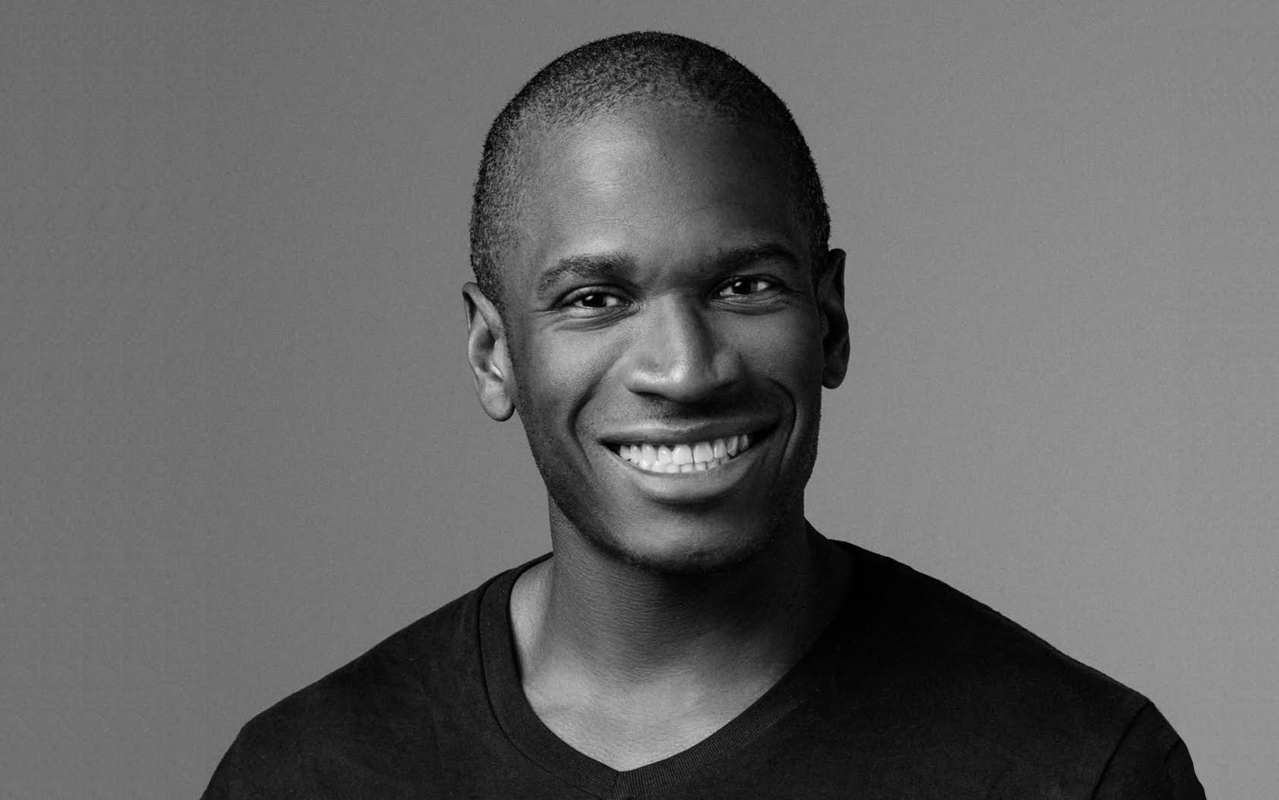

BitMEX’s Arthur Hayes Promotes New Memecoin, Price Surges

23.11.2024 22:00 2 min. read Kosta Gushterov

BitMEX's Arthur Hayes has once again promoted a Solana-based memecoin to his followers, triggering a surge in its price.

In a recent post on X, Hayes shared the Dextool profile of the FlowerAI (FLOWER) meme coin, using the phrase “kek,” which led to an immediate rally. At the time of the post, FLOWER was priced at $0.02232, but the coin’s value quickly spiked above $0.03, boosting its market capitalization from $22 million to $30 million.

This move has attracted some criticism from the crypto community, with some questioning why a prominent figure like Hayes would promote a low-cap coin. Accusations of manipulating the market for personal gain have also emerged, with detractors suggesting he is attempting to pump and dump the asset on his followers. Hayes has previously promoted other Solana meme coins, including Dogwifhat (WIF) and Solana AI meme coin Goatseus Maximus (GOAT), in addition to investing in lesser-known tokens like MOTHER and MOG.

In recent months, Hayes has made waves with his endorsement of Solana meme coin Deep Worm Price, which skyrocketed 180% following his mention. However, the coin’s market cap dropped after the initial surge, reflecting the volatility that often accompanies meme coin investments.

Despite this, the Solana meme coin ecosystem has proven to be a significant driver for the Solana network itself. The rising demand for these tokens has contributed to Solana’s all-time high price of $263 and propelled it to lead other blockchains, including Ethereum, in decentralized exchange (DEX) volume.

-

1

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

2

Will Ethereum and Solana Benefit from Wall Street’s Shift?

09.07.2025 19:00 2 min. read -

3

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read -

4

BNB Chain Upgrades and Token Delistings Reshape Binance Ecosystem

16.07.2025 22:00 2 min. read -

5

Dogecoin Price Prediction: DOGE Volumes Nearly Double – Can It Get to $1 In This Cycle?

18.07.2025 20:10 3 min. read

Ethereum Surges Past $3,900 as Altcoin Season Sparks ETF Boom

Ethereum just crossed the $3,900 mark, rising over 62% in the past month, according to CoinMarketCap data.

Ethereum Spot ETFs Dwarf Bitcoin with $1.85B Inflows: Utility Season in Full Swing

Ethereum is rapidly emerging as the institutional favorite, with new ETF inflow data suggesting a seismic shift in investor focus away from Bitcoin.

Ethereum 2025 Mirrors 2017 Breakout—But With Wall Street Fueling the Surge

Ethereum (ETH) appears to be entering a breakout phase eerily reminiscent of its historic 2017 rally—but this time, the move is backed by deep institutional support and ETF inflows.

SUI Price Breaks Key Resistance as BTCFi Vision Gains Traction

SUI, the native token of the Sui blockchain, is drawing attention following a major breakout on the charts—driven by surging total value locked (TVL) and growing anticipation around Bitcoin-native decentralized finance (BTCFi) infrastructure.

-

1

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

2

Will Ethereum and Solana Benefit from Wall Street’s Shift?

09.07.2025 19:00 2 min. read -

3

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read -

4

BNB Chain Upgrades and Token Delistings Reshape Binance Ecosystem

16.07.2025 22:00 2 min. read -

5

Dogecoin Price Prediction: DOGE Volumes Nearly Double – Can It Get to $1 In This Cycle?

18.07.2025 20:10 3 min. read