BlackRock’s Ethereum ETF Surpasses $10B, Becomes 3rd Fastest in History

24.07.2025 17:28 2 min. read Kosta Gushterov

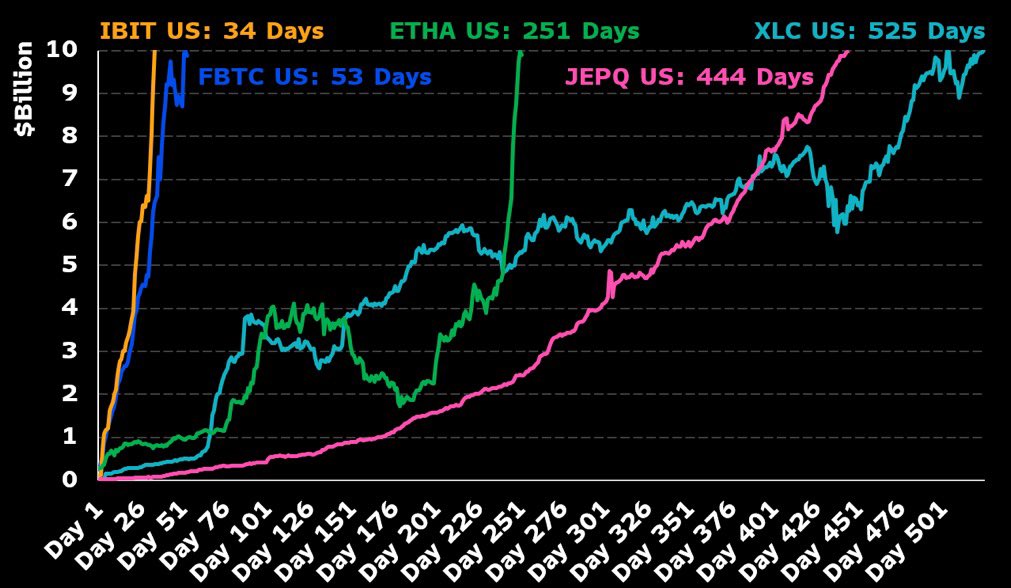

BlackRock’s Ethereum ETF, $ETHA, has officially crossed the $10 billion asset mark, doing so in just 251 days, according to newly released data.

This achievement makes it the third fastest ETF in history to reach the milestone, trailing only behind the Bitcoin ETFs $IBIT (34 days) and $FBTC (53 days).

The chart highlights $ETHA’s meteoric rise, showing how it outpaced traditional ETFs like $JEPI and $XLC, which took 444 and 525 days, respectively, to reach the same level of assets under management (AUM).

Ethereum demand surges amid ETF momentum

BlackRock’s success with $ETHA reflects the growing institutional appetite for Ethereum exposure, especially after regulatory clarity and Ethereum ETF approvals earlier this year.

The ETF’s rapid capital inflow signals strong conviction in Ethereum as more than just a digital asset—positioning it as a serious infrastructure layer for Web3, DeFi, and tokenized real-world assets.

$ETHA’s explosive growth also comes amid broader strength in the crypto market, with Ethereum’s price hovering near multi-month highs and outperforming Bitcoin on several institutional metrics.

ETF race intensifies between crypto and TradFi giants

BlackRock’s $ETHA now joins $IBIT (iShares Bitcoin ETF) and $FBTC (Fidelity Bitcoin ETF) at the top of the ETF leaderboard, signaling a shift in capital markets where crypto-native funds are scaling faster than legacy sector ETFs.

As Ethereum ETF products continue to gain traction, analysts expect even more inflows in Q3 and Q4, potentially pushing AUM beyond $15 billion by year-end—especially if ETH’s price momentum continues alongside altcoin season.

-

1

Binance Could Introduce Golden Visa Option for BNB Investors Inspired by TON

07.07.2025 8:00 1 min. read -

2

Ethereum and Solana 2025 Update: Upgrades, Growth, and What’s next

12.07.2025 14:30 2 min. read -

3

Pepe Price Prediction: PEPE Could Rise Another 10% If It Breaks This Key Level

16.07.2025 17:26 3 min. read -

4

Top 10 Trending Altcoins Right Now, According to CoinGecko Data

13.07.2025 17:30 3 min. read -

5

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read

10 Crypto Unlocks to Watch in the Next 14 hours

A wave of token unlocks is set to hit the crypto market within the next 14 hours, potentially shaking up price dynamics for several low- and mid-cap projects.

What the Crypto Community is Thinking as Bitcoin Slips

Traders are growing cautious, and the crypto mood is beginning to shift. Bitcoin has stalled near $115,500, and momentum is no longer as confident as it was earlier this month.

Solana Plans 66% Block Upgrade to Boost Network Capacity

Solana developers have introduced a new proposal aimed at pushing the network’s performance even further.

Societe Generale Backs Bitcoin and Ethereum ETP Expansion

French banking giant Societe Generale has entered the crypto space more directly, forming a strategic partnership with 21Shares.

-

1

Binance Could Introduce Golden Visa Option for BNB Investors Inspired by TON

07.07.2025 8:00 1 min. read -

2

Ethereum and Solana 2025 Update: Upgrades, Growth, and What’s next

12.07.2025 14:30 2 min. read -

3

Pepe Price Prediction: PEPE Could Rise Another 10% If It Breaks This Key Level

16.07.2025 17:26 3 min. read -

4

Top 10 Trending Altcoins Right Now, According to CoinGecko Data

13.07.2025 17:30 3 min. read -

5

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read