BlackRock CEO Flags Recession Risk – And Crypto Bulls Are Paying Attention

12.04.2025 20:00 2 min. read Alexander Stefanov

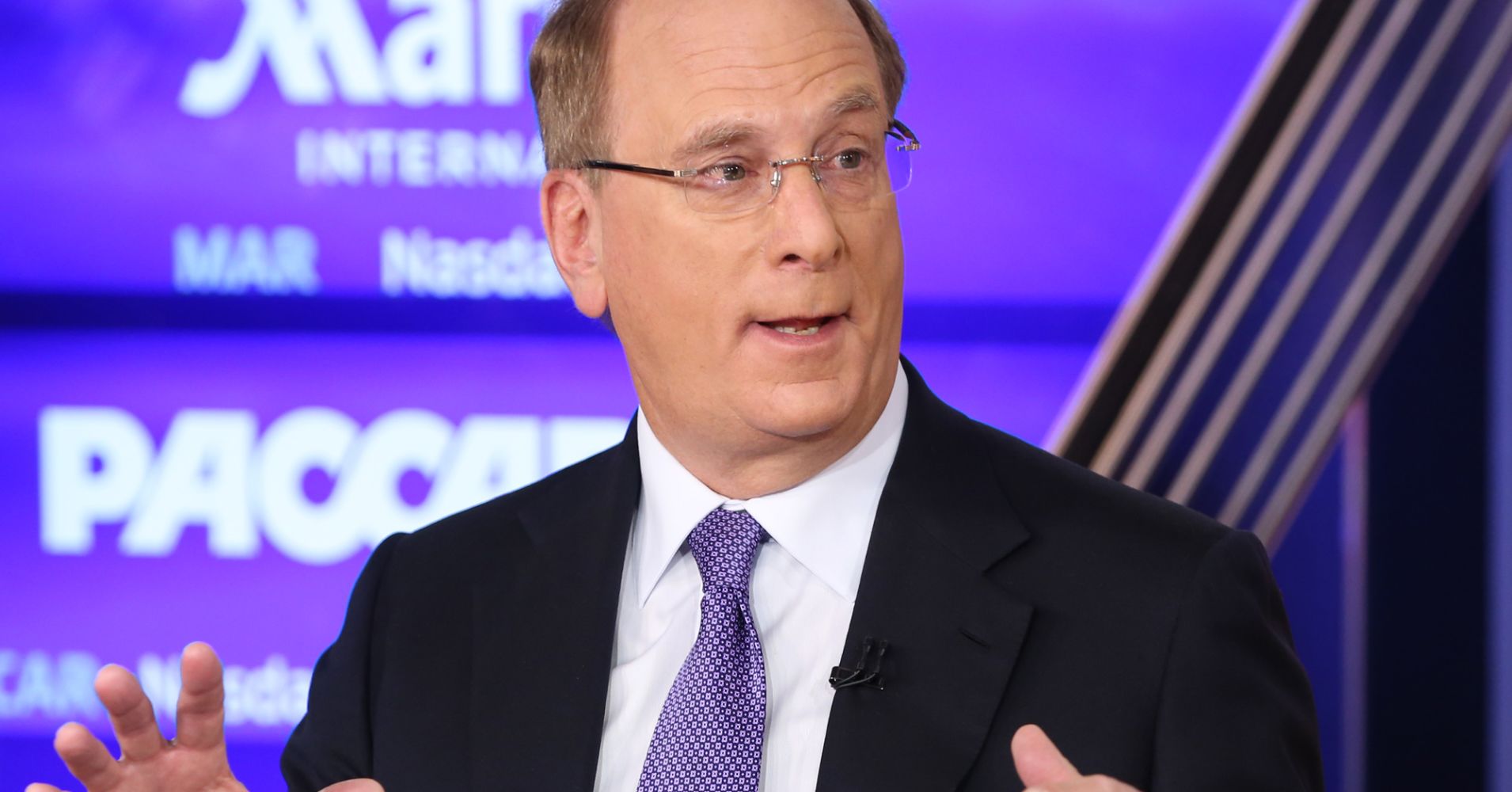

BlackRock CEO Larry Fink has raised alarms over a possible U.S. recession, warning that the downturn may have already begun.

Speaking in a CNBC interview, Fink cited rising economic strain and protectionist trade policies—particularly tariffs under former President Trump—as key drivers behind what he sees as a slow-motion economic contraction.

While recession fears typically rattle traditional markets, crypto investors may have reason to cheer. A looming slowdown could prompt the Federal Reserve to reverse course on monetary tightening, potentially unleashing a fresh wave of liquidity. That scenario, according to analysts, could be a major catalyst for digital assets like Bitcoin.

Fink’s remarks follow similar predictions from major Wall Street institutions, including JPMorgan, Deutsche Bank, and Goldman Sachs. On decentralized prediction markets such as Kalshi and PolyMarket, traders are also increasingly betting that a U.S. recession is on the horizon.

Adding fuel to the crypto narrative, recent economic data points to easing inflation. March’s Producer Price Index fell by 0.4% month-over-month—well below expectations—while the Consumer Price Index came in at 2.4% year-over-year, softer than Wall Street’s 2.6% estimate.

Combined with a weakening U.S. dollar, now at a three-year low, the data is bolstering expectations of rate cuts. Bitwise CIO Matt Hougan believes that dollar weakness could boost Bitcoin in the short term—and potentially open the door for BTC to gain traction as an alternative global reserve asset in the longer run.

As uncertainty looms over the broader economy, crypto investors may find themselves on the edge of a new bull cycle, fueled not by hype—but by macroeconomic shifts.

-

1

Jamie Dimon Warns U.S. Risks Losing Dollar Dominance Without Swift Reform

02.06.2025 8:00 1 min. read -

2

Elon Musk Says Congress Is Bankrupting America

04.06.2025 14:00 2 min. read -

3

Trillions in Debt Payments Could Break U.S. Economy, Ray Dalio Predicts

06.06.2025 12:00 1 min. read -

4

Trump Defends Tariffs as Legal Battles and Global Trade Talks Escalate

03.06.2025 21:00 2 min. read -

5

Wall Street Veteran Warns Tariffs Could Disrupt AI-Driven Market Rally

05.06.2025 12:00 1 min. read

Fed’s New Projections Hint at a Slower Easing Cycle Through 2026

The Federal Reserve left its target range at 4.25–4.50 percent for a fourth straight meeting and quietly dialed back how much easing it expects through 2026.

UK Inflation Stalls at 3.4%, Spotlight Shifts to BoE’s August Meeting

Britain’s cost-of-living pulse barely budged in May, with headline CPI stuck at 3.4%—the same pace (after correction) seen in April, the Office for National Statistics said on Wednesday.

Fed Holds Fire on Rates, Signals Cuts Could Arrive if Jobs Falter

After wrapping up a two-day policy meeting, the Federal Reserve left its benchmark rate unchanged near 4.4 percent—exactly what markets had penciled in.

Billionaire Investor Sees Dollar Crash If Key Support Breaks

Jeffrey Gundlach believes the greenback is tiptoeing along its final line of support. In a recent webcast, the DoubleLine Capital founder highlighted a chart that links the dollar index’s 2011 trough near 72 to its 2021 low around 89.

-

1

Jamie Dimon Warns U.S. Risks Losing Dollar Dominance Without Swift Reform

02.06.2025 8:00 1 min. read -

2

Elon Musk Says Congress Is Bankrupting America

04.06.2025 14:00 2 min. read -

3

Trillions in Debt Payments Could Break U.S. Economy, Ray Dalio Predicts

06.06.2025 12:00 1 min. read -

4

Trump Defends Tariffs as Legal Battles and Global Trade Talks Escalate

03.06.2025 21:00 2 min. read -

5

Wall Street Veteran Warns Tariffs Could Disrupt AI-Driven Market Rally

05.06.2025 12:00 1 min. read