BitMEX Founder Questions Viability of Trump’s Crypto Reserve Proposal

04.03.2025 15:00 1 min. read Alexander Stefanov

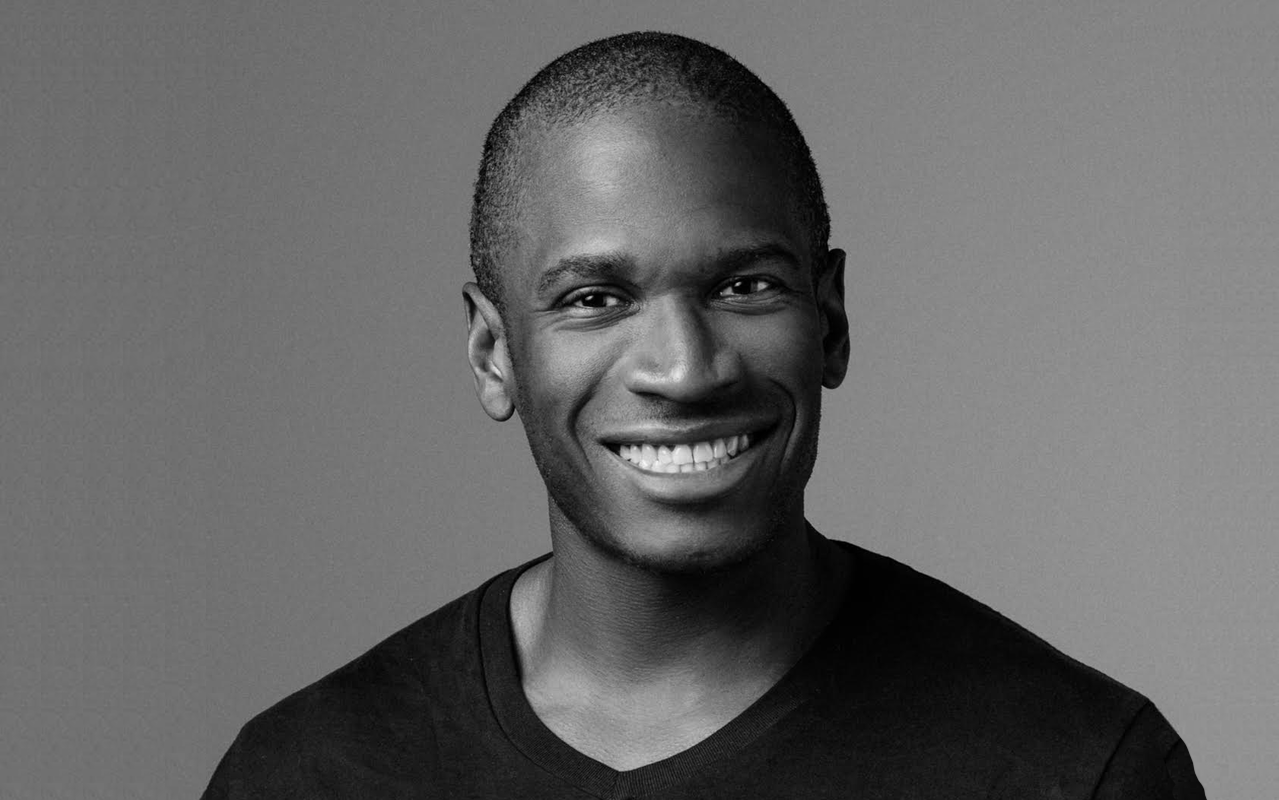

Arthur Hayes, the co-founder of BitMEX, has voiced his doubts about U.S. President Donald Trump’s recent proposal for a national cryptocurrency reserve.

In a blunt response to Trump’s announcement, Hayes dismissed it as mere “words” and questioned its practicality, especially without the necessary financial backing.

He pointed out that for such a reserve to be effective, it would require congressional approval to access funds, something Trump has yet to secure.

Despite the initial market excitement following Trump’s suggestion that Bitcoin (BTC), Ethereum (ETH), Solana (SOL), XRP, and Cardano (ADA) might be part of the reserve, Hayes remains unphased.

While he maintains a long-term positive outlook on cryptocurrencies, he made it clear that he would not be adding to his holdings for now.

In contrast, Binance’s Changpeng Zhao (CZ) took a more hopeful view, suggesting that additional valuable assets could be incorporated into the reserve in the future, encouraging the community to stay optimistic.

-

1

Nvidia Surges as Barclays Sees $200 Target on Blackwell Momentum

18.06.2025 11:00 1 min. read -

2

Gold Glides Toward New Peaks as Middle-East Strife Lifts Safe-Haven Demand

15.06.2025 10:00 2 min. read -

3

a16z Backs EigenCloud Launch With Fresh $70M Token Buy

18.06.2025 14:00 1 min. read -

4

Bybit Steps Into DeFi With Solana-Based Platform

16.06.2025 17:00 1 min. read -

5

Ripple’s Stablecoin Gains Global Reach Through Alchemy Pay Integration

18.06.2025 8:00 1 min. read

Donald Trump Signs “One Big Beautiful Bill”: How It Can Reshape the Crypto Market

U.S. President Donald Trump has officially signed his sweeping policy bill into law, enacting one of the most consequential pieces of legislation of his presidency.

FTX Halts Recovery Payments in 49 Countries: Here Is the List

The long-awaited creditor repayments from bankrupt crypto exchange FTX have hit a major roadblock, with the FTX Recovery Trust announcing a temporary suspension of payments to users in 49 foreign jurisdictions.

Trump’s ‘Big, Beautiful Bill’ Approved: What It Means for Crypto Markets

Congress has officially passed President Donald Trump’s landmark economic package, a sweeping bill that combines aggressive tax cuts with deep federal spending reductions.

BlackRock’s Bitcoin ETF Now Out-Earning Its $624B S&P 500 Fund

BlackRock’s spot Bitcoin exchange-traded fund (ETF), known by its ticker IBIT, has surpassed the firm’s flagship S&P 500 ETF in annual revenue, according to a new report from Bloomberg.

-

1

Nvidia Surges as Barclays Sees $200 Target on Blackwell Momentum

18.06.2025 11:00 1 min. read -

2

Gold Glides Toward New Peaks as Middle-East Strife Lifts Safe-Haven Demand

15.06.2025 10:00 2 min. read -

3

a16z Backs EigenCloud Launch With Fresh $70M Token Buy

18.06.2025 14:00 1 min. read -

4

Bybit Steps Into DeFi With Solana-Based Platform

16.06.2025 17:00 1 min. read -

5

Ripple’s Stablecoin Gains Global Reach Through Alchemy Pay Integration

18.06.2025 8:00 1 min. read