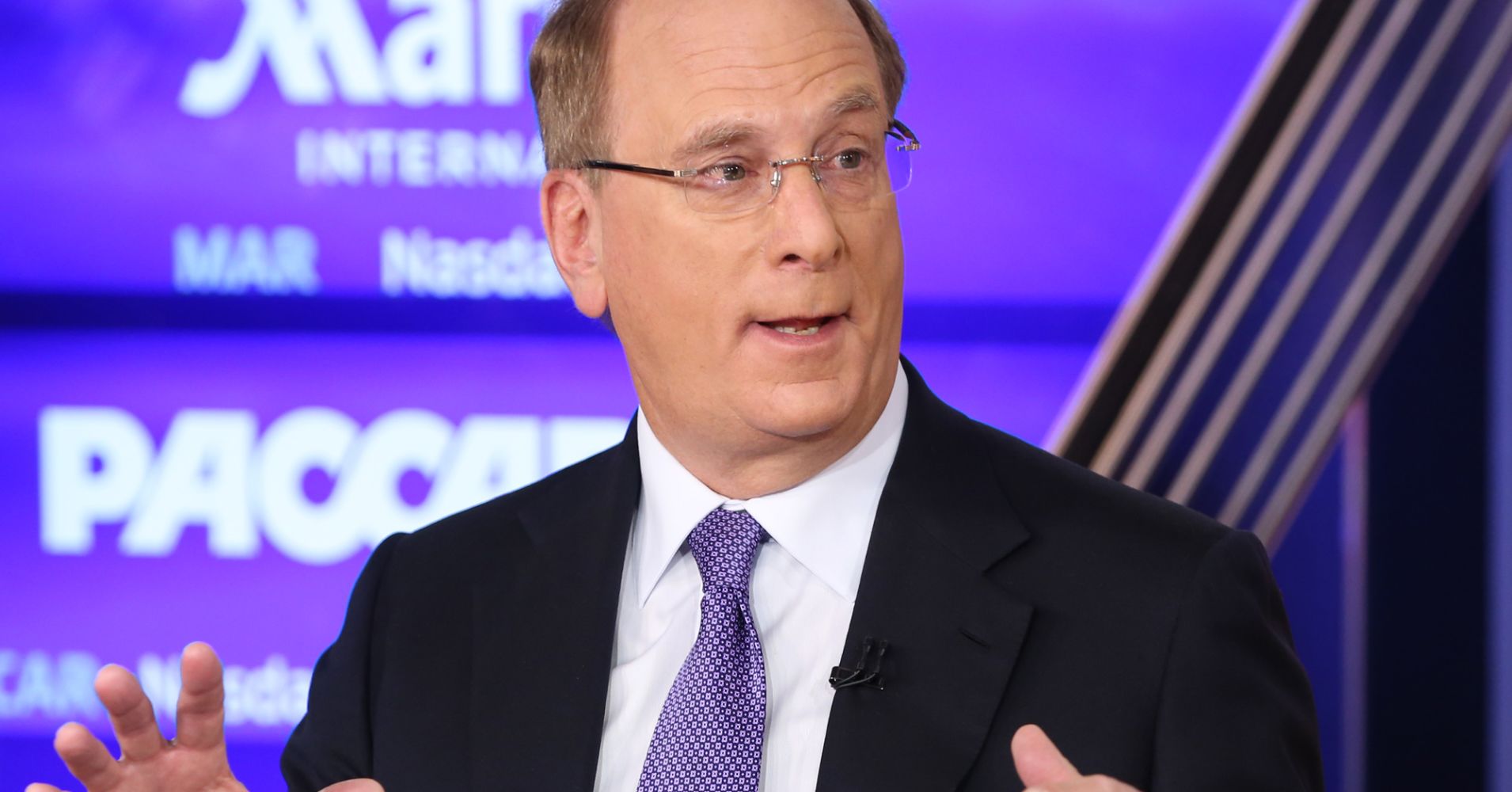

BlackRock CEO Predicts Bitcoin Boom Driven by Sovereign Wealth Funds

22.01.2025 19:00 1 min. read Alexander Stefanov

Larry Fink, the head of the world’s largest asset management firm, has suggested that Bitcoin could experience a significant surge in value if sovereign wealth funds begin to invest in the digital asset.

Speaking at the World Economic Forum in Davos, Switzerland, Fink highlighted the potential role of Bitcoin as a hedge against various economic and political concerns.

He explained that in times of uncertainty, such as rising inflation or instability in a country’s economy or political system, Bitcoin offers an internationally recognized alternative that can address these fears.

According to Fink, this could lead sovereign wealth funds to consider allocating a small percentage of their portfolios—perhaps 2% to 5%—to Bitcoin. He speculated that widespread adoption of this strategy could drive Bitcoin’s price to unprecedented levels, potentially reaching between $500,000 and $700,000 per coin.

BlackRock, the firm led by Fink, has increasingly embraced Bitcoin over the past year. It launched the iShares Bitcoin Trust ETF (IBIT) in early 2024, backed by a $50 billion reserve. By November, the Bitcoin ETF had surpassed the company’s long-standing gold ETF (IAU), which debuted in 2005, in terms of net assets.

The Bitcoin fund now manages over $33 billion, underscoring the growing institutional interest in the cryptocurrency.

-

1

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

12.07.2025 20:00 1 min. read -

2

Bitcoin ETFs See $1B Inflow as IBIT Smashes Global AUM record

11.07.2025 21:00 1 min. read -

3

Corporate Bitcoin Adoption Soars: 125 Public Companies Now Hold BTC

16.07.2025 20:00 2 min. read -

4

Bitcoin Reaches $119,000 Milestone as Corporate Demand and ETF Inflows Rise

13.07.2025 17:45 2 min. read -

5

Bitcoin Price Prediction From Bernstein After the Recent All-Time High

14.07.2025 20:00 1 min. read

Billionaire Ray Dalio Revealed What his Portfolio Says About the Future of mMoney

Billionaire investor Ray Dalio, founder of Bridgewater Associates, has suggested that a balanced investment portfolio should include up to 15% allocation to gold or Bitcoin, though he remains personally more inclined toward the traditional asset.

Where Is The Smart Entry Point For Bitcoin Bulls?

With Bitcoin hovering near $119,000, traders are weighing their next move carefully. The question dominating the market now is simple: Buy the dip or wait for a cleaner setup?

Matrixport Warns of Bitcoin Dip After Hitting This Target

Bitcoin has officially reached the $116,000 milestone, a level previously forecasted by crypto services firm Matrixport using its proprietary seasonal modeling.

Bitcoin Risk Cycle Flips Again as Market Enters Safer Zone

Bitcoin’s market signal has officially shifted back into a low-risk phase, according to a new chart shared by Bitcoin Vector in collaboration with Glassnode and Swissblock.

-

1

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

12.07.2025 20:00 1 min. read -

2

Bitcoin ETFs See $1B Inflow as IBIT Smashes Global AUM record

11.07.2025 21:00 1 min. read -

3

Corporate Bitcoin Adoption Soars: 125 Public Companies Now Hold BTC

16.07.2025 20:00 2 min. read -

4

Bitcoin Reaches $119,000 Milestone as Corporate Demand and ETF Inflows Rise

13.07.2025 17:45 2 min. read -

5

Bitcoin Price Prediction From Bernstein After the Recent All-Time High

14.07.2025 20:00 1 min. read