Bitcoin Pauses Below $110K as Analysts Eye Consolidation Phase

15.06.2025 20:00 1 min. read Alexander Stefanov

Bitcoin is facing strong headwinds just shy of its all-time high, with analysts at Swissblock warning that a breakout may be off the table—at least for now.

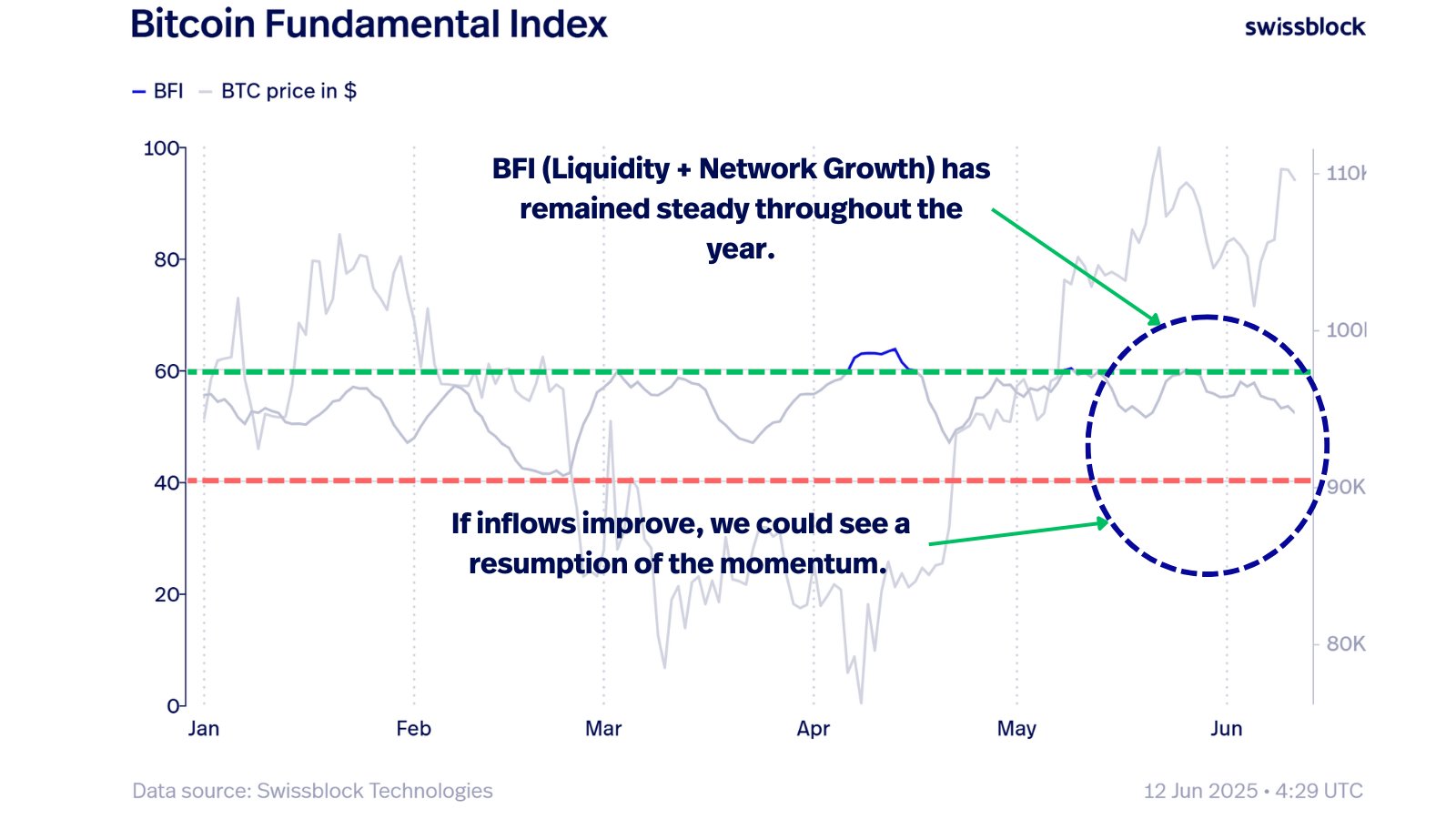

According to the firm, BTC appears stuck between the $100,000 floor and a resistance zone just under $110,000. They describe the current price action as a “stall,” adding that any move beyond the current range will require a fresh surge in fundamental momentum.

At the time of writing, Bitcoin is trading around $104,447—about 7% beneath last month’s peak near $112,000.

No Clear Breakout Without Fuel

Swissblock cautioned earlier this week that the lack of new capital entering the market raises the risk of a double-top formation, a technical pattern that often signals an impending reversal.

In parallel, a joint report with analyst Willy Woo, titled Bitcoin Vector, showed that while transaction volumes and liquidity are sliding, the network remains fundamentally stable.

The report highlighted three main takeaways:

- Liquidity has dipped, with fewer transactions and lower volume.

- Despite this, network activity has held steady, suggesting user confidence remains intact.

- Profit-taking remains limited, meaning sellers aren’t flooding the market.

This combination, according to Swissblock and Woo, suggests that while Bitcoin might remain rangebound for now, a sharp decline is unlikely—at least until sentiment or fundamentals shift more significantly.

-

1

Bitcoin Reaches New All-Time High Above $116,000

11.07.2025 7:56 1 min. read -

2

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read -

3

Canadian Bank Sees Bitcoin Hitting $155,000 by 2025

15.07.2025 10:00 1 min. read -

4

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

12.07.2025 20:00 1 min. read -

5

Strategy Claims It Can Weather a Bitcoin Crash to $20K Without Trouble

16.07.2025 14:08 1 min. read

Where Is The Smart Entry Point For Bitcoin Bulls?

With Bitcoin hovering near $119,000, traders are weighing their next move carefully. The question dominating the market now is simple: Buy the dip or wait for a cleaner setup?

Matrixport Warns of Bitcoin Dip After Hitting This Target

Bitcoin has officially reached the $116,000 milestone, a level previously forecasted by crypto services firm Matrixport using its proprietary seasonal modeling.

Bitcoin Risk Cycle Flips Again as Market Enters Safer Zone

Bitcoin’s market signal has officially shifted back into a low-risk phase, according to a new chart shared by Bitcoin Vector in collaboration with Glassnode and Swissblock.

Robert Kiyosaki Warns of 1929-Style Crash, Urges Bitcoin Hedge

Financial author Robert Kiyosaki is once again sounding the alarm on America’s economic health.

-

1

Bitcoin Reaches New All-Time High Above $116,000

11.07.2025 7:56 1 min. read -

2

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read -

3

Canadian Bank Sees Bitcoin Hitting $155,000 by 2025

15.07.2025 10:00 1 min. read -

4

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

12.07.2025 20:00 1 min. read -

5

Strategy Claims It Can Weather a Bitcoin Crash to $20K Without Trouble

16.07.2025 14:08 1 min. read