Bitcoin’s Realized Cap Hits Record as Market Eyes Six-Figure Return

08.05.2025 16:00 1 min. read Alexander Zdravkov

Bitcoin is on the verge of regaining its psychological threshold of $100,000, and analysts at CryptoQuant explain some of the reasons behind the rise.

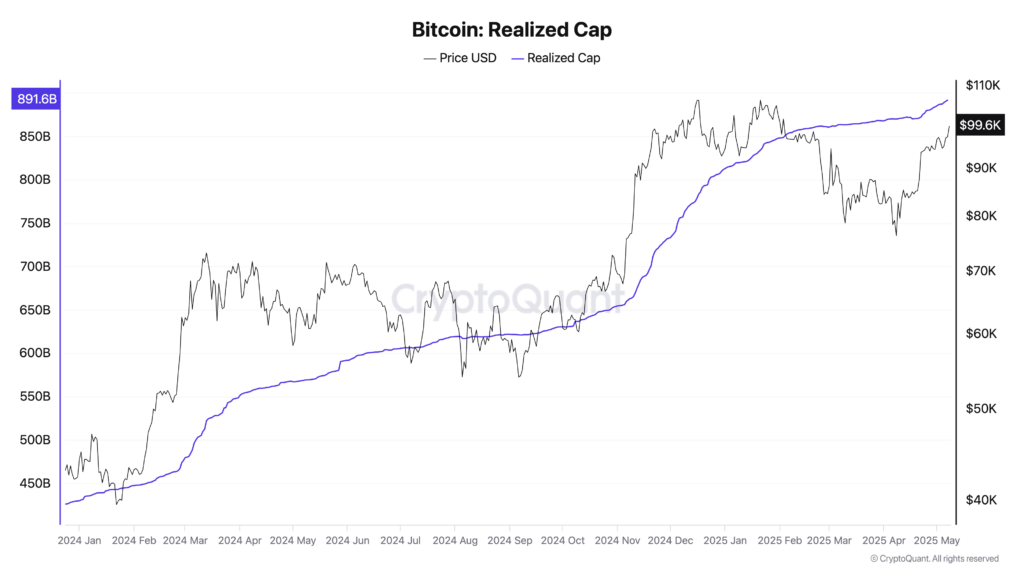

Bitcoin is seeing new highs — not just in price but in on-chain valuation metrics. According to CryptoQuant, the network’s realized cap, which tracks the value of BTC based on its last on-chain movement, reached an all-time high of $891 billion as of May 7. This metric reflects increasing investor conviction and steady capital inflows.

CryptoQuant’s Carmelo Alemán notes that both long- and short-term holders are accumulating, signaling confidence in Bitcoin’s long-term potential. The current momentum may be laying the groundwork for a broader bull cycle.

Glassnode’s latest report echoes this optimism, noting that daily profit-taking now exceeds $1 billion. Despite fears of a pullback, the report suggests that rising demand is absorbing sell pressure, maintaining market balance near the $100,000 mark.

Since late 2023, the market has remained in a profit-focused regime, with capital inflows consistently outpacing outflows — a trend analysts see as a healthy sign of growing demand.

-

1

UniCredit to Launch Structured Product Tied to BlackRock’s Spot Bitcoin ETF

01.07.2025 17:53 1 min. read -

2

Saylor’s Strategy Halts Bitcoin Buying After Historic Accumulation

07.07.2025 17:00 2 min. read -

3

Trump’s Two big Bitcoin Moves: Key Catalysts or Just Noise for BTC Price?

08.07.2025 7:30 2 min. read -

4

Bitcoin Market Stalls as Profit-Taking, Whale Dispersal, and Sideways Action Define the Cycle

01.07.2025 20:00 3 min. read -

5

Speculation Surges as Binance BTC Futures Volume Tops $650 Trillion

04.07.2025 17:37 2 min. read

Trump Media Holds $2B in Bitcoin as Crypto Plan Expands

Trump Media and Technology Group, the parent company of Truth Social, Truth+, and Truth.Fi, has officially disclosed that it now holds approximately $2 billion in Bitcoin and Bitcoin-related securities.

Strategy Adds 6,220 BTC, Pushing Total Holdings Past 607,000

Michael Saylor’s Strategy has confirmed another major Bitcoin purchase, acquiring 6,220 BTC last week for approximately $739.8 million.

Bitcoin Open Interest Hits $42B as Funding Rates Signal Bullish Overextension

Bitcoin’s derivatives market is heating up, with open interest climbing back to $42 billion while funding rates continue to surge.

Tim Draper Predicts Bitcoin Will Replace U.S. Dollar

Tim Draper isn’t just betting on Bitcoin—he’s forecasting the death of the U.S. dollar.

-

1

UniCredit to Launch Structured Product Tied to BlackRock’s Spot Bitcoin ETF

01.07.2025 17:53 1 min. read -

2

Saylor’s Strategy Halts Bitcoin Buying After Historic Accumulation

07.07.2025 17:00 2 min. read -

3

Trump’s Two big Bitcoin Moves: Key Catalysts or Just Noise for BTC Price?

08.07.2025 7:30 2 min. read -

4

Bitcoin Market Stalls as Profit-Taking, Whale Dispersal, and Sideways Action Define the Cycle

01.07.2025 20:00 3 min. read -

5

Speculation Surges as Binance BTC Futures Volume Tops $650 Trillion

04.07.2025 17:37 2 min. read