Bitcoin Remains Dominant Despite Altcoin Surges

26.08.2024 11:00 2 min. read Alexander Stefanov

Last week, the cryptocurrency market saw a notable rally, bringing significant profits for short-term traders.

Bitcoin led the charge, surpassing $64,790, though its momentum seemed to wane by the end of the week.

This positive trend extended to altcoins, with several seeing substantial gains of 20% to 30% in just one week.

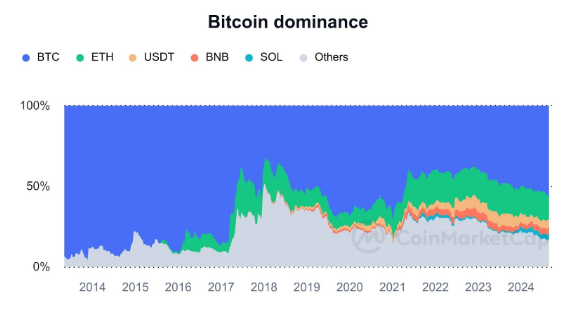

Despite these gains in altcoins, Bitcoin remains the dominant force in the market. The Altcoin Season Index, which measures altcoin performance relative to Bitcoin, is currently at 22, indicating Bitcoin’s continued dominance. Similarly, the Altcoin Monthly Index stands at 29, also favoring Bitcoin.

The index assesses whether 75% of the top 50 altcoins have outperformed Bitcoin over the past 90 days to determine altcoin season. The last official altcoin season was during the 2021 bull market. The index nearly tipped in favor of altcoins in January 2024 but has since hovered between 20 and 30, with a low of 12 in late July, reflecting Bitcoin’s ongoing dominance.

Currently, Bitcoin is trading at $63,850 with a market capitalization of $1.26 trillion, representing a 6.92% increase over the past week. Bitcoin now constitutes 56.3% of the total cryptocurrency market value.

Due to Bitcoin’s dominance, many altcoins often mirror its performance, though some can experience independent surges. Ethereum currently holds the largest share of the altcoin market cap at $314.2 billion, with other altcoins collectively valued at $438.48 billion and stablecoins at $161.97 billion.

Among the notable performers, Sun Token, a stablecoin swap token on the TRON network, has surged 305% in the past week. Memecoins Dogwifhat (WIF) and POPCAT have also posted significant gains of 32.7% and 76%, respectively.

-

1

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

2

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

3

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

4

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

5

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

What Price Bitcoin Could Reach If ETF Demand Grows, According to Citi

Citigroup analysts say the key to Bitcoin’s future isn’t mining cycles or halving math—it’s ETF inflows.

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

-

1

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

2

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

3

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

4

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

5

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read