with Up to 4.2% APR

Binance Earn has rolled out RWUSD, a new principal-protected product offering exposure to yields from Real-World Assets (RWA) like tokenized U.S. Treasury Bills.

-

1

Will Ethereum and Solana Benefit from Wall Street’s Shift?

09.07.2025 19:00 2 min. read -

2

Dogecoin Price Prediction: DOGE Volumes Nearly Double – Can It Get to $1 In This Cycle?

18.07.2025 20:10 3 min. read -

3

BNB Chain Upgrades and Token Delistings Reshape Binance Ecosystem

16.07.2025 22:00 2 min. read -

4

Most Trending Cryptocurrencies on CoinGecko After Bitcoin’s New ATH

11.07.2025 19:00 2 min. read -

5

Altcoin Supercycle? Analysts Signal ‘Banana Zone 2.0’ as Market Erupts

13.07.2025 19:00 2 min. read