Bitcoin Soars to $61,000 – Crypto Market in the Green

17.09.2024 18:59 2 min. read Alexander Stefanov

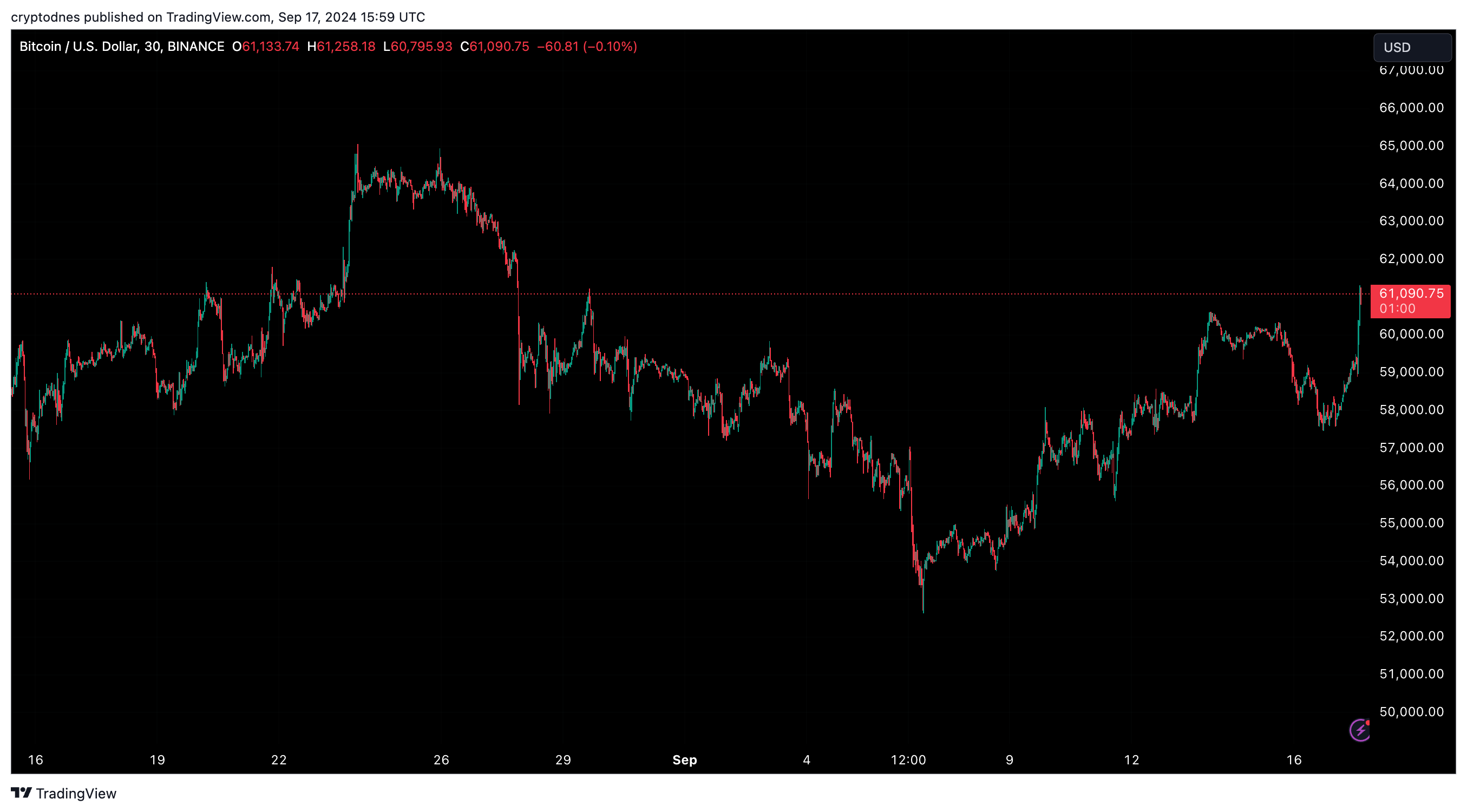

Bitcoin and the crypto market as a whole experienced a swift recovery this past day, with most prices being in the green.

Bitcoin (BTC) managed to claim the $61,000 mark after a 5.5% surge in the past 24 hours and 7% on the weekly chart. Just this morning Bitcoin was trading at $57,460. During this past day the trading volume of the number one cryptocurrency reached $34.36 billion.

The total liquidations in the past 24 hours amounted to $123.1 million ($49.93 million in long positions, and $72.24 million in shorts) and Bitcoin accounted for $46.93 million, as per data from CoinGlass.

The 1-day technical analysis from TradingView also seems rather bullish with the summary and oscillators showing “buy” at 14 and 2, respectively, while the moving averages show “strong buy” at 12.

Ethereum (ETH) soared to $2,380 after a 4% surge on the 24-hour chart and has a trading volume of around $15.3 billion.

The biggest winners amongst the altcoins were Celestia (TIA) and Immutable X (IMX). TIA reached $5.2 after a 15.75% price jump in the past 24 hours (and 24.3% in the past 7 days), while IMX soared by 14.75% in the past day, reaching $1.42.

The total cryptocurrency market cap reached $2.11 trillion after a 4.32% surge.

Today was also the first day in three weeks that BlackRock’s Bitcoin ETF registered positive inflows (as well as all the other spot BTC ETFs).

-

1

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

2

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

3

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

4

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read -

5

Will Ethereum and Solana Benefit from Wall Street’s Shift?

09.07.2025 19:00 2 min. read

Ethereum Spot ETFs Dwarf Bitcoin with $1.85B Inflows: Utility Season in Full Swing

Ethereum is rapidly emerging as the institutional favorite, with new ETF inflow data suggesting a seismic shift in investor focus away from Bitcoin.

Ethereum 2025 Mirrors 2017 Breakout—But With Wall Street Fueling the Surge

Ethereum (ETH) appears to be entering a breakout phase eerily reminiscent of its historic 2017 rally—but this time, the move is backed by deep institutional support and ETF inflows.

SUI Price Breaks Key Resistance as BTCFi Vision Gains Traction

SUI, the native token of the Sui blockchain, is drawing attention following a major breakout on the charts—driven by surging total value locked (TVL) and growing anticipation around Bitcoin-native decentralized finance (BTCFi) infrastructure.

Tom Lee Reveals What Makek Ethereum His Top Bet

Tom Lee, managing partner and head of research at Fundstrat Global Advisors, recently outlined his bullish stance on Ethereum, linking it directly to the rapid growth of the stablecoin sector.

-

1

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

2

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

3

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

4

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read -

5

Will Ethereum and Solana Benefit from Wall Street’s Shift?

09.07.2025 19:00 2 min. read