Bitcoin Rally Heats Up as Supply Shrinks and Bullish Patterns Emerge

15.05.2025 21:00 1 min. read Alexander Stefanov

Bitcoin is edging closer to new highs, and signs across the board suggest it may not be long before it smashes through its previous record.

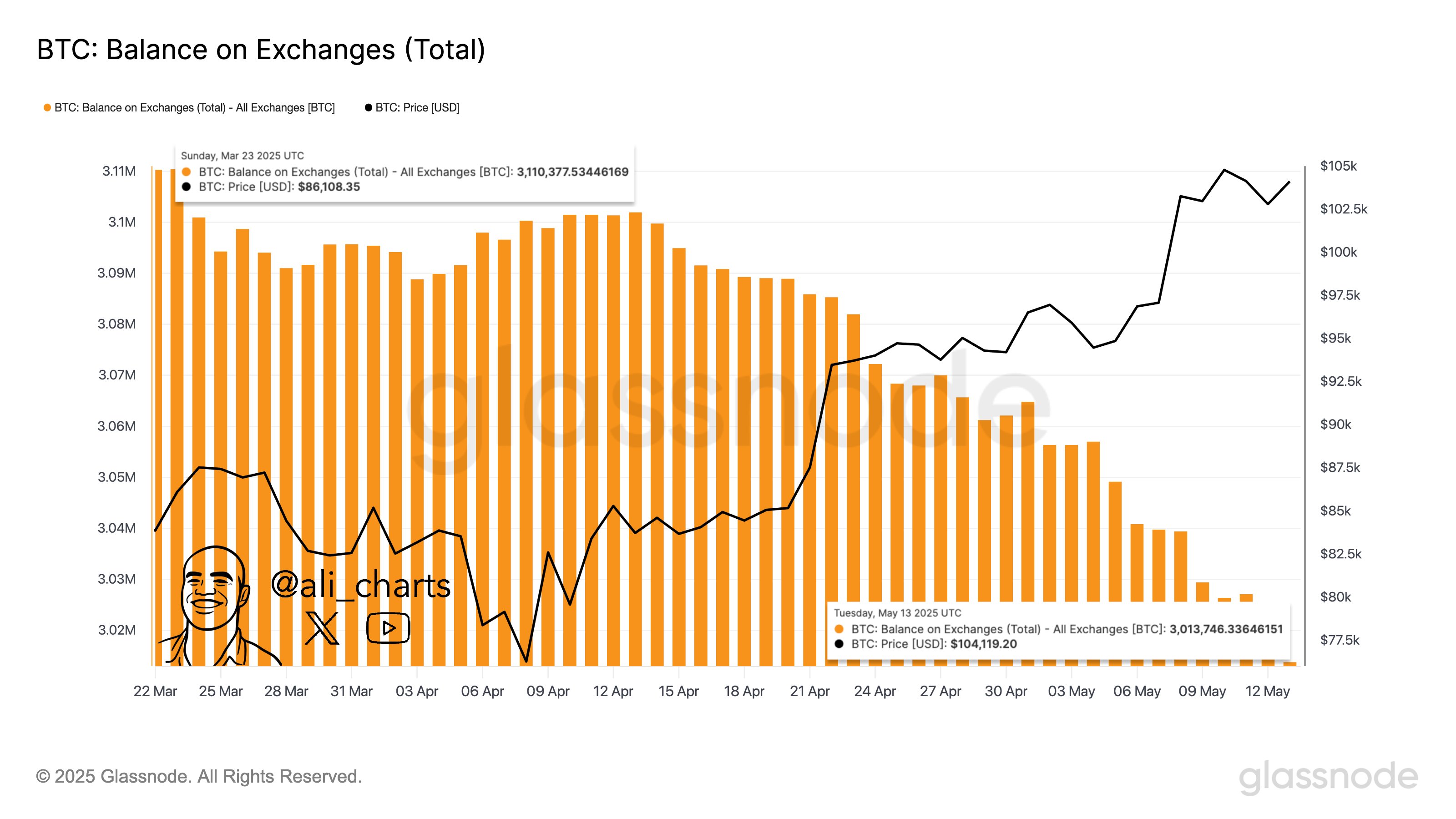

The market’s recent momentum is backed by aggressive accumulation and a sharp drop in BTC held on exchanges — both classic signs of brewing upward pressure.

On-chain data reveals that over 100,000 BTC has quietly exited trading platforms in recent weeks.

The dwindling exchange supply reflects a growing preference among investors to hold rather than sell, reinforcing Bitcoin’s scarcity narrative at a time when price is flirting with its historical peak.

Meanwhile, technical patterns point toward further upside. Analysts are watching a recurring market structure — known as the “Power of Three” — which hints at a potential breakout above $112,000. That pattern, along with bullish momentum signals like a weekly MACD crossover, adds fuel to an already energetic rally.

If Bitcoin clears the $105K level, it could trigger a wave of liquidations in short positions, potentially accelerating gains. With confidence rising and supply thinning, the stage appears set for Bitcoin’s next leap into price discovery.

-

1

Bitcoin Reaches $119,000 Milestone as Corporate Demand and ETF Inflows Rise

13.07.2025 17:45 2 min. read -

2

Bitcoin Price Prediction From Bernstein After the Recent All-Time High

14.07.2025 20:00 1 min. read -

3

Top Crypto Trends Dominating Discussions This Week

15.07.2025 17:30 2 min. read -

4

Ethereum Sparks Altcoin Season as FOMO Shifts Away From Bitcoin

17.07.2025 18:30 2 min. read -

5

Bitcoin Price Hits Record Highs as Exchange Balances Plunge

12.07.2025 19:00 2 min. read

Strategy Adds 21,021 Bitcoin at $117,000, Pushing Total Holdings Past $46 Billion

Michael Saylor, executive chairman of Strategy, has revealed that the company has acquired an additional 21,021 Bitcoin for approximately $2.46 billion, paying an average price of $117,256 per BTC.

Bitcoin Funding Rates Stay Elevated—Rally Ahead or Shakeout Coming?

As Bitcoin continues to consolidate above $100K, a critical market signal is flashing: BTC funding rates remain elevated, even as price action cools.

Billionaire Ray Dalio Revealed What his Portfolio Says About the Future of mMoney

Billionaire investor Ray Dalio, founder of Bridgewater Associates, has suggested that a balanced investment portfolio should include up to 15% allocation to gold or Bitcoin, though he remains personally more inclined toward the traditional asset.

Where Is The Smart Entry Point For Bitcoin Bulls?

With Bitcoin hovering near $119,000, traders are weighing their next move carefully. The question dominating the market now is simple: Buy the dip or wait for a cleaner setup?

-

1

Bitcoin Reaches $119,000 Milestone as Corporate Demand and ETF Inflows Rise

13.07.2025 17:45 2 min. read -

2

Bitcoin Price Prediction From Bernstein After the Recent All-Time High

14.07.2025 20:00 1 min. read -

3

Top Crypto Trends Dominating Discussions This Week

15.07.2025 17:30 2 min. read -

4

Ethereum Sparks Altcoin Season as FOMO Shifts Away From Bitcoin

17.07.2025 18:30 2 min. read -

5

Bitcoin Price Hits Record Highs as Exchange Balances Plunge

12.07.2025 19:00 2 min. read