Bitcoin Outpaces Stocks, But Recession Threat Looms Ahead, According to strategist Mike McGlone

25.04.2025 10:00 1 min. read Kosta Gushterov

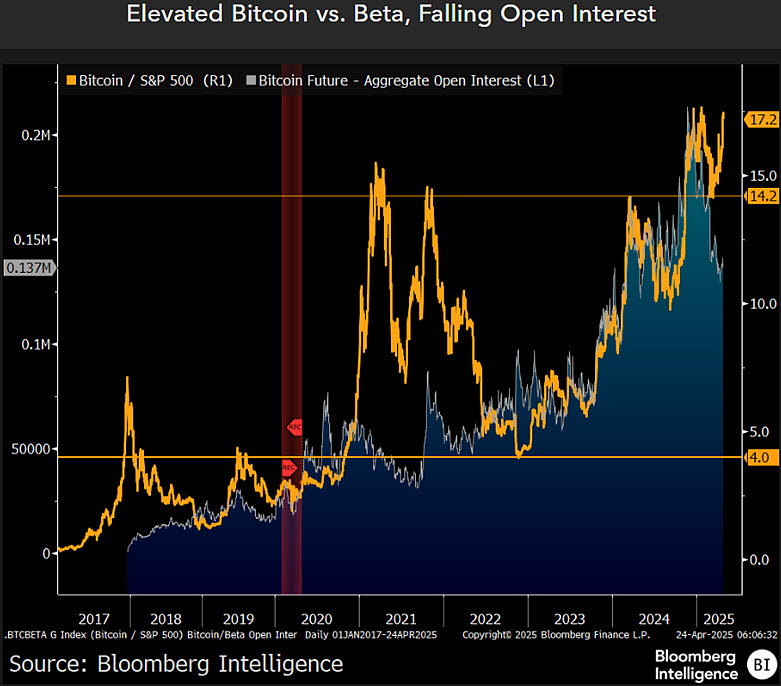

According to Bloomberg’s senior commodity strategist Mike McGlone, Bitcoin (BTC) has outshined the S&P 500 so far in 2025.

As of April 23, BTC had returned to breakeven for the year, while the S&P 500 lagged with a nearly 10% loss. McGlone called this performance “an accomplishment,” especially given the broader downturn in traditional equity markets.

Recession Could Derail Crypto Momentum

McGlone warned that Bitcoin’s lead may not hold if the U.S. economy dips into recession. Citing Bloomberg Economics projections, he outlined a potential 30% stock market decline under such conditions. Drawing parallels to major market collapses—1929 in the U.S., 1989 in Japan, and the 2000 dot-com crash—he argued that crypto markets could face similar deflationary risks due to excessive speculation and token oversupply.

Bitcoin and Gold Rise Together—but For How Long?

Over the past year, both Bitcoin and gold have climbed roughly 42%, far outpacing equities. McGlone sees Bitcoin as a strong contender in the ongoing “safe haven” narrative.

While gold remains a traditional hedge, he noted that BTC’s appeal could rise if economic instability and debates over Fed independence intensify.

McGlone concluded that Bitcoin remains a high-risk, high-reward asset—but in uncertain times, it may continue to attract investors looking for alternatives to fiat-based systems.

-

1

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

2

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

3

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

4

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

5

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

What Price Bitcoin Could Reach If ETF Demand Grows, According to Citi

Citigroup analysts say the key to Bitcoin’s future isn’t mining cycles or halving math—it’s ETF inflows.

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

-

1

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

2

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

3

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

4

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

5

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read