Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Bitcoin Price Prediction: Here’s When BTC Could Hit $150,000 as Bitcoin Hyper Presale Goes Viral

15.07.2025 14:11 5 min. read Nikolay KolevWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

After Bitcoin (BTC) hit a new all-time high just above $123,000 yesterday, investor attention is now turning to the $150,000 milestone. Polymarket’s prediction markets show a roughly 46% chance of BTC hitting $150,000 this year, and a 74% probability for the $130,000 level.

A few market commentators are even more bullish. For instance, the analyst Michael van de Poppe forecasts that Bitcoin could reach $150,000 in Q3, before reaching a peak of around $250,000. This outlook has motivated experienced traders to look for lower-cap altcoins that could offer an even higher upside.

Investors are also betting big on the future of Layer 2 (L2) networks and rotating capital into Bitcoin Hyper (HYPER), the first-ever project to launch a Bitcoin L2 based on Solana’s Virtual Machine. The HYPER token presale has already raised north of $2.8 million within just a few months of its official launch.

Buyers have a limited window to purchase HYPER for $0.012275 before the price increases in less than 48 hours.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

Bitcoin’s Bullish Cup-and-Handle Pattern Points to $150,000 Target

After breaking into blue skies on July 9, Bitcoin is moving through an extended price discovery phase supported by bullish technical signals.

To put the latest developments into perspective, Milk Road co-owner Kyle Reidhead recently highlighted a classic cup-and-handle pattern on BTC’s weekly chart.

see you at $150k 🫡 https://t.co/bvdCmzZq7X pic.twitter.com/rlcKhAzTBe

— Kyle Reidhead | Milk Road (@KyleReidhead) July 9, 2025

A closer look at the chart reveals that Bitcoin’s breakout above the $111,000 neckline cleared a potential path toward $150,000. While the precise timeline will naturally differ, the consensus among crypto bulls is that $150,000 is in sight as part of this cycle’s continued uptrend.

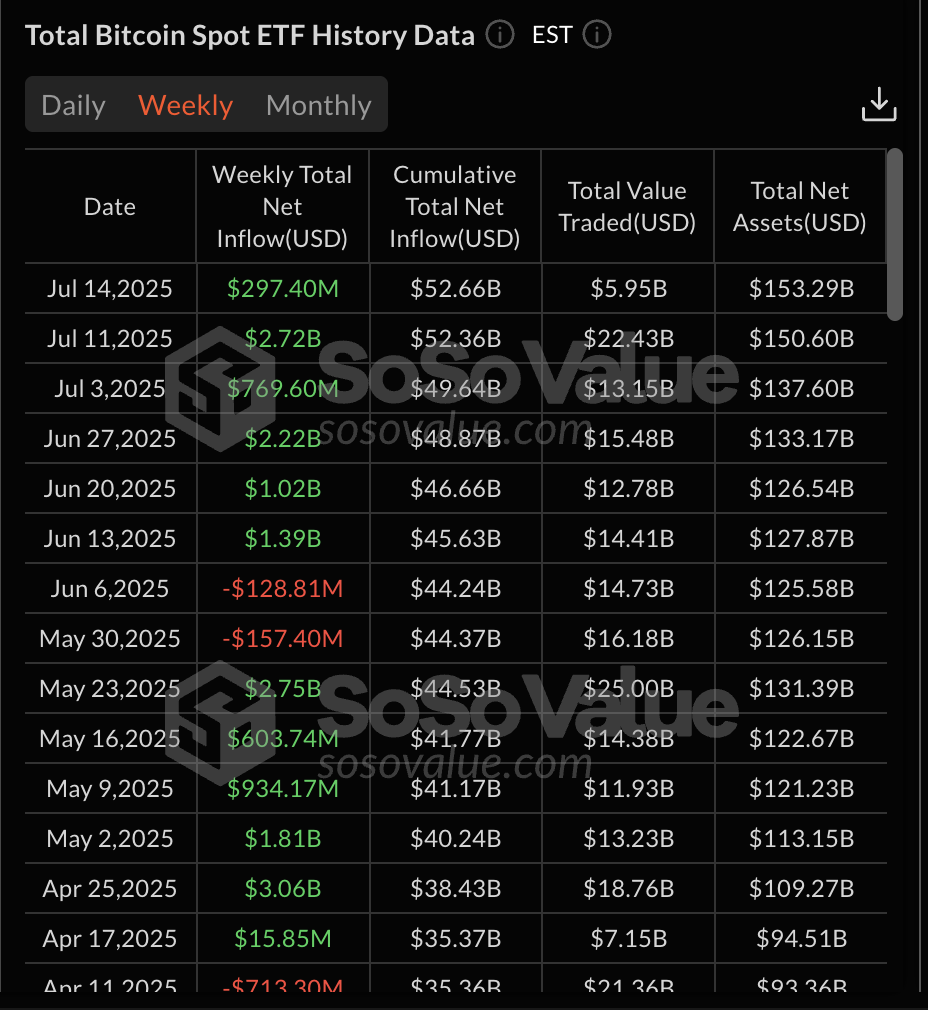

Key drivers supporting these predictions include institutional adoption and increasing liquidity in the market. Over the course of last week, US spot Bitcoin ETFs saw a total net inflow of more than 24,000 BTC – equating to about $2.7 billion.

In the meantime, regulatory tailwinds are adding even more confidence in Bitcoin’s growth. The prospect of clearer US crypto regulations, with lawmakers considering bills to solidify crypto industry guidelines this week, has strengthened the narrative that large-scale capital can safely enter the space.

This optimistic backdrop also puts a spotlight on Bitcoin-related projects. As BTC’s valuation and network activity are set to surge even further, technologies that improve Bitcoin’s utility will also open up new opportunities. That’s where Bitcoin Hyper enters the picture, aiming to introduce greater on-chain functionality for the Bitcoin ecosystem.

Bitcoin Hyper Unlocks Smart Contract Transactions on Bitcoin

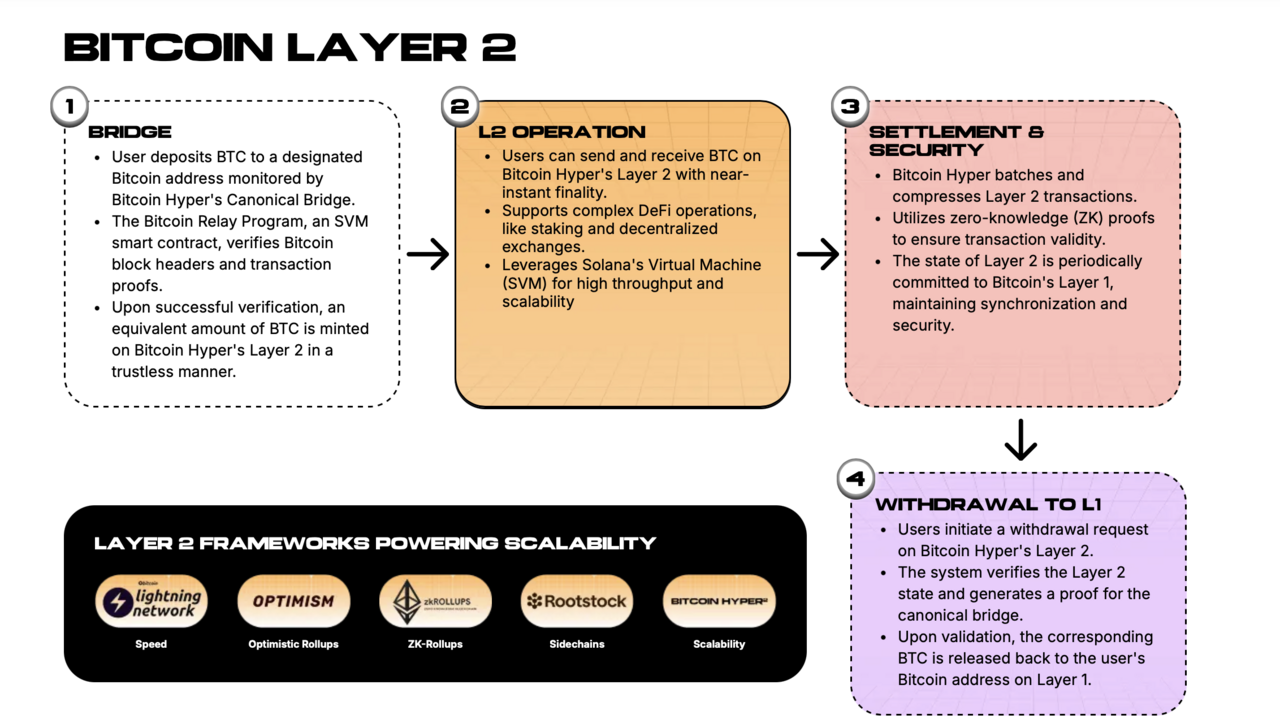

Bitcoin Hyper is a new Layer 2 (L2) blockchain that connects directly to Bitcoin’s base layer, bringing smart contract programmability and high-speed transactions to the otherwise slow and limited Bitcoin network.

The project’s approach is simple: it will leverage the Solana Virtual Machine to create the execution layer for a Bitcoin-linked L2 chain. By integrating Solana’s performance technology, Bitcoin Hyper will supercharge transaction throughput and reduce fees, while using the original Bitcoin blockchain for final settlement and security.

At the heart of Bitcoin Hyper is a “Canonical Bridge” that will link the Layer 2 chain with Bitcoin’s mainnet. This non-custodial bridge will allow users to deposit BTC into a smart contract on the base layer, which is then cryptographically verified (using zero-knowledge proofs for security) and locked in place.

Once confirmed, an equivalent amount of wrapped BTC will be minted on the Bitcoin Hyper L2, effectively bringing that BTC into the Bitcoin Hyper network’s faster environment. This wrapped BTC can then circulate on the Layer 2, powering everything from lightning-fast payments to decentralized app interactions.

Importantly, Bitcoin Hyper will periodically commit proofs of these Layer 2 transactions back to the Bitcoin blockchain, anchoring the L2’s activity to Bitcoin’s secure ledger.

When a user wishes to return their BTC to Bitcoin’s base chain, the wrapped tokens on Bitcoin Hyper’s L2 will be burned, and the corresponding BTC will be released back to the user’s Bitcoin address via the bridge. The end result is a Layer 2 network that retains Bitcoin’s security while enabling low-cost transactions and smart contract functionality.

BTC holders will finally be able to put their assets to greater use on-chain – whether through trading, lending, yield farming, or even minting NFTs – all without leaving the Bitcoin ecosystem. This could unlock a multi-billion-dollar DeFi and Web3 market for Bitcoin liquidity that has not been adequately served by previous solution attempts.

Why HYPER Could Be the Biggest Winner as Bitcoin’s First L2 Token

At the core of this new Layer 2 is the HYPER token, which will fuel the entire Bitcoin Hyper network. Much like ETH is used for gas on Ethereum, HYPER will be used to pay transaction fees on the Bitcoin Hyper L2 and participate in the ecosystem’s governance and reward mechanisms. This means that as on-chain activity grows on Bitcoin Hyper, demand for HYPER could increase in tandem.

If Bitcoin’s next chapter involves real on-chain utility through Bitcoin Hyper, then HYPER stands to be among the biggest winners as the first-mover Bitcoin L2 token.

Bitcoin Hyper is still in its presale phase, giving investors a chance to buy HYPER before the Layer 2 network goes live. You can visit Bitcoin Hyper’s official website to purchase the tokens using popular cryptos like SOL, ETH, USDT, or BNB before the next presale round begins.

The project also lets you stake HYPER for a dynamic APY of up to 306% during the presale phase itself.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Best Crypto to Buy Now as XRP’s Legal Saga With Ripple Ends

28.06.2025 22:31 7 min. read -

2

3 Crypto Presales That Could Generate 100x Returns in Q3

29.06.2025 12:27 4 min. read -

3

Bitcoin Records Another All Time High as Bitcoin Hyper Presale Soars: Best Crypto to Buy?

11.07.2025 12:05 6 min. read -

4

Best Crypto to Buy Now After Trump’s $220 Million Bitcoin Power Play

02.07.2025 19:23 7 min. read -

5

5 Best Crypto to Buy for Q3 Altcoin Season as Bitcoin Dominance Dips

29.06.2025 12:31 5 min. read

Pump.fun Token Price Prediction: PUMP Tanks After Launch, Traders Rotate Into Snorter Token Presale

The Solana-based crypto launchpad Pump.fun recently made headlines by raising roughly $500 million in just 12 minutes during its PUMP token sale, achieving a fully diluted valuation of $4 billion. But the hype quickly fizzled away after PUMP became available for trading, as its price dropped almost 55% from its peak and fell to around […]

Ethereum Price Prediction: ETH to Could Soar to $3.5K as Trading Volumes Hit $33.7B

Ethereum (ETH) just broke $3,000 for the first time since February, with volume and open interest jumping in tandem. But can ETH continue rising to $3,500 or will this rally fizzle out? Meanwhile, the rest of the Ethereum ecosystem is benefiting from ETH’s latest surge. Best Wallet Token (BEST) is one project that is taking […]

Altcoin Season Is Starting as Bitcoin Soars to $123,000: Which Crypto to Buy Now?

Bitcoin (BTC) has hit the $123,000 mark for the first time in history, as the market-leading cryptocurrency continues the price discovery phase that began after BTC started hitting new all-time highs last Wednesday. Bullish news updates and key market data, from a frenzy of ETF inflows to the start of “Crypto Week” on Capitol Hill, […]

Best Crypto to Buy Now as Capitol Hill Ignites a High-Stakes Crypto Showdown

U.S. lawmakers have locked horns over a flurry of legislative proposals that could swing Wall Street’s back door wide open to digital assets. Dubbed “Crypto Week,” the clash pits Republicans championing bills like the CLARITY Act, GENIUS Act and a CBDC ban against Democrats warning of national security risks and weakened investor safeguards. The House […]

-

1

Best Crypto to Buy Now as XRP’s Legal Saga With Ripple Ends

28.06.2025 22:31 7 min. read -

2

3 Crypto Presales That Could Generate 100x Returns in Q3

29.06.2025 12:27 4 min. read -

3

Bitcoin Records Another All Time High as Bitcoin Hyper Presale Soars: Best Crypto to Buy?

11.07.2025 12:05 6 min. read -

4

Best Crypto to Buy Now After Trump’s $220 Million Bitcoin Power Play

02.07.2025 19:23 7 min. read -

5

5 Best Crypto to Buy for Q3 Altcoin Season as Bitcoin Dominance Dips

29.06.2025 12:31 5 min. read