BlackRock’s Ethereum ETF Leads Market With Strong Inflows

15.10.2024 19:00 1 min. read Alexander Stefanov

BlackRock's Ethereum ETF is currently at the forefront of the market, indicating increased investor confidence in ETH as a suitable investment.

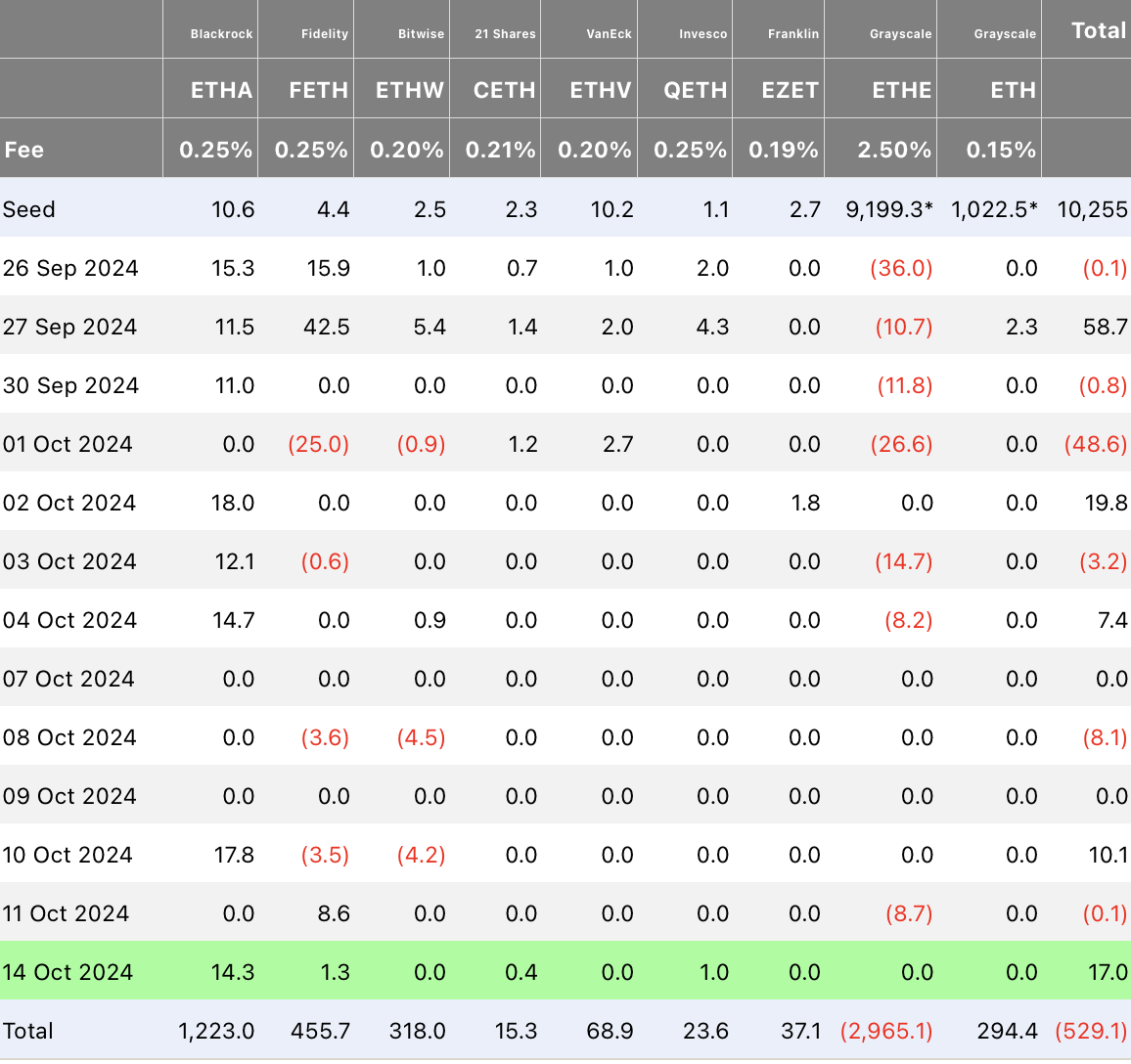

BlackRock’s ETHA led the way with a remarkable $14.3 million in daily net inflows, bringing its total historical net inflows to $1.223 billion.

Close behind was Fidelity’s Ethereum ETF, FETH, which recorded daily net inflows of $1.3 million and amassed historical net inflows of $456 million.

In contrast, Grayscale’s Ethereum Trust showed no daily net inflows or outflows, as did the Ethereum Mini Trust (ETH).

At last count, the net value of all spot Ethereum ETFs totaled $7.195 billion, with a ratio of net assets to total cryptocurrency market value of 2.28%.

Despite cumulative net outflows of $542 million, the inflows to spot ETFs suggest that Ethereum remains an attractive investment, a signal that investor interest in this dynamic asset class has not completely waned.

-

1

Solana Exchange Balances Surge as Bearish Signals Grow

13.06.2025 18:25 1 min. read -

2

Cardano Moves Toward Ripple Asset Integration as Hoskinson Teases DeFi Expansion

15.06.2025 11:00 2 min. read -

3

SEC Postpones Decision on Franklin Templeton Ethereum ETF Staking Proposal

17.06.2025 8:00 1 min. read -

4

BTC Bull Token Price Prediction: The Next Crypto with 1000% Potential?

25.06.2025 18:55 4 min. read -

5

Crypto Whale Makes $3.5M Shorting Altcoins on Hyperliquid

15.06.2025 15:00 1 min. read

New Meme Coin to Watch: TOKEN6900 Presale Tipped as Next SPX6900

The recent launch of the TOKEN6900 (T6900) meme coin presale is a refreshing sight in a market oversaturated with presales focused on providing utility. Token6900 returns to the roots of meme coins, offering no utility. This is precisely what makes it appealing to those seeking a high-risk, high-reward asset to stockpile. Marketed as the world’s […]

XRP Price Prediction: Price Compression and Higher ETF Approval Odds Could Propel XRP to $4

XRP trading volumes have doubled in the past 24 hours. Although the price action has not reacted as expected yet, something could be brewing as bulls could be accumulating tokens at these low prices in anticipation of the token’s next leg up. Yesterday, the market reacted quite positively to the approval of the first Solana […]

Which Crypto ETFs Could Get SEC Approval in 2025? Here Are the Chances

With the U.S. Securities and Exchange Commission (SEC) already greenlighting spot Bitcoin and Ethereum ETFs, attention is now turning to the next wave of crypto-backed exchange-traded funds.

Top Trending Cryptocurrencies Today

As crypto markets navigate another week of volatility and shifting sentiment, traders are increasingly turning their attention to emerging altcoins and high-momentum tokens.

-

1

Solana Exchange Balances Surge as Bearish Signals Grow

13.06.2025 18:25 1 min. read -

2

Cardano Moves Toward Ripple Asset Integration as Hoskinson Teases DeFi Expansion

15.06.2025 11:00 2 min. read -

3

SEC Postpones Decision on Franklin Templeton Ethereum ETF Staking Proposal

17.06.2025 8:00 1 min. read -

4

BTC Bull Token Price Prediction: The Next Crypto with 1000% Potential?

25.06.2025 18:55 4 min. read -

5

Crypto Whale Makes $3.5M Shorting Altcoins on Hyperliquid

15.06.2025 15:00 1 min. read