Bitcoin Price on the Road to Strong Recovery, Ethereum Still Lags Behind

27.07.2024 19:03 2 min. read Alexander Stefanov

The cryptocurrency market is showing signs of recovery as the total market cap surged by 1.41% today, reaching $2.44 trillion.

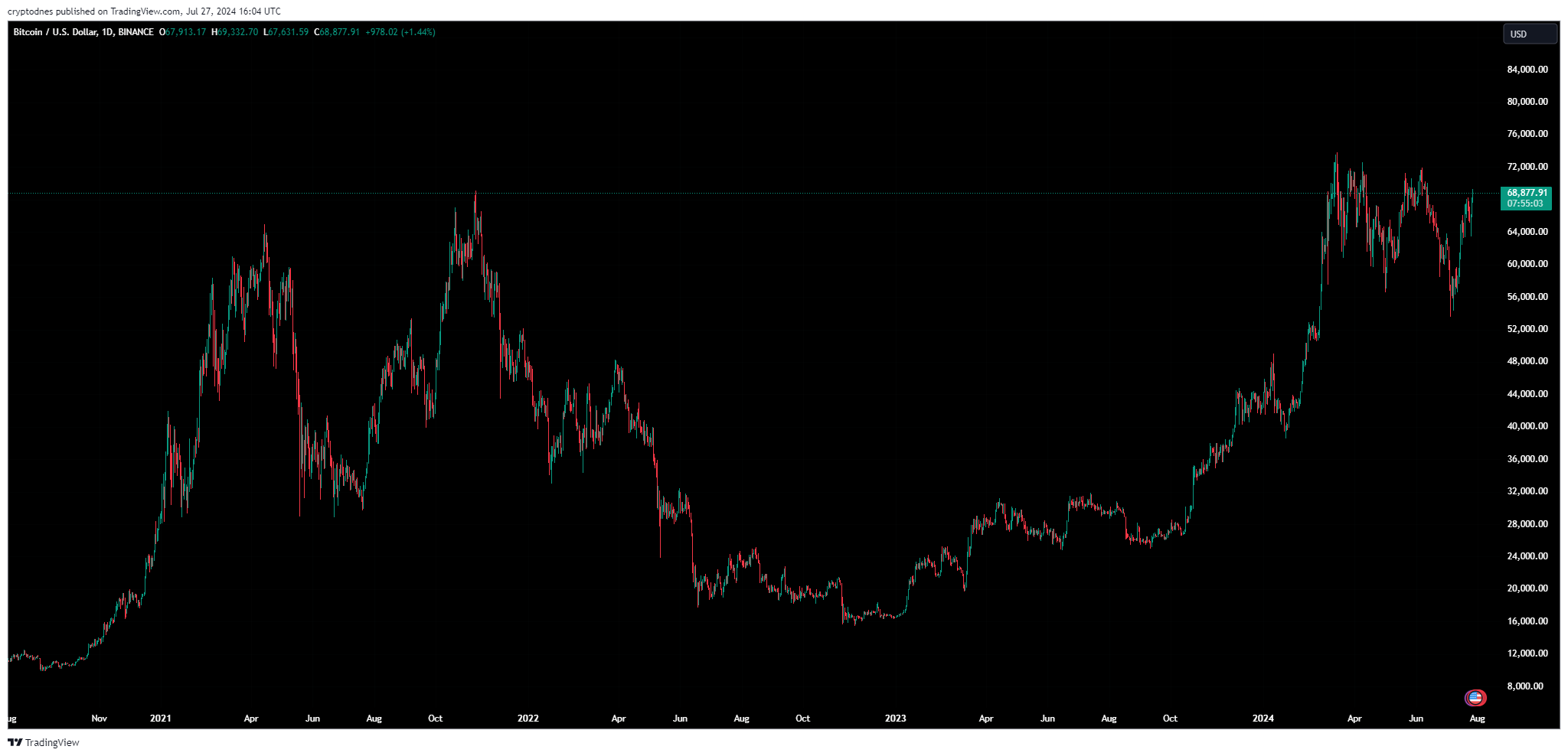

Bitcoin managed to briefly breach the $69,000 level, but retraced to its current price at $68,850.

Despite this retracement, BTC is still up 2.7% on the weekly chart and has 24-hour trading volume of around $23.2 billion.

In the past 24 hours $80.36 million were liquidated from the market ($25.95 million being longs and $54.4 million in shorts).

The 1-day technical analysis from TradingView remains extremely bullish with the summary and moving averages pointing to “strong buy” at 17 and 14, while oscillators show “buy” at 3.

Many altcoins followed suit, with the bigggest gainer for today being eCash, which surged 14.9% and has a trading volume over $100 million.,

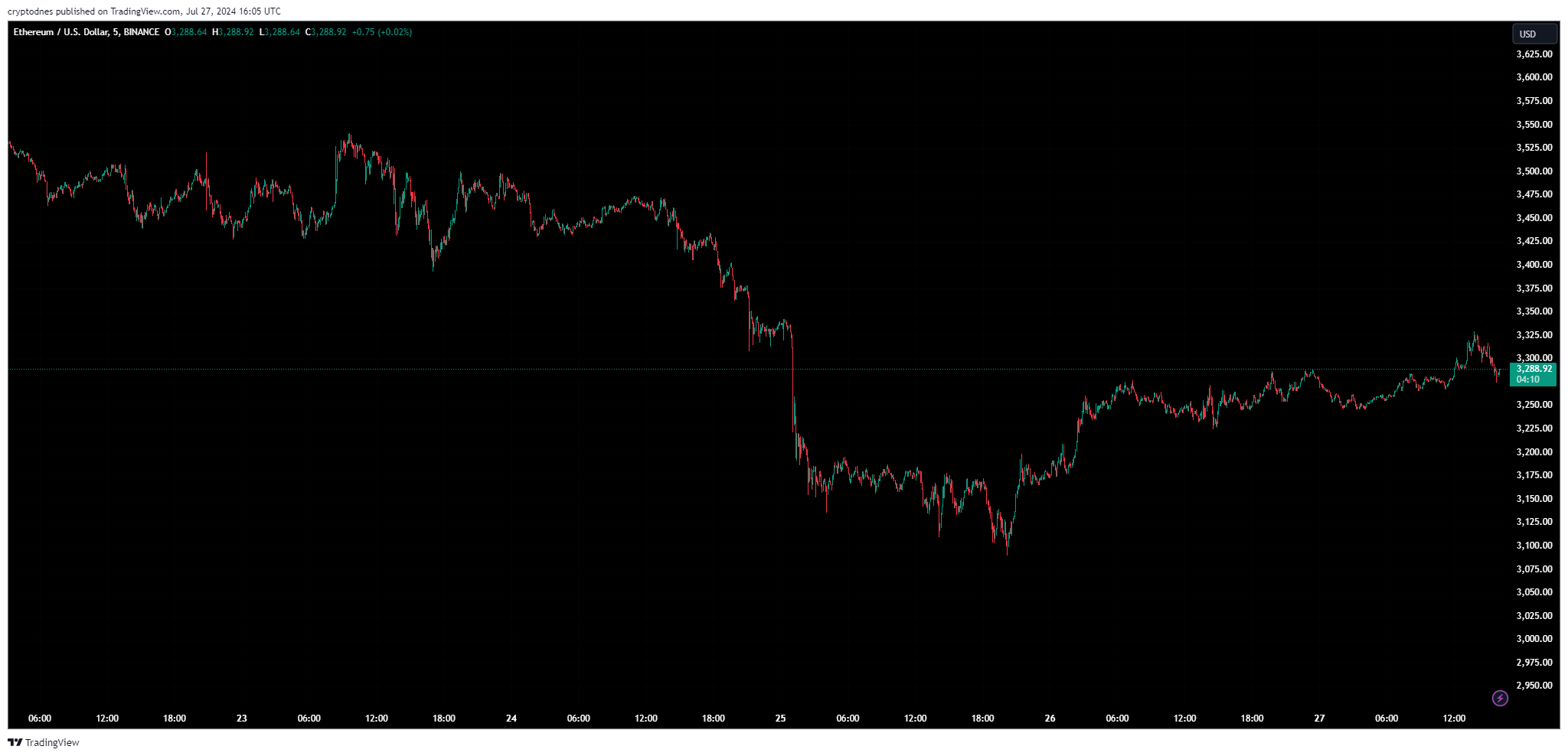

However, there is one altcoin that isn’t showing much bullishness during this surge and that is Ethereum.

Although Ethereum recently got the greenlit from SEC for spot ETFs, the prce of ETH seems to be lagging behind Bitcoin.

At the time of writing, Ethereum is valued at $3.274 with a 6.5% weekly decrease and $11.8 billion trading vokume.

Despite the positive start of spot ETH ETFs, these funds seem to be registering outflows in the past 2 days. Nevertheless, many analysts and crypto experts are optimistic about the ETFs’ future performance and the positive impact on the price of Ethereum.

However, Ethereum’s 1-day technical analysis from TradingView seems rather bearish. The summary and moving averages pont to “sell” at 11 and 10, respectively, while oscillators remain “neutral” at 9.

-

1

SPX6900 Price Prediction: SPX Holders Jump and Trading Volumes Explode – Is $2 In Sight?

09.07.2025 17:44 3 min. read -

2

2 Altcoins Gaining Strength as Bitcoin Enters New Phase

08.07.2025 13:00 2 min. read -

3

Whales Quietly Accumulate Four Altcoins: Early Signals of Potential Rally

08.07.2025 17:30 2 min. read -

4

What’s Ahead for Ethereum, According to Former Core Developer

05.07.2025 19:00 2 min. read -

5

SEC Accelerates Spot Solana ETF Timeline as July Deadline Looms

07.07.2025 19:40 2 min. read

Trump Media Holds $2B in Bitcoin as Crypto Plan Expands

Trump Media and Technology Group, the parent company of Truth Social, Truth+, and Truth.Fi, has officially disclosed that it now holds approximately $2 billion in Bitcoin and Bitcoin-related securities.

Strategy Adds 6,220 BTC, Pushing Total Holdings Past 607,000

Michael Saylor’s Strategy has confirmed another major Bitcoin purchase, acquiring 6,220 BTC last week for approximately $739.8 million.

Altcoin Season Signals Strengthen as Institutional Flows Accelerate

According to QCP Capital’s latest report, altcoin season may have finally arrived.

Solana Price Prediction: SOL Could be Ready to Move to $225 After Breakout

Solana (SOL) has gone up by 35% in the past 30 days as multiple tailwinds have lifted the price of this top altcoin above the $190 level. A breakout above this level favors a bullish Solana price prediction as it could anticipate a big move ahead, especially at a point when market conditions are favorable. […]

-

1

SPX6900 Price Prediction: SPX Holders Jump and Trading Volumes Explode – Is $2 In Sight?

09.07.2025 17:44 3 min. read -

2

2 Altcoins Gaining Strength as Bitcoin Enters New Phase

08.07.2025 13:00 2 min. read -

3

Whales Quietly Accumulate Four Altcoins: Early Signals of Potential Rally

08.07.2025 17:30 2 min. read -

4

What’s Ahead for Ethereum, According to Former Core Developer

05.07.2025 19:00 2 min. read -

5

SEC Accelerates Spot Solana ETF Timeline as July Deadline Looms

07.07.2025 19:40 2 min. read