Bitcoin Rises as Thousands of Altcoins Disappear

07.07.2025 13:00 2 min. read Kosta Gushterov

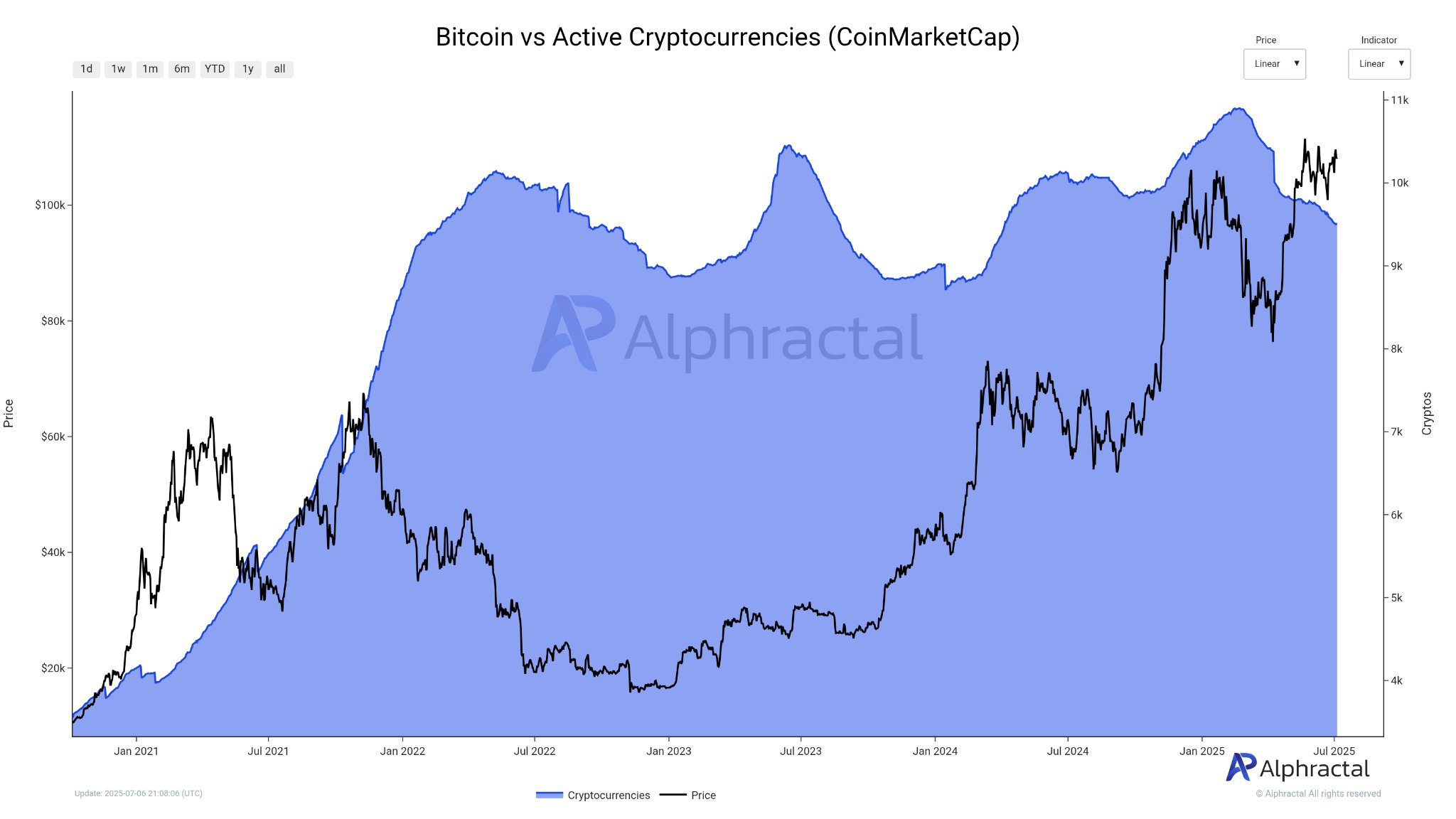

According to a new chart analysis from Alphractal, the number of active cryptocurrencies has declined significantly even as Bitcoin’s price continues to climb.

This market trend, based on CoinMarketCap data, reveals a culling of weaker projects—over 1,400 altcoins are no longer active due to delistings, low trading volume, lack of community interest, or exposure as scam ventures.

The chart shows two overlapping metrics: Bitcoin’s price in black and the number of active cryptocurrencies in blue.

Since early 2024, there has been a sharp drop in the number of listed projects, coinciding with Bitcoin’s steady rise back above $100,000. As of July 2025, the number of tracked active tokens has fallen to around 10,000, down from over 11,400 at the cycle’s peak.

Alphractal’s interpretation of this divergence is broadly positive. The exit of underperforming or fraudulent projects is seen as a form of market cleansing—removing noise and making room for quality. In previous cycles, similar drops in token count have signaled a return to fundamentals and renewed investor focus on core assets like Bitcoin and Ethereum.

Analysts say this shrinking project pool is bullish for crypto. With fewer “zombie” tokens competing for attention and liquidity, capital increasingly flows toward high-conviction plays. Bitcoin’s resilience against the backdrop of widespread project failures supports the narrative that it remains the digital asset market’s anchor.

The delisting of 1,400+ coins may also help restore trust in crypto markets. Many of the defunct tokens were launched during speculative hype phases and failed to deliver real use cases or development activity. Their removal reduces confusion for new investors and highlights the importance of due diligence.

In short, Alphractal’s report presents a healthy sign: fewer tokens, stronger conviction. As Bitcoin rises and the altcoin landscape thins out, the market appears to be entering a more mature, selective growth phase.

-

1

Binance to Debut New Project on Alpha Pool and 50x Futures

22.06.2025 20:00 1 min. read -

2

Fidelity Drives Ethereum ETF Boom as Inflows Top $4 Billion

24.06.2025 17:00 1 min. read -

3

Crypto Funds Pull in $1.2B Despite Market Drop and Global Tensions

23.06.2025 19:00 1 min. read -

4

Ripple’s Stablecoin Edges Toward $500M Milestone After Latest Mint

21.06.2025 12:00 1 min. read -

5

Cardano ETF Approval Odds Hit Record High on Polymarket

22.06.2025 12:00 2 min. read

Major Altseason May Be Incoming: Bullish Signals Strengthen as Q3 Begins

Crypto strategist Michaël van de Poppe recently highlighted a striking pattern in the Altcoin Season Index, signaling a potential surge in altcoin markets.

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

Tech billionaire Elon Musk has unveiled a new political movement called the America Party, positioning it as a direct challenge to the United States’ long-standing two-party system.

Bitcoin Shouldn’t Be Taxed, Says Fund Manager

Bill Miller IV, chief investment officer at Miller Value Partners, argues that the U.S. government has no legitimate claim to tax Bitcoin ownership, as it doesn’t require any state infrastructure to manage or verify property rights.

Binance Could Introduce Golden Visa Option for BNB Investors Inspired by TON

Changpeng Zhao, the former head of Binance, has hinted at the possibility of a new initiative that would allow BNB token holders to obtain long-term residency in the United Arab Emirates through a token-staking model.

-

1

Binance to Debut New Project on Alpha Pool and 50x Futures

22.06.2025 20:00 1 min. read -

2

Fidelity Drives Ethereum ETF Boom as Inflows Top $4 Billion

24.06.2025 17:00 1 min. read -

3

Crypto Funds Pull in $1.2B Despite Market Drop and Global Tensions

23.06.2025 19:00 1 min. read -

4

Ripple’s Stablecoin Edges Toward $500M Milestone After Latest Mint

21.06.2025 12:00 1 min. read -

5

Cardano ETF Approval Odds Hit Record High on Polymarket

22.06.2025 12:00 2 min. read