BlackRock’s IBIT Bitcoin ETF Sees First Net Inflow in Three Weeks

17.09.2024 18:44 1 min. read Alexander Stefanov

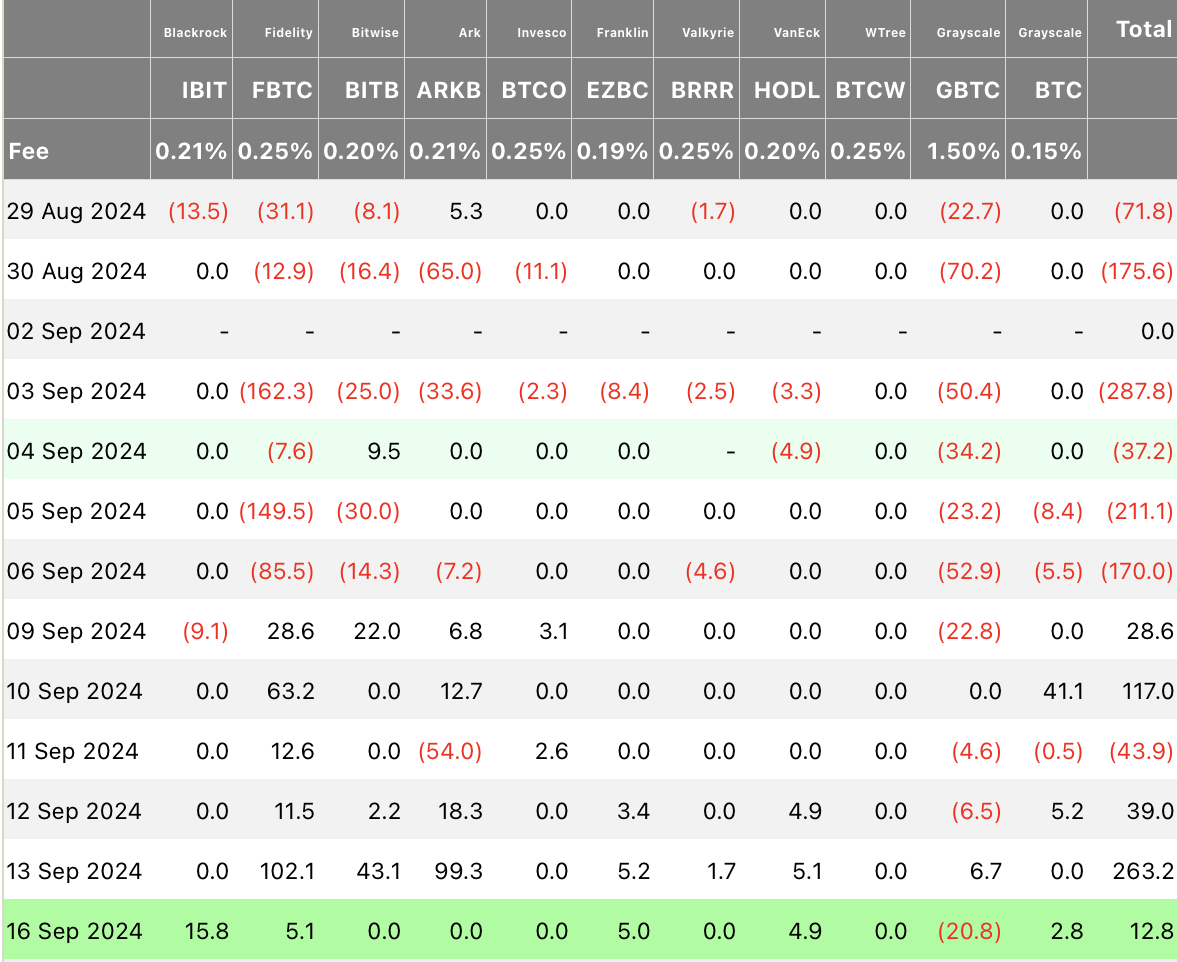

BlackRock’s IBIT Bitcoin ETF recorded its first daily net inflow in three weeks, bringing in $15.8 million.

This marks the end of a prolonged period of stagnant or negative flows, which had lasted since August 26. Prior to this, the ETF had experienced 11 consecutive days without positive inflows and two days of net outflows on August 29 and September 9.

On the same day, other Bitcoin ETFs also saw net inflows: Fidelity’s FBTC added $5.1 million, Franklin Templeton’s EZBC saw $5 million, and VanEck’s HODL gained $4.9 million, according to CoinGlass data.

Conversely, Grayscale’s high-fee Bitcoin ETF, GBTC, experienced net outflows of $20.8 million on Friday, despite recent inflows of $6.7 million. Its mini-merchant BTC had a modest net inflow of $2.8 million.

BlackRock’s IBIT remains the leader in spot Bitcoin ETF flows, with $20.9 billion in net inflows since January. Fidelity’s FBTC follows with $9.6 billion, while Grayscale’s GBTC has seen net outflows exceeding $20 billion.

-

1

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

2

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

3

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

4

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read -

5

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

What Price Bitcoin Could Reach If ETF Demand Grows, According to Citi

Citigroup analysts say the key to Bitcoin’s future isn’t mining cycles or halving math—it’s ETF inflows.

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

-

1

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

2

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

3

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

4

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read -

5

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read