Bitcoin vs. the Dollar: BlackRock CEO Warns Policymakers

01.04.2025 8:00 2 min. read Alexander Stefanov

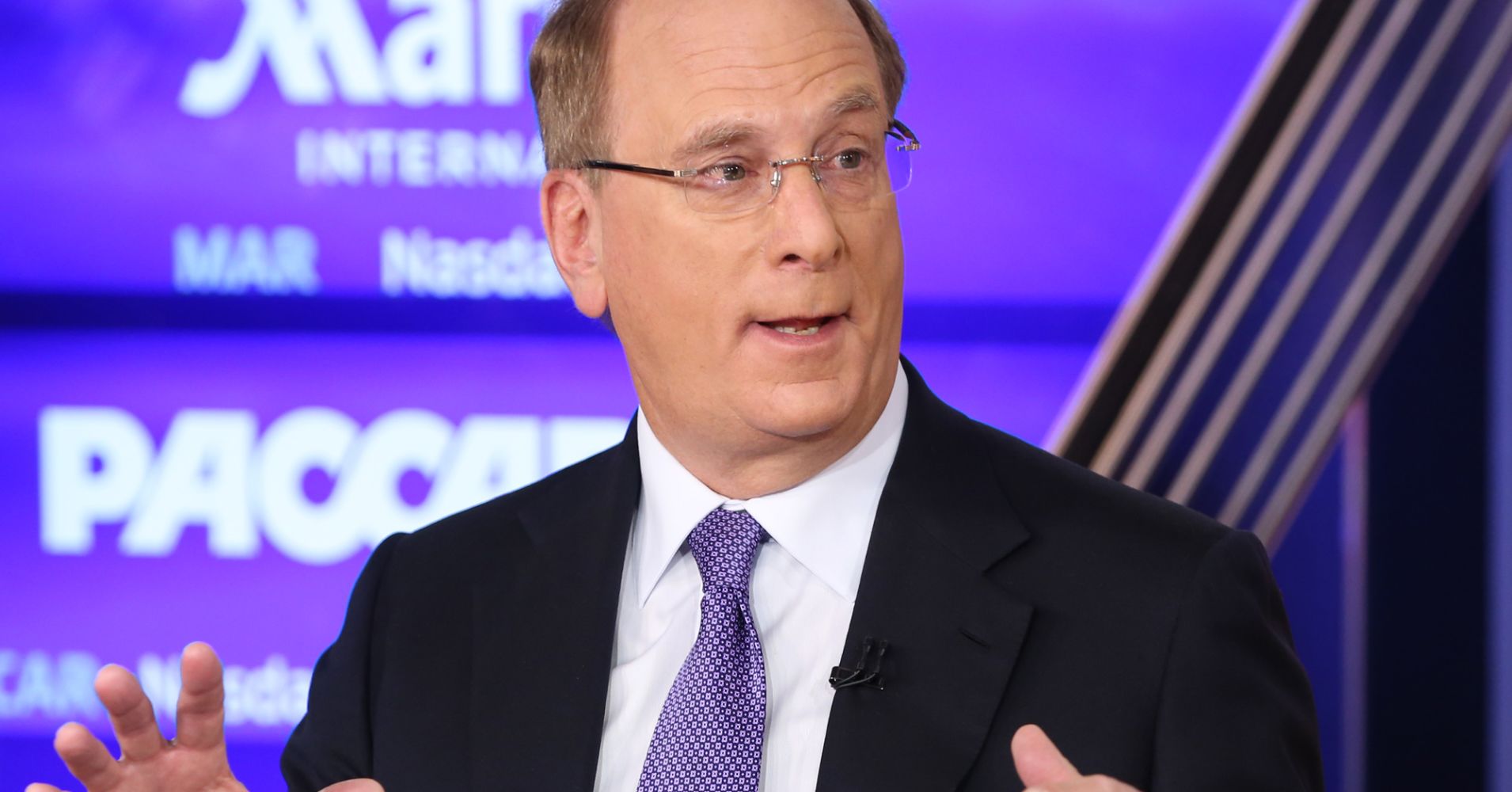

In a dramatic shift from Wall Street’s traditional stance, BlackRock CEO Larry Fink has openly acknowledged Bitcoin as a potential competitor to the U.S. dollar.

His latest letter to shareholders raises concerns that unchecked federal debt could weaken the dollar’s status as the world’s reserve currency, creating an opportunity for digital assets to step in.

Fink’s recognition of Bitcoin’s influence marks a turning point for institutional finance. Just a few years ago, such an admission from the head of the world’s largest asset manager would have been unthinkable. Now, he speaks of Bitcoin almost as frequently as the U.S. dollar, signaling its growing relevance in macroeconomic discussions.

Bitcoin’s Role in a Changing Financial Landscape

BlackRock’s letter presents a complex view of digital assets, praising DeFi as an innovation while also cautioning that Bitcoin’s rise could pose challenges to U.S. financial dominance. The underlying concern is that investors may increasingly turn to Bitcoin as a long-term store of value, particularly as the U.S. grapples with fiscal instability.

Fink’s perspective aligns with a broader institutional shift, where Bitcoin is being considered not just as a speculative asset but as a hedge against economic uncertainty. His comments suggest that digital assets could play a much larger role in global finance than previously anticipated.

BlackRock’s Bitcoin Investments Set Records

BlackRock isn’t just talking about Bitcoin—it’s actively investing in it. The firm’s U.S.-based Bitcoin ETF has become the most successful ETF launch in history, accumulating over $50 billion in assets within a year. It ranks among the top three ETFs in net inflows, drawing strong interest from retail investors.

Significantly, a large portion of these investors had never used BlackRock’s products before, indicating that Bitcoin is bringing new participants into traditional investment markets. The company is also expanding its Bitcoin offerings to international markets, reinforcing the growing demand for institutional-grade crypto products.

The Future of Finance

Beyond Bitcoin, Fink emphasizes tokenization as a revolutionary shift in financial markets. He argues that blockchain-based systems could replace traditional intermediaries, enabling faster and more efficient asset transfers. BlackRock sees this as a way to democratize finance, making high-yield opportunities more accessible to retail investors.

Additionally, the letter highlights the importance of digital identity systems, pointing to India as an example of successful large-scale financial digitization. These advancements could be key to unlocking the full potential of tokenized economies.

-

1

Mysterious $8.6B Bitcoin Transfer Sparks Speculation Over Satoshi-Era Wealth

05.07.2025 15:00 3 min. read -

2

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

30.06.2025 15:00 2 min. read -

3

Bitcoin Tops Crypto Social Buzz as $110,000 Milestone Fuels Market Debate

04.07.2025 8:15 3 min. read -

4

UniCredit to Launch Structured Product Tied to BlackRock’s Spot Bitcoin ETF

01.07.2025 17:53 1 min. read -

5

10,000 Dormant Bitcoin Moved After 14 Years: Volatility Ahead?

04.07.2025 20:00 2 min. read

UK to Sell Almost $7B in Seized Bitcoin as Treasury Eyes Crypto Boost

The United Kingdom’s Home Office is preparing to liquidate a massive cache of seized cryptocurrency—at least $7 billion worth of Bitcoin—according to a new report by The Telegraph.

Crypto’s Top Narratives in Focus, According to AI

A fresh breakdown from CoinMarketCap’s AI-powered narrative tracker reveals the four most influential crypto trends currently shaping the market: BTCFi & DePIN, U.S. regulatory breakthroughs, AI agent economies, and real-world asset (RWA) tokenization.

Strategy’s $71B in Bitcoin Now Ranks Among Top 10 S&P 500 Treasuries

Seems like Strategy has officially broken into the top 10 S&P 500 corporate treasuries with its massive $71 billion in Bitcoin holdings—ranking 9th overall and leapfrogging major firms like Exxon, NVIDIA, and PayPal.

How Much Bitcoin You’ll Need to Retire in 2035

A new chart analysis offers a striking projection: how much Bitcoin one would need to retire comfortably by 2035 in different countries—assuming continued BTC price appreciation and 7% inflation adjustment.

-

1

Mysterious $8.6B Bitcoin Transfer Sparks Speculation Over Satoshi-Era Wealth

05.07.2025 15:00 3 min. read -

2

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

30.06.2025 15:00 2 min. read -

3

Bitcoin Tops Crypto Social Buzz as $110,000 Milestone Fuels Market Debate

04.07.2025 8:15 3 min. read -

4

UniCredit to Launch Structured Product Tied to BlackRock’s Spot Bitcoin ETF

01.07.2025 17:53 1 min. read -

5

10,000 Dormant Bitcoin Moved After 14 Years: Volatility Ahead?

04.07.2025 20:00 2 min. read