Bitcoin Poised for Parabolic Surge if This Level Holds, Says Crypto Expert

06.11.2024 15:05 1 min. read Alexander Stefanov

Bitcoin has recently achieved a major milestone, rallying to new all-time highs after successfully filling a significant CME Gap, as noted by prominent cryptocurrency analyst Rekt Capital.

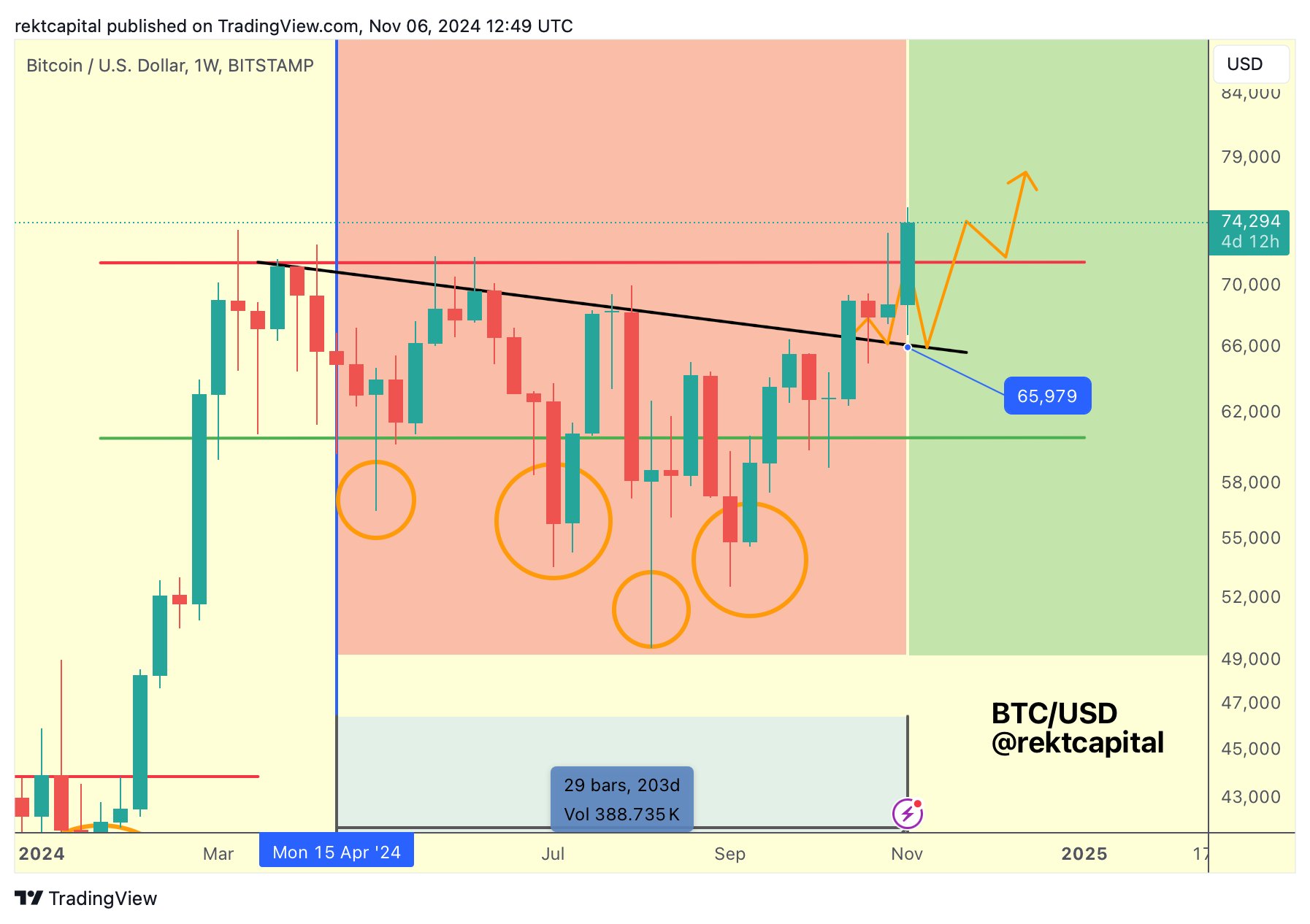

The price action has closely followed a predicted pathway outlined in the RC Newsletter three weeks ago, highlighting a positive shift for the leading digital asset.

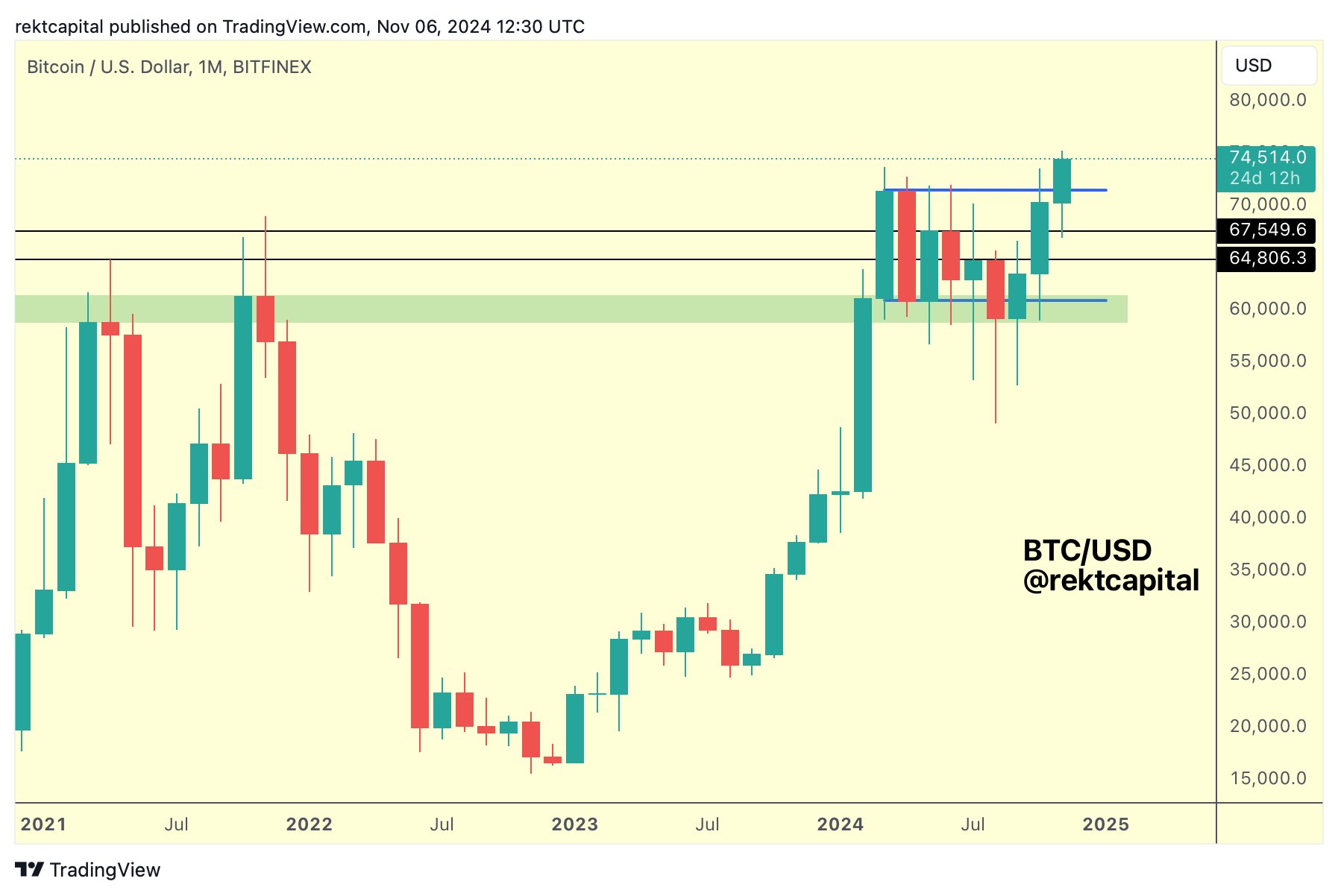

The latest price surge marks a successful retest of the May highs, which were previously set at around $67,500. This level has since transitioned from resistance to support, effectively acting as a springboard for Bitcoin’s new record-breaking highs. The fact that Bitcoin has managed to break through these key levels signals strength in its ongoing rally.

Looking ahead, Bitcoin is at a critical juncture. To confirm its transition from the reaccumulation phase into a parabolic upside phase, BTC needs to maintain a weekly close above the $71,500 mark. A sustained hold above this level would indicate that the market is prepared for further upward movement.

If Bitcoin can secure a monthly close around this level, it would set a historic precedent for the cryptocurrency. Analysts and investors alike will be watching closely to see if Bitcoin can maintain its momentum and continue to build on this newfound support around $71,500.

For now, Bitcoin’s path appears bullish, but the key test will be whether it can hold above this crucial support level in the coming weeks.

-

1

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

2

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read -

3

Bitcoin Reaches New All-Time High Above $116,000

11.07.2025 7:56 1 min. read -

4

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read -

5

Canadian Bank Sees Bitcoin Hitting $155,000 by 2025

15.07.2025 10:00 1 min. read

Ethereum Spot ETFs Dwarf Bitcoin with $1.85B Inflows: Utility Season in Full Swing

Ethereum is rapidly emerging as the institutional favorite, with new ETF inflow data suggesting a seismic shift in investor focus away from Bitcoin.

Ethereum Flashes Golden Cross Against Bitcoin: Will History Repeat?

Ethereum (ETH) has just triggered a golden cross against Bitcoin (BTC)—a technical pattern that has historically preceded massive altcoin rallies.

Bitcoin Banana Chart Gains Traction as Peter Brandt Revisits Parabolic Trend

Veteran trader Peter Brandt has reignited discussion around Bitcoin’s long-term parabolic trajectory by sharing an updated version of what he now calls the “Bitcoin Banana.”

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

-

1

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

2

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read -

3

Bitcoin Reaches New All-Time High Above $116,000

11.07.2025 7:56 1 min. read -

4

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read -

5

Canadian Bank Sees Bitcoin Hitting $155,000 by 2025

15.07.2025 10:00 1 min. read