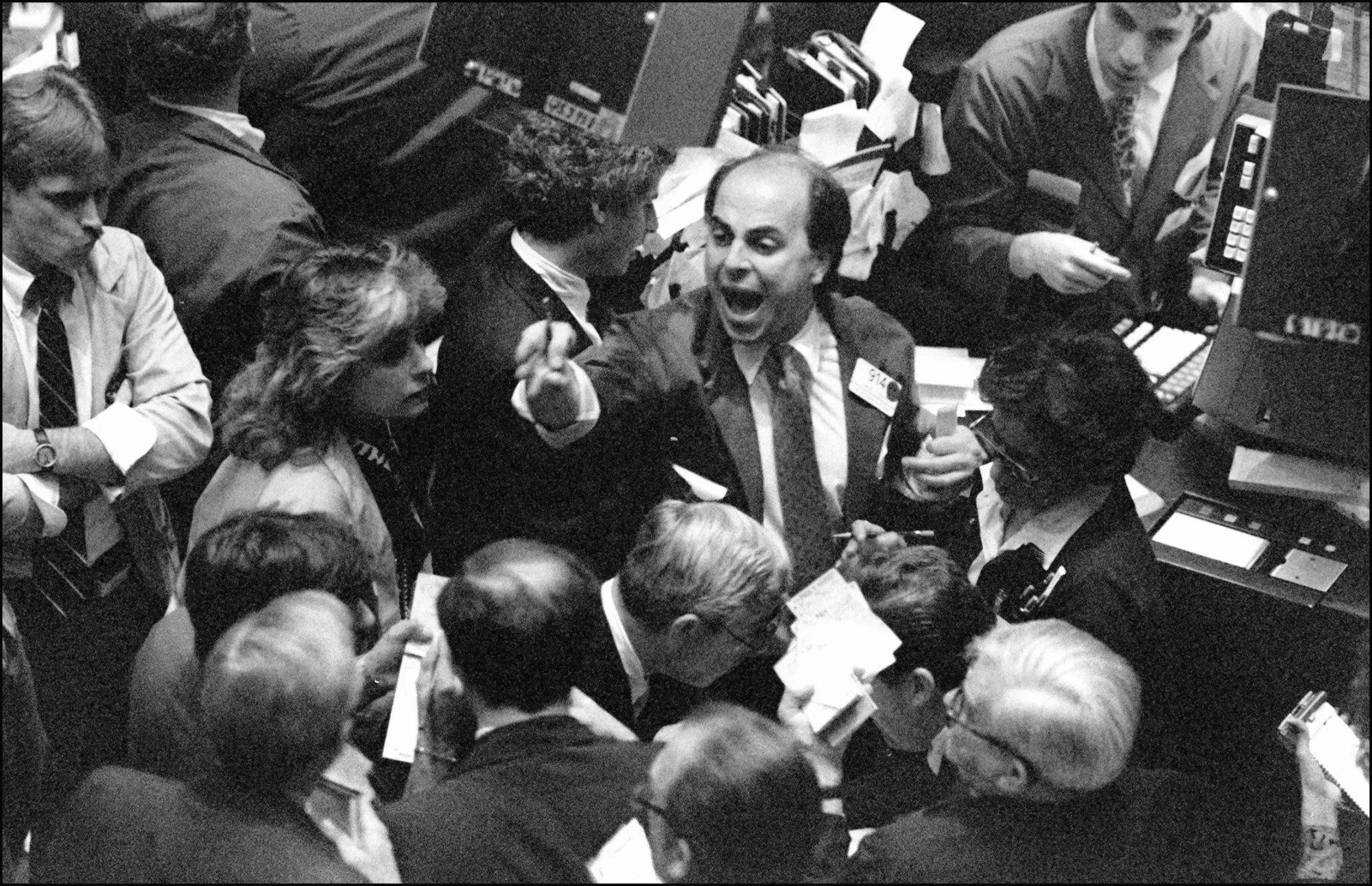

Black Tuesday: The Stock Market Catastrophe That Sparked the Great Depression

05.11.2024 11:00 2 min. read Alexander Stefanov

The 'Roaring Twenties,' characterized by wealth and urban migration, ended abruptly as economic troubles emerged, particularly in Europe and the U.S. Scholars attribute this downturn to the Federal Reserve's decision to cut the money supply, leading to a decline in economic output.

Despite the risks, many believed the stock market would continue its upward trajectory. However, on March 25, 1929, a minor market crash triggered by the Federal Reserve’s warnings prompted rapid sell-offs, exposing market weaknesses.

Although banker Charles E. Mitchell briefly stabilized the situation with a $25 million credit pledge, economic indicators worsened, with declines in steel production, construction, and automobile sales. The market saw a temporary resurgence until a major crash began in October, following a prediction by financial analyst Roger Babson and the arrest of British investor Clarence Hatry for fraud.

The Great Depression soon plunged millions into hardship, with unemployment skyrocketing from 1.6 million in 1929 to 14 million by 1933—25% of the workforce. Many resorted to desperate measures for income, while those employed faced falling wages and unpaid government salaries. Hunger and homelessness surged, with over 250,000 families losing their homes and many becoming ‘hobos’ in search of shelter.

Federal efforts to provide emergency funding were met with frustration, leading to riots and protests demanding action against poverty. Meanwhile, World War I veterans, known as the ‘Bonus Army,’ gathered in Washington, D.C., seeking early bonus payments, only to be forcibly dispersed by military forces.

Farmers faced their own crises due to overproduction and falling crop prices, with wheat plummeting from 103 cents per bushel in 1929 to 38 cents by 1933, resulting in approximately 750,000 losing their land. The Dust Bowl further exacerbated their plight, forcing many to migrate west in search of work.

President Hoover’s response included limited aid programs, with the Reconstruction Finance Corporation providing loans and public works projects creating jobs. However, many citizens deemed these measures inadequate as frustration over poverty and unemployment persisted.

-

1

Robert Kiyosaki Predicts When The Price of Silver Will Explode

28.06.2025 16:30 2 min. read -

2

Trump Targets Powell as Fed Holds Rates: Who Could Replace Him?

27.06.2025 9:00 2 min. read -

3

U.S. PCE Inflation Rises for First Time Since February, Fed Rate Cut Likely Delayed

27.06.2025 18:00 1 min. read -

4

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

15.07.2025 16:15 2 min. read -

5

Key U.S. Economic Events to Watch Next Week

06.07.2025 19:00 2 min. read

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

U.S. inflation accelerated in June, dealing a potential setback to expectations of imminent Federal Reserve rate cuts.

Gold Beats U.S. Stock Market Over 25 Years, Even With Dividends Included

In a surprising long-term performance shift, gold has officially outpaced the U.S. stock market over the past 25 years—dividends included.

U.S. Announces Sweeping New Tariffs on 30+ Countries

The United States has rolled out a broad set of new import tariffs this week, targeting over 30 countries and economic blocs in a sharp escalation of its trade protection measures, according to list from WatcherGuru.

Key U.S. Economic Events to Watch Next Week

After a week of record-setting gains in U.S. markets, investors are shifting focus to a quieter yet crucial stretch of macroeconomic developments.

-

1

Robert Kiyosaki Predicts When The Price of Silver Will Explode

28.06.2025 16:30 2 min. read -

2

Trump Targets Powell as Fed Holds Rates: Who Could Replace Him?

27.06.2025 9:00 2 min. read -

3

U.S. PCE Inflation Rises for First Time Since February, Fed Rate Cut Likely Delayed

27.06.2025 18:00 1 min. read -

4

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

15.07.2025 16:15 2 min. read -

5

Key U.S. Economic Events to Watch Next Week

06.07.2025 19:00 2 min. read