Bitcoin Whales Pull Back – What’s Next for the Price?

24.12.2024 10:00 1 min. read Kosta Gushterov

Bitcoin’s value has dropped by 7% over the past week, reflecting a concerning lack of momentum in the market.

While the broader cryptocurrency landscape is under pressure, a key factor behind Bitcoin’s decline is the noticeable inactivity of large-scale investors, commonly known as whales, who are critical to sustaining price stability.

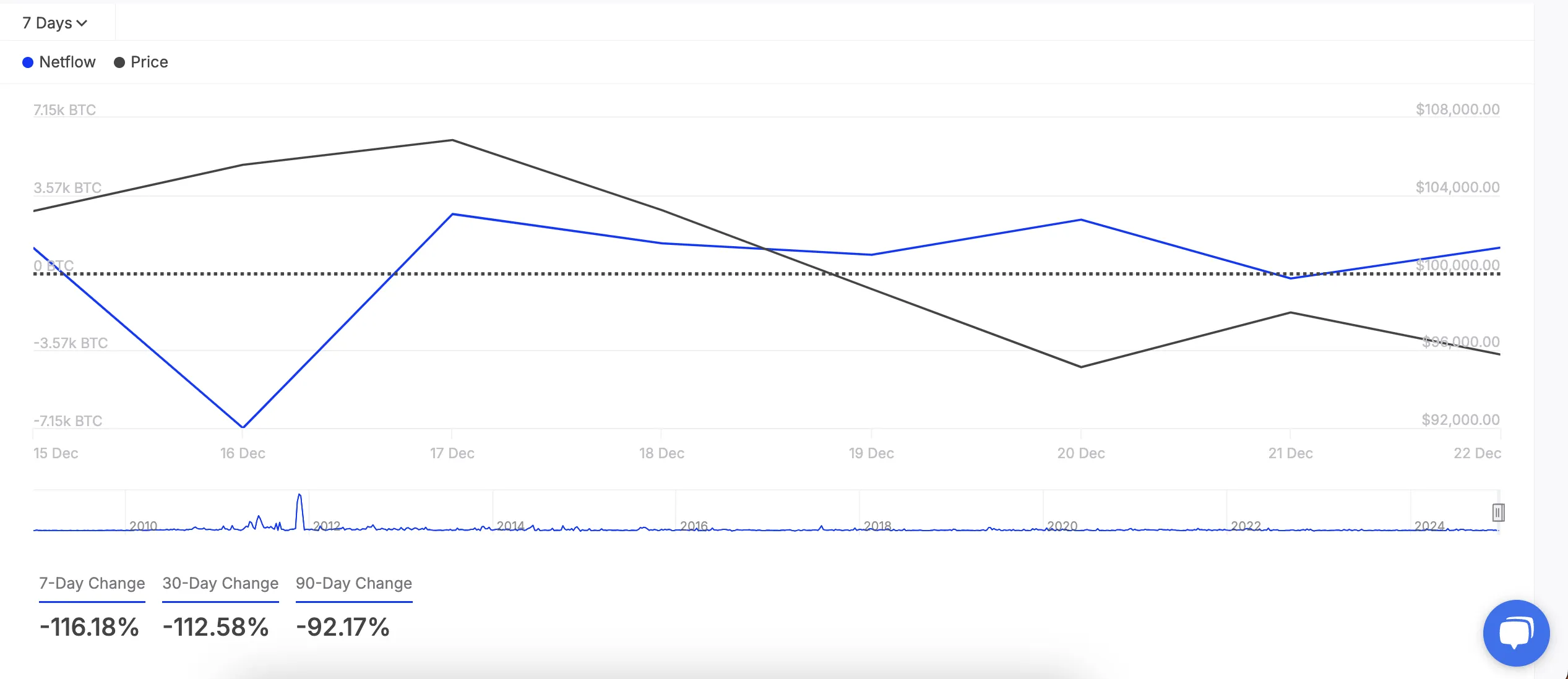

Recent data reveals that major Bitcoin holders are significantly scaling back their activity. Over the last seven days, net inflows to whale wallets have sharply decreased, signaling a preference for selling rather than accumulating. This shift, as tracked by IntoTheBlock, suggests a growing reluctance among these investors to bet on Bitcoin’s short-term performance.

Additionally, the frequency of large Bitcoin transactions has nosedived. Transfers valued between $100,000 and $1 million have seen a 48% reduction, while transactions exceeding $1 million but below $10 million have dropped by 50%. Such a decline in high-value trades indicates weakened confidence from these influential market participants, creating less upward pressure on Bitcoin’s price.

Bitcoin is currently trading around $94,000. However, if the current lack of whale activity persists, this support could crumble. Analysts caution that a break below this point might trigger a rapid descent.

With major investors seemingly hesitant to reengage, the outlook for Bitcoin appears precarious. The coming days will likely determine whether the market can stabilize or if deeper losses are ahead.

-

1

Bitcoin Reaches New All-Time High Above $116,000

11.07.2025 7:56 1 min. read -

2

Canadian Bank Sees Bitcoin Hitting $155,000 by 2025

15.07.2025 10:00 1 min. read -

3

Strategy Claims It Can Weather a Bitcoin Crash to $20K Without Trouble

16.07.2025 14:08 1 min. read -

4

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

12.07.2025 20:00 1 min. read -

5

Corporate Bitcoin Adoption Soars: 125 Public Companies Now Hold BTC

16.07.2025 20:00 2 min. read

Where Is The Smart Entry Point For Bitcoin Bulls?

With Bitcoin hovering near $119,000, traders are weighing their next move carefully. The question dominating the market now is simple: Buy the dip or wait for a cleaner setup?

Matrixport Warns of Bitcoin Dip After Hitting This Target

Bitcoin has officially reached the $116,000 milestone, a level previously forecasted by crypto services firm Matrixport using its proprietary seasonal modeling.

Bitcoin Risk Cycle Flips Again as Market Enters Safer Zone

Bitcoin’s market signal has officially shifted back into a low-risk phase, according to a new chart shared by Bitcoin Vector in collaboration with Glassnode and Swissblock.

Robert Kiyosaki Warns of 1929-Style Crash, Urges Bitcoin Hedge

Financial author Robert Kiyosaki is once again sounding the alarm on America’s economic health.

-

1

Bitcoin Reaches New All-Time High Above $116,000

11.07.2025 7:56 1 min. read -

2

Canadian Bank Sees Bitcoin Hitting $155,000 by 2025

15.07.2025 10:00 1 min. read -

3

Strategy Claims It Can Weather a Bitcoin Crash to $20K Without Trouble

16.07.2025 14:08 1 min. read -

4

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

12.07.2025 20:00 1 min. read -

5

Corporate Bitcoin Adoption Soars: 125 Public Companies Now Hold BTC

16.07.2025 20:00 2 min. read