Bitcoin’s Bull Run May Extend Beyond 2026 as Institutional Adoption Grows

31.01.2025 16:30 2 min. read Alexander Zdravkov

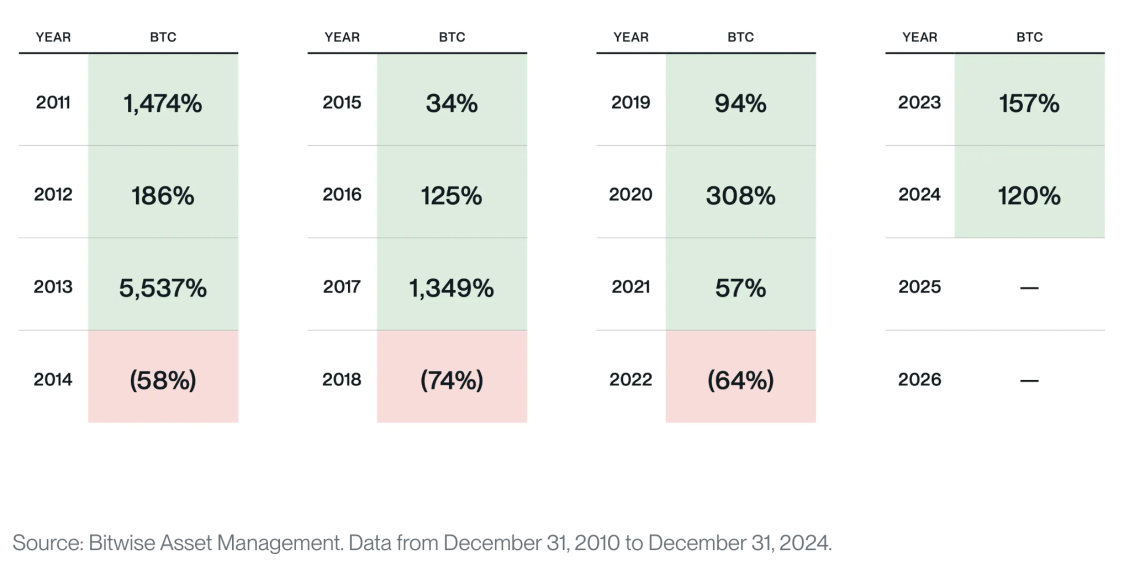

Bitcoin’s historical price cycles could be shifting, according to Bitwise Chief Investment Officer Matt Hougan.

He suggests that regulatory changes under the Trump administration and rising institutional interest may push the current bull market beyond 2026, breaking the traditional pattern of sharp price corrections.

Bitcoin has historically followed a cycle of three bullish years followed by a major downturn, with halvings often cited as the primary driver. Hougan, however, disputes this, arguing that institutional adoption plays a bigger role in shaping price trends. He predicts Bitcoin could double in value this year, potentially surpassing $200,000, fueled by ETF inflows and corporate accumulation.

Trump’s recent executive order on crypto regulation could further accelerate Bitcoin’s adoption. The policy prioritizes digital assets in the U.S. financial system, proposes a national crypto reserve, and clears a path for major banks and investment firms to integrate crypto holdings. While the full effects may take time, Hougan believes this shift will ultimately bring trillions into the market.

If Bitcoin’s cycle is evolving, future downturns may not be as severe as in previous years. With institutional backing and clearer regulations, Hougan suggests that any correction will likely be shallower and shorter-lived.

His outlook aligns with Standard Chartered’s forecast, which anticipates Bitcoin reaching $200,000 by the end of 2025—an indication that the crypto market could be moving toward greater long-term stability.

-

1

Bitcoin Reaches $119,000 Milestone as Corporate Demand and ETF Inflows Rise

13.07.2025 17:45 2 min. read -

2

Bitcoin Price Prediction From Bernstein After the Recent All-Time High

14.07.2025 20:00 1 min. read -

3

Ethereum Sparks Altcoin Season as FOMO Shifts Away From Bitcoin

17.07.2025 18:30 2 min. read -

4

Top Crypto Trends Dominating Discussions This Week

15.07.2025 17:30 2 min. read -

5

Robert Kiyosaki Reacts to Bitcoin’s Surge Past $120K: “I’m Buying One More”

14.07.2025 17:00 1 min. read

Billionaire Ray Dalio Revealed What his Portfolio Says About the Future of mMoney

Billionaire investor Ray Dalio, founder of Bridgewater Associates, has suggested that a balanced investment portfolio should include up to 15% allocation to gold or Bitcoin, though he remains personally more inclined toward the traditional asset.

Where Is The Smart Entry Point For Bitcoin Bulls?

With Bitcoin hovering near $119,000, traders are weighing their next move carefully. The question dominating the market now is simple: Buy the dip or wait for a cleaner setup?

Matrixport Warns of Bitcoin Dip After Hitting This Target

Bitcoin has officially reached the $116,000 milestone, a level previously forecasted by crypto services firm Matrixport using its proprietary seasonal modeling.

Bitcoin Risk Cycle Flips Again as Market Enters Safer Zone

Bitcoin’s market signal has officially shifted back into a low-risk phase, according to a new chart shared by Bitcoin Vector in collaboration with Glassnode and Swissblock.

-

1

Bitcoin Reaches $119,000 Milestone as Corporate Demand and ETF Inflows Rise

13.07.2025 17:45 2 min. read -

2

Bitcoin Price Prediction From Bernstein After the Recent All-Time High

14.07.2025 20:00 1 min. read -

3

Ethereum Sparks Altcoin Season as FOMO Shifts Away From Bitcoin

17.07.2025 18:30 2 min. read -

4

Top Crypto Trends Dominating Discussions This Week

15.07.2025 17:30 2 min. read -

5

Robert Kiyosaki Reacts to Bitcoin’s Surge Past $120K: “I’m Buying One More”

14.07.2025 17:00 1 min. read